Mart Resources (MMT.to) released a corporate update this morning with details on the Umugini pipeline as well as a drilling update. Mart is a junior oil producer in Nigeria with current production of 7,874 bopd (August). Management says the completion of the Umugini pipeline could potentially double current production.

Mart has previously disappointed investors by missing several deadlines. News today shows the pipeline is almost ready to go and the company expects formal authorization of oil injection by the operator of the Trans Forcados export pipeline shortly.

This is significant news for Mart shareholders as once this pipeline is running at full capacity it will double current production and help limit line loss to ~8%. Mart has had significant problems with its previous pipeline including line loss rates of up to >20% of oil flowing through the pipeline due to theft. The old pipeline also required on average several days of downtime per month for maintenance and repairs.

Mart is also currently drilling and has completed well UMU-12 which will undergo clean up and testing of a 40 foot oil column. The rig is being moved to a new location to drill UMU-13, an exploration well.

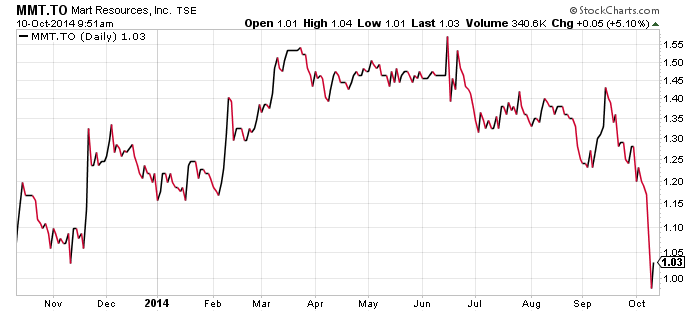

The share price of Mart has been volatile this year as you can see from the chart below. The stock is down from $1.40 on September 15th to $1.03 today due to the decline in oil price, Ebola concerns in Africa, and investor frustration with lack of news on the pipeline.

Mart is a high risk high reward potential stock for investors who can stomach the uncertainty of doing business in Nigeria. It seems everything happens slower there, but Mart has a proven track record of production and even paying a dividend.

No question that Mart will remain an interesting stock to watch going forward.

Symbol: MMT.T

Share price:$1.04

Shares outstanding: 356.58M

Market cap: $370.8M

I own shares in Mart purchased in the open market therefore I am biased. As always do your own due diligence.

Read: Umugini Pipeline and Umusadege Drilling Update