Canada's most western province (BC) has had a rocky history with regards to the ease of doing business in the mining sector. Despite being one of the most endowed mineralized regions in the world, many large projects have encountered delays and setbacks especially in the areas of environmental and social licensing.

The Imperial Metals disaster this summer caused by a massive breach of the Mount Polley tailings dam brought even more scrutiny to the BC operators.

While all of this has been going on, some miners have continued to try and permit their large-scale projects.

Seabridge Gold (SEA:TSX) is no exception.

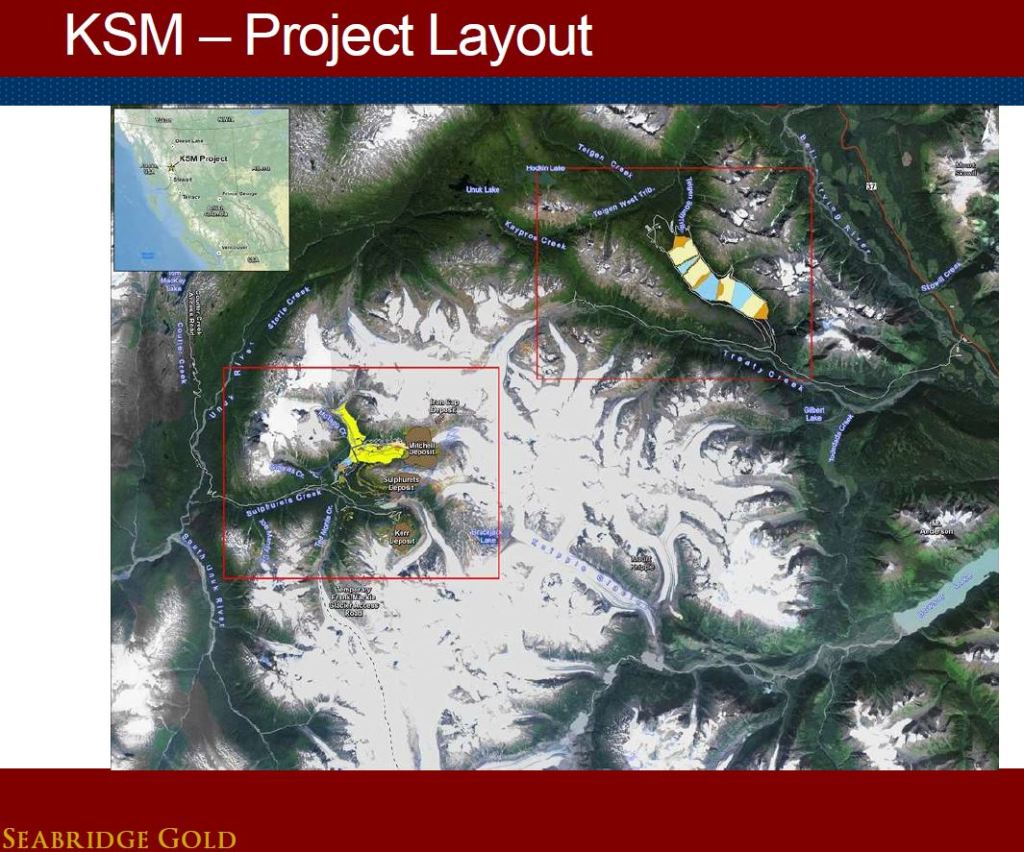

They are working to permit the KSM mega project. That project in northern BC holds 2P reserves totalling 38.2 million ounces of gold and 9.9 billion pounds of copper.

The gigantic project is expected to cost over $5.2 billion to construct and will produce 508,000 ounces of gold, 146.8 million pounds of copper, 2.2 million ounces of silver and 1.1 million pounds of molybdenum annually over a 55 year mine-life.

Due to the immense scale of the mega project, permitting and other regulatory hurdles are the biggest risk. Investors are skeptical of big capex and big footprint projects like this, especially after the disaster at Barrick's Pascua Lama.

This morning, the company announced that they have checked off a key box in their permitting campaign. They were granted key construction permits by the BC provincial government. These included:

- Authority to construct and use select roadways,

- Rights-of-way for the proposed Mitchell-Treaty tunnels connecting project facilities,

- Authority to construct and operate camps to support construction activities; and,

- Authorization of early-stage construction activities at the mine site and tailings management facilities.

The province is working with the Federal regulators in Ottawa, in a 'harmonized' process, to permit these types of projects in BC.

The company already received the receipt of provincial approval and the BC Environmental Assessment Certificate in July 2014, but now awaits the key Federal permit decision which Seabridge expects to announce in November.

Seabridge Gold chairman and CEO Rudi Fronk commented: "The granting of land tenure for the proposed Mitchell-Treaty tunnels is an especially important milestone for the project, as it awards to KSM the rights to a corridor connecting the project's two main areas -- the mine site and the tailings management facility."

Should the company get approved by the Federal government, then the next step would be finding the funding to build the project.

Although the KSM project is considered a gold primary deposit, it also holds a large and undeveloped copper component which are becoming more and more rare with the recent consolidation in the space (Augusta and Lumina). Asian smelters, outright sale or financing it themselves all remain options (with the latter looking like the most challenging given how out of favour large capex, low grade gold projects currently are).

The granting of the Federal permits would be a much needed piece of positive news for the mining industry in BC.

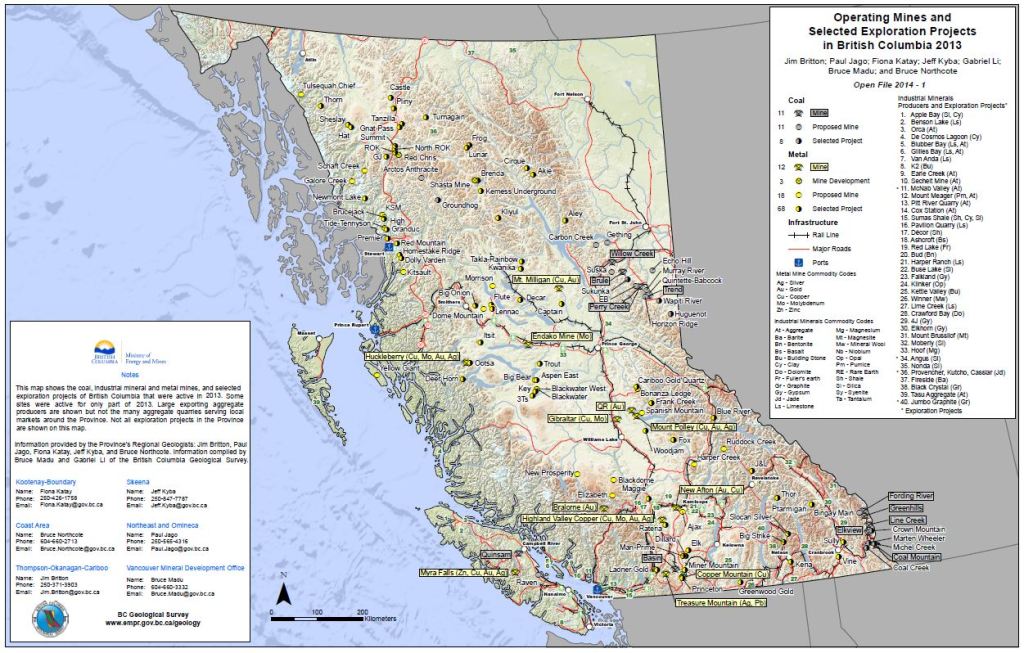

Companies with large mining projects in BC include:

- Pretium (PVG:TSX) and their Brucejack high-grade gold project. Permitting phase.

- New Gold (NGD:TSX) and their Blackwater gold project. On standby.

- Novagold (NG:TSX) and their Galore Creek gold project. On standby.

- Avanti Mining (AVT:TSXV) and their Kitsault molybdenum project. Financing phase.

Seabridge shares are off 30% from their highs this year and down 66% from their $26 per share peak in 2011.

Read: Key Construction Permits Issued to Seabridge Gold's KSM Project