One of the best ways to invest in mining stocks with the current market environment is to find companies with strong cash positions.

With all stocks on the TSX having to release Q2 financials before August 15th we have found some of the best cash rich mining stocks.

Companies on the TSX Venture have until the end of August to release Q2 financials.

Some of these mining companies are even trading at discount to cash value. That means investors get the assets of the company for free or even sometimes 60 or 70 cents on the dollar.

Here are some mining stocks we found that are trading at a market cap close to their cash position.

————————————————————————————————————————————————————

Ryan Gold – RYG.V

Ryan Gold decided due to market conditions after the 2013 exploration season in the Yukon to cease all exploration work and conserve cash. Currently the are looking to JV the Ida Oro project in the Yukon and are evaluating acquiring other assets.

June 30/2014 cash = $21,205,570

August 15/2014 share price $0.12 market cap = $14,060,000

Cash as a % of market cap = 150%

————————————————————————————————————————————————————

Eastern Platinum -ELR.T

Eastern Platinum was a former platinum producer that made the prudent decision to close its mine down just over a year ago in July 2013. The company was losing money quarter after quarter and decided that until the platinum market improves this would be the best decision.

June 30 cash = $87,297,000

August 15/2014 share price $0 .97 market cap = $89,940,000

Cash as a % of market cap = 97%

————————————————————————————————————————————————————–

Independence Gold – IGO.V

Independence Gold is still sitting in a strong cash position a couple years after selling a project to New Gold (NGD.T)

June 30 cash = $8,102,732

August 15/2014 share price $0.12 market cap = $5,260,000

Cash as a % of market cap = 154%

————————————————————————————————————————————————————-

Corona Gold – CRG.T

Corona Gold sold the Sugar Zone property to Harte Gold in May 2012. Management continues to look for acquistion opportunities to put the $8 million to work.

June 30 cash = $8,276,126

August 15/2014 share price $0.455 market cap =$9,740,000

Cash as a % of market cap = 84.9%

—————————————————————————————————————————————————————–

Entree Gold – ETG.T

Entree Gold has development properties in Mongolia and Nevada. Entree owns 20% of the large Lookout Hill project in Mongolia. In February 2013 Sandstorm provided $40 million in cash up front as a deposit. The Ann Mason project in Nevada is a large copper project with a PEA that has a $1.2 billion dollar CAPEX and 14% IRR at $3 copper.

June 30 cash = $42,011,899

August 15/2014 share price market cap = $45,570,000

Cash as a % of market cap =92%

—————————————————————————————————————————————————————–

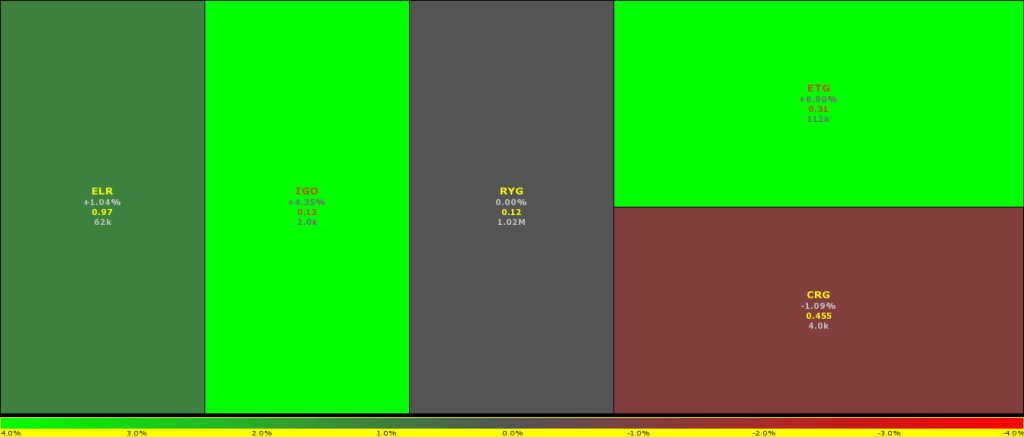

We have put together a heatmap of these cash rich stocks and will be tracking how they perform.

Heatmap courtesy of Stockmarketviz – Changing the way you LOOK at your portfolio!

Do you know of any cash rich mining stocks? If so please let us know in the comments section.

Follow James Fraser on Twitter:

5 Mining Stocks that are cash rich https://t.co/6upJ3sCNNj

— James Fraser (@miningstocks) August 18, 2014

Just 2:

Ethos Gold, over 8 million in cash and a market cap just a little above that at about 9 million… I like this company and think Gary Freeman has a good rep, but seems he is content to just sit on the sidelines and wait for better days…

Duran Ventures, don’t know much about them except they are active in Peru, but they recently sold a property for 7 million cash and are currently sitting with a marketcap of under 4 million…