I woke up to some good news this morning. As a shareholder of Roxgold (ROG:TSXV) I was pleased to see the news that the company had been granted their Environment and Social Impact Assessment (ESIA) from the Government of Burkina Faso just four months after first applying for it.

"Where else can you do that?" John Dorward, President and CEO of Roxgold asked me by phone today. (Read: This Gold Developer Punches Above its Weight - Interview with John Dorward).

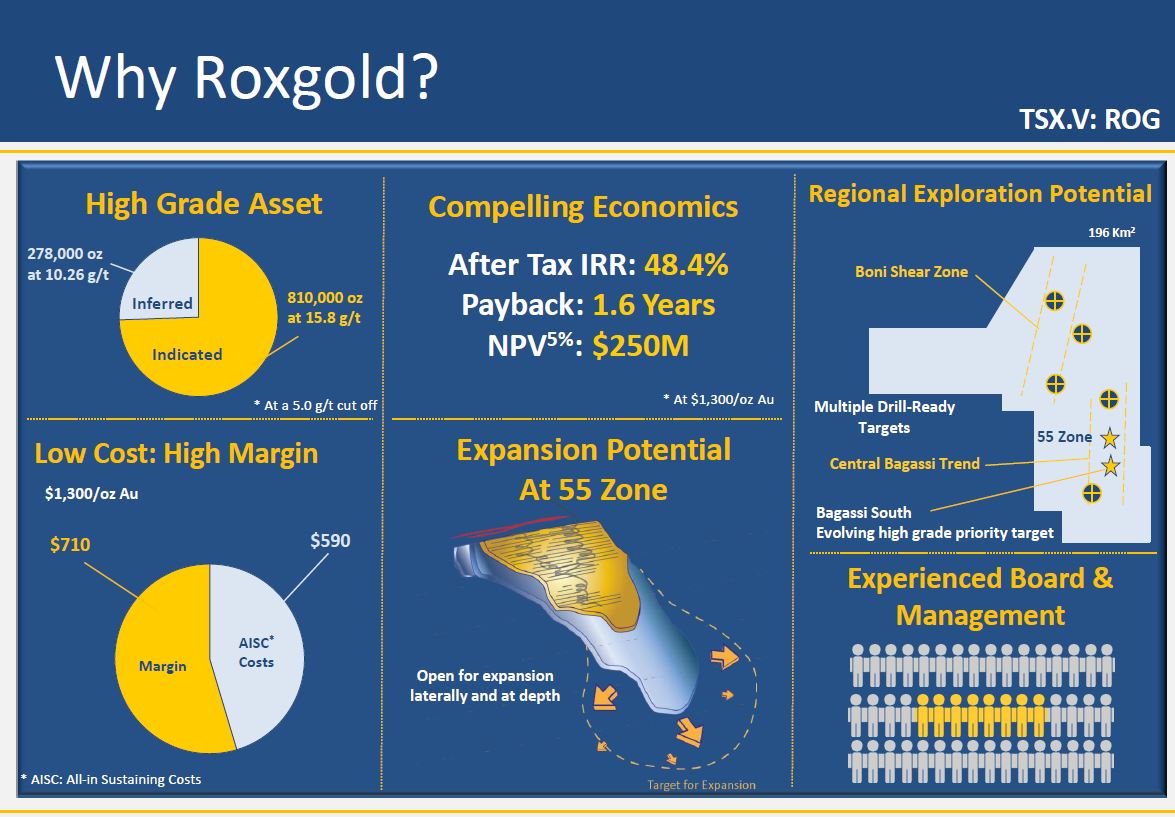

This was a critical catalyst for the development of the 55 Zone which is part of the Yaramoko deposit and Mr. Dorward attributes it to both the pro mining environment present in all levels of government in Burkina Faso and also the fact his mine although wildly rich is not going to have a very big footprint.

"The 750tpd plant creates only a small footprint and we don't have to relocate anyone, so this process has been very simple for us," he says.

Up next for this outperforming gold story (shares are up nearly 80% year-to-date) is the receipt of the exploitation permit and completion of its mining convention, which will enable the company to start development activities.

Mr. Dorward told me, "the ESIA is the most important permit and although we have to complete the other steps thoroughly, we expect to remain within our timelines."

The company has a catalyst rich next 12 months, with EPCM contractors expected to be finalized this quarter, completion of a $75 million debt facility in Q4/14, exploitation permit also in Q4/14 and the commencement of the underground development soon thereafter.

Societe Generale and Credit Suisse were mandated by Roxgold to syndicate a $75M project finance facility (Photo: AFP/GETTY IMAGES)

With regards to how the process was going for the $75 million project finance facility, Mr. Dorward says that the banks are going through the final stages of credit approval and that he expects to get the full approval by the end of September with the money coming in during the fourth quarter.

Another catalyst to look forward to (not that there isn't already enough of them) is the release of the remaining assays from their latest exploration program as well as a highly anticipated and aggressive exploration campaign at the Baggassi South discovery zone which is expected to start in late fall after the wet season.

The company is well funded with $30 million in cash on hand. Mr. Dorward will most likely do a small raise early next year which will fill the kitty in order to fund the $106.5 million capex.

This is likely the final overhang on the story. Once fully-funded, the company will be less than one year away from commercial production and investors can expect a re-rating of the shares to start then (typically investors are willing to pay for production 9-12 months out).

As a result of this critical permit being granted Canaccord Genuity's Senior Mining Analyst, Joe Mazumdar, put Roxgold on his "Focus List" as a company he thinks offers good upside.