The Toronto-based mining private equity firm, Waterton Global loves gold and has $1 billion to deploy. Probably a good starting point for gold executive to look for money.

They have been trying to consolidate gold assets and in May 2013, they closed the acquisition of the Hollister gold mine and Esmeralda Mill in Nevada out of bankruptcy for $15 million cash and a 15% net profits royalty.

Shortly after, Waterton was back at it, this time bidding on Newmont's Midas mine complex, also in Nevada. That deal was lost and Klondex Mines subsequently jumped in to buy it for $83 million.

In February 2014, the fund went after Chaparral Gold (CHL:TSX). It was a hostile $0.50 per share, $58.8 million offer. That was rejected by the board and Waterton eventually raised their bid to $0.55 and extended their offer 7 times before letting it expire in August 2014.

Waterton was after Chaparral's Goldfields project in Nevada which hosts 1.34 million ounces of gold (38.66 Mt @ 1.19/g/t). Chaparral also holds the 6 million ounce (363 Mt @ 0.5 g/t Au) Converse project located in the Battle Mountain-Cortez trend in Nevada.

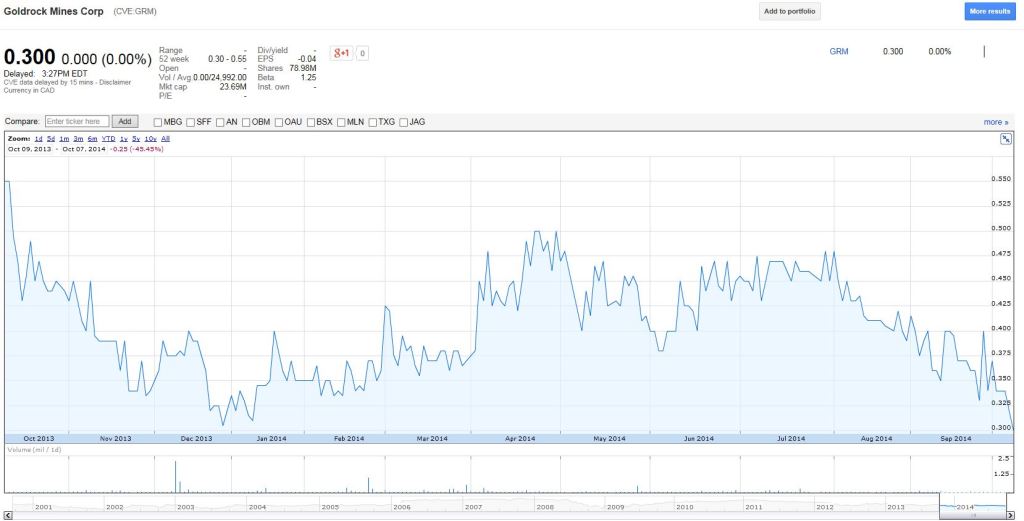

Enter deal-man Paul Matysek, CEO of Goldrock Mines (GRM:TSXV).

Matysek has a long history of doing accretive deals.

He built and sold Lithium One in a $112 million transaction in 2012. He did the same with Potash One this time selling it to K+S in 2011 for $434 million. His biggest transaction was the 2007 $1.8 billion sale of his Energy Metals to Uranium One.

Yesterday, Goldrock announced it was acquiring Chaparral in an all-cash $0.61 per share transaction valued at $73.4 million. Goldrock, having a market cap of only $23 million and sitting on a small treasury of just $1 million, got the funding from (you guessed it) Waterton.

"Waterton has been trying to get Chaparral for awhile now. I approached them, they liked me and we did the deal," Mr. Matysek told me by phone this morning.

Goldrock will repay Waterton's funding by transferring them a 100%-interest in the Goldfields project, 49%-interest in the Converse project (51% to remain with Goldrock) and rights to all of the recievables associated with an Ecuadorian project (estimated at $5 million).

"Its a fair deal for everyone," says Matysek. "We get a deep-pocketed partner in Waterton, 3 million ounces of gold and geographic diversity. Chaparral shareholders get a good premium and Waterton gets Goldfield."

Isser Elishis, Waterton's Managing Partner and Chief Investment Officer, said in the news release, "We look forward to advancing the Converse property with Goldrock in our role as a strategic capital partner, and developing the Goldfield project within Waterton's growing portfolio of high-quality Nevada assets."

The deal also comes with a $5 million private placement by Waterton into Goldrock at $0.45 per share which is a 50% premium to the last trade. Waterton will own 12.3% of Goldrock and will get one board seat.

"If I went to the brokerage houses, it would have been a $0.30 financing with a full warrant which is very dilutive," says Matysek and he's probably right.

The $5 million allows them to advance their Argentine asset as well as gives them options in Nevada.

Goldrock holds the Lindero project in Argentina which is a low-grade, bulk tonnage, heap leach project.

A 2013 feasibility study (at $1,400/oz gold) showed the project would produce 110,000 ounces of gold over a 9 year mine-life and would cost $155 million to build. At all-in sustaining costs of $703 per ounce, the project is expected to repay the initial investment within 2 years and return 33.4% after-tax. The project return drops to 22% in a $1,200 per ounce gold price environment, but is still economic.

The project is turn-key. It is fully-permitted and just needs the funding to build it. So what's the hold up? With the risk-off trade still there and the state of the gold markets, financing a gold project in Argentina isn't easy.

"Under the current market environment, you have to survive. Our group can do that. We are creative," he told me.

Shares in Goldrock haven't traded today. From what we are hearing from investors, they are concerned by the association with Waterton which has a mixed reputation in the sector given their sometimes aggressive tactics. Also, the strategy of the transaction is unclear.

After speaking with Mr. Matysek he told me that Waterton is a 'misunderstood group" and that he is thrilled to be working with them. And why not? Again, they have deep pockets and love gold.

With regards to the strategy, he says Converse offers them diversity both geographically and across assets.

Overall, Waterton was willing to pay $60 million for Chaparral (almost all of which is associated with Goldfields), so Goldrock is getting a netted, 3 million ounce Nevada gold project for $10 million (after you remove the $5 million in receivables). On top of that, they get $5 million at a 50% premium without a warrant component. That, on its own, deserves praise in this environment.

"Stay tuned," Mr. Matysek told me as we ended the call.