This morning, one of the most undervalued Colombian light oil producers, Petroamerica Oil (PTA:TSXV), provided the market with an update on their recently acquired Putumayo Basin assets. Community issues in the region have impacted timelines for companies operating in this area, including Petroamerica and Gran Tierra Energy. This has forced Petroamerica to slightly revise 2014 guidance downward.

Recall, Petroamerica won a bitter takeover battle for Suroco Energy in July. After raising its bid from $0.57 per share to $0.80 in several rounds of offers they successfully acquired Suroco gaining access to their valuable Putumayo Basin prospects. This Basin, like Petroamerica's most productive basin; the Llanos, is one of the most highly sought after in Colombia.

The main prospect in the Putumayo Basin is the N Sand play which has been successful in northern Ecuador since the 1990's but has yet to be developed in Colombia. Petroamerica and others believe that the Colombian side of the border could be as productive.

Petroamerica has lagged its peer group, trading at less than 1.5x cash flow despite continuously growing light oil production. The acquisition of Suroco was strategic. It gave them access to the second most prospective oil basin in Colombia, added to their reserves and production potential and also enabled them to become operators (which has been a knock against the company for months).

While the market was receptive to the acquisition, rising from the mid-30's to over $0.44 per share following closing, community issues in the areas of the newly acquired assets have delayed Petroamerica's ability to get in there and start developing the play.

Today, the company announced that they were now guiding average annual production for the combined assets of 6,600 boepd with an exit rate of 7,400 boepd. Although this is slightly below expectations and is disappointing, the fact remains that the company continues to significantly grow production year-over-year and isn't being rewarded for it in the markets.

This guidance is below original expectations because of extended production restrictions in the Putumayo that have been there since mid-July. The company says these restrictions are in the process of being lifted and that their guidance assumes that normal production will resume on October 1st.

The company produced an average of 6,064 boepd in Q3, but expects to produce 7,457 boepd in the last quarter (23% growth quarter-over-quarter).

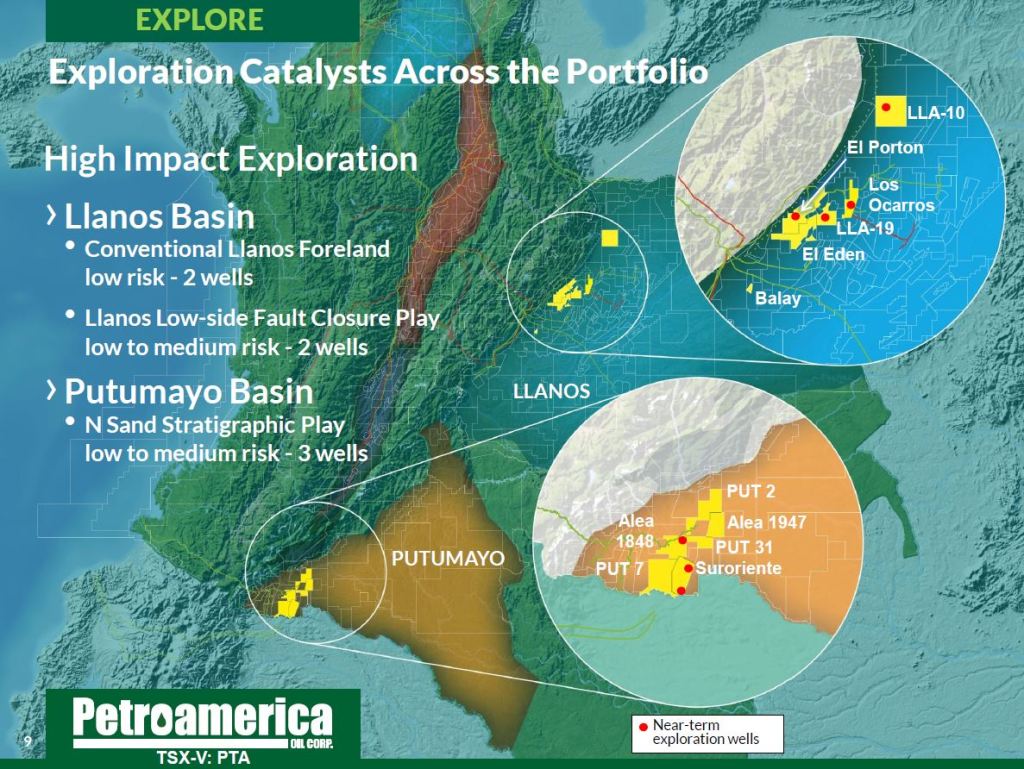

The company has 7 high-impact wells planned for the Llanos Basin (4 wells) and the N Sand (3 wells) in the Putumayo Basin which will provide continuous newsflow and catalysts for the company. They expect to provide 2015 guidance and budget estimates in early December.

Petroamerica plans to drill 7 high-impact wells over the next 6 months (Image: Petroamerica Oil Corp.)

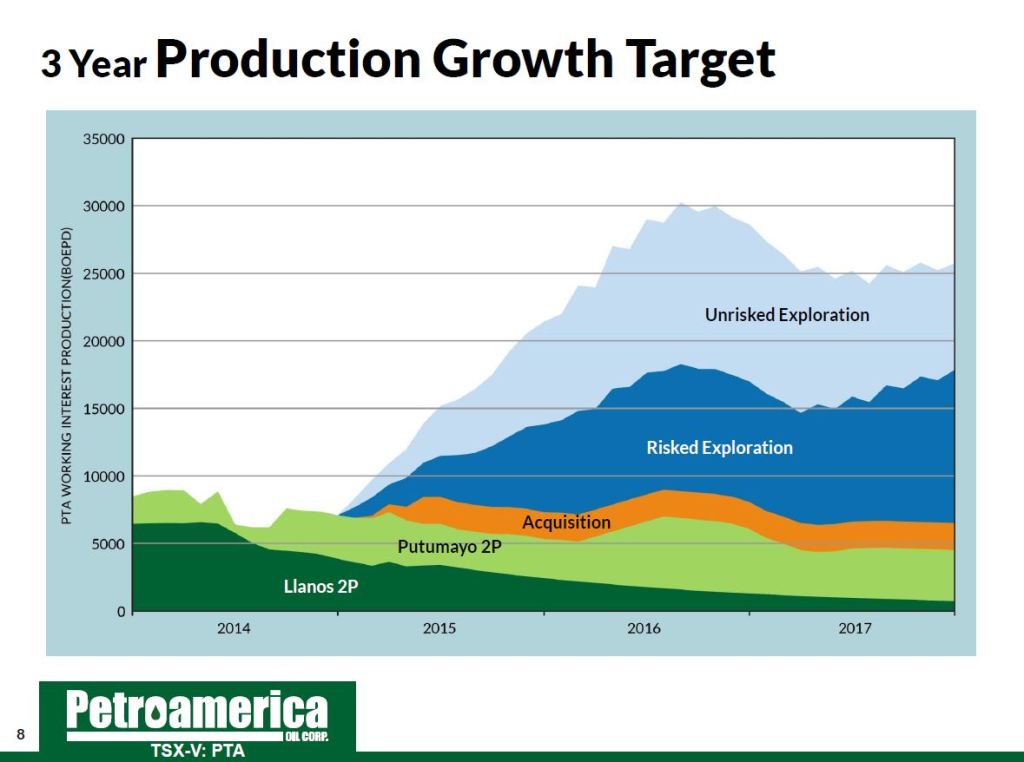

Given management's ability thus far to deliver on guidance, I expect the trend to continue. The company remains cheap relative to its international E&P peers, yet management believes they will be able to grow production to over 30,000 boepd by 2017.

Parex Resources, another Colombian E&P produces over 25,000 boepd and trades at over a $1.5 billion enterprise value. Petroamerica trades at $250 million. They lag Parex in reserves, however with over 1 million net acres and highly successful exploration efforts thus far, the company is poised to re-rate next year.

As of August 31st the company had $64 million in cash and expects to end the year with $60 million.

Read: Petroamerica Provides Revised 2014 Production Guidance