The long and sustained downturn in the mineral exploration sector has caused share prices to be decimated over the last three years as companies have been incapable of convincing investors to pony up. Even companies with the highest-quality management teams have had to reduce their spend drastically as they batten down the hatches and try to weather the storm.

This has been exaggerated over the past two weeks whereby the broader equity markets have seen huge spikes in volatility furthering the unlikeliness of any meaningful increase in investor risk appetite.

This morning, Bear Creek Mining (BCM:TSXV) which is among the few companies with high-quality leadership announced that they would be furthering their cost-cutting efforts by reducing staff and other overheads. This even included their VP Exploration (a vital role in an exploration company).

Bear Creek's board includes Catherine McLeod-Seltzer who has raised over $600 million for mining companies, Nolan Watson founder of Sandstorm Gold and David de Witt of Pathway Capital which worked with the likes of David Lowell, Lukas Lundin and Geoff Loudon. If companies with this pedigree of Board is cutting their spend dramatically, then others should take note.

Andrew Swarthout, President and CEO, stated in the release this morning: "Bear Creek was originally established as, and owes its success, to its exploration roots. We regret that current market conditions cause us to reduce this component; however the company's mandate is to create shareholder value, and we are committed to conserve cash while moving our projects containing over 330 million ounces of silver in proven and probable reserves defined by two feasibility studies towards permitting and production. We are deeply appreciative of Christian Rio's efforts over the past 10 years. His leadership has added significant value to the company's principal assets, the Corani and Santa Ana projects, through enhancing our scientific understandings of the Corani metallurgical aspects and the opportunities for upside at Santa Ana."

The company says that this latest cut will make way for further staff reductions and allow them to preserve the capital they need to complete the updated Corani feasibility study by Q1/2015 as well as complete the permitting process.

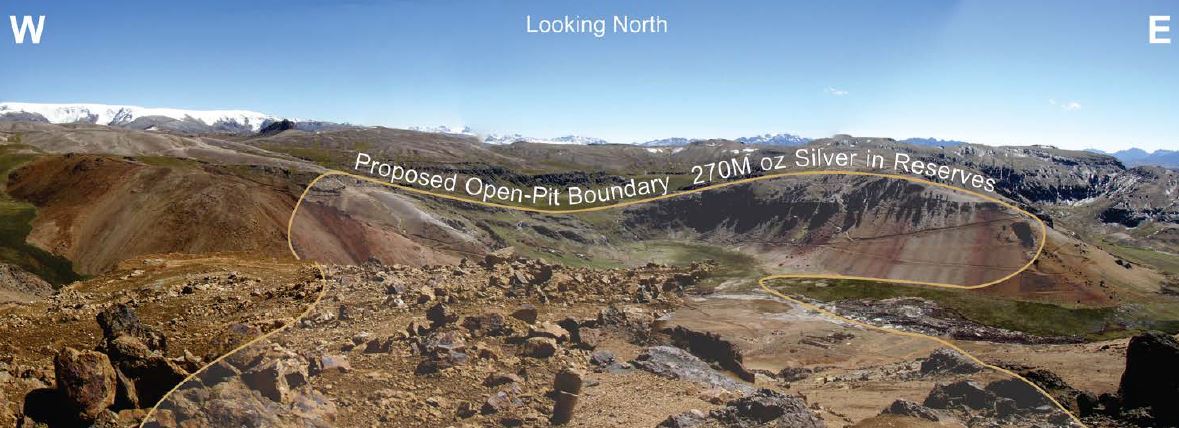

Corani is one of the largest undeveloped silver deposits in the world hosting 2P reserves of 270 million ounces of silver, 3.1 billion pounds of lead and 1.7 billion pounds of zinc.

The company is aiming to reduce the footprint of the Corani project given the tightness in the capital markets.

The original plan was to build their smaller Santa Ana project and roll the cash flow from that mine into the development of the larger Corani mine. After Bear Creek's mining rights to Santa Ana were revoked and development remains halted (still in legal proceedings with Peruvian government), the company has been working to redesign Corani to a more manageable project size.

A 2011 feasibility study envisioned a mine capable of producing 14.7 million ounces of silver equivalent over a 20 year mine life at $3.68 net cash costs per ounce. This design was expected to cost $574 million in initial capital.

The company is now targeting $150 million in capex savings by utilizing dry-stacking tailings as opposed to a tailings dam facility and a few other design tweaks. The updated feasibility study remains on track for a first quarter 2015 release and will allow Bear Creek to advance permitting and to look into financing alternatives in H2/2015.

Corani is a project that offers tremendous leverage to the silver price. At $21.60/oz silver price, the Corani feasibility study shows an after-tax IRR of 25.5% and at $14.40/oz it drops to 6.5%. These returns are likely to improve given the expected capex savings with little-to-no impact on opex or the production profile.

The move to further reduce costs is prudent and shows the maturity of Bear Creek's leadership. The company is sitting on $40 million in cash. They are clearly planning for a prolonged downturn in the sector.

Shares are down $0.07 (5%) today, last at $1.43. This is near 5-year lows.

I agree with much of Travis’ analysis above, but I’d add two observations.

First, the Corani project has in fact been greatly effected by the substantial drop in silver prices, but actually derives more value from the base metals of Lead and Zinc. The drop in silver from $21 to $17.50 is more than off-set by the rise in the base metal prices — particularly Zinc. Santa Ana is much more of a pure silver deposit so if anything the current market makes a strong case for developing Corani first and parking Santa Ana until silver prices recover.

Secondly, eliminating exploration operations does make sense purely from a business point of view. On the other hand this action can also be considered from the point of view of a company currently engaged in arbitration with the government of Peru. Bear Creek has consistently signaled their eagerness to reach a mutually satisfactory resolution to the issue of Santa Ana — but this recent action could easily be taken as a sign that the corporation no longer views Peru as a supportive environment for mining operations.

Disclosure: BCM is a substantial portion of my personal IRA