In what looks to be a classic example of "first mover advantage', the billionaire Lundin family is acquiring one of the best gold projects in the world, in the worst market in decades.

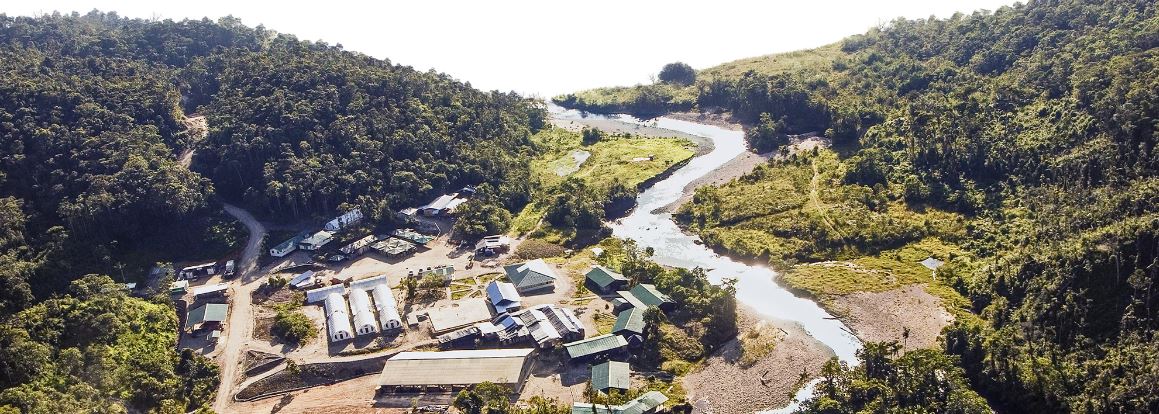

Lukas Lundin's Fortress Minerals is acquiring the Fruta del Norte (FDN) gold project in Equador from Kinross Gold for $240 million in cash and stock. The company will change its name to Lundin Gold Inc and will be principally controlled by the Lundin family.

Kinross acquired FDN in 2008 with the $1.2 billion buyout of Aurelian Resources. After struggling to make any progress in Equador, they took a $720 million write-down in 2013.

Concurrently, Fortress plans to raise $250 million in subscription receipts (at $4 per receipt) in order to fund the acquisition and for development at FDN. Each receipt will transfer into one share upon closing, which is expected in mid December.

The Lundin Family Trust will be subscribing to up to $100 million worth of the placement.

Fortress will pay between $100 million and $190 million in cash (depending on how much they raise) to Kinross with the balance payable in stock. Depending on the amount raised, Lundin Gold should have ample funds to move the project toward construction. The project is remote and will be a multi-hundred million dollar build. Fortress currently has $21.2 million in cash (Q2/14).

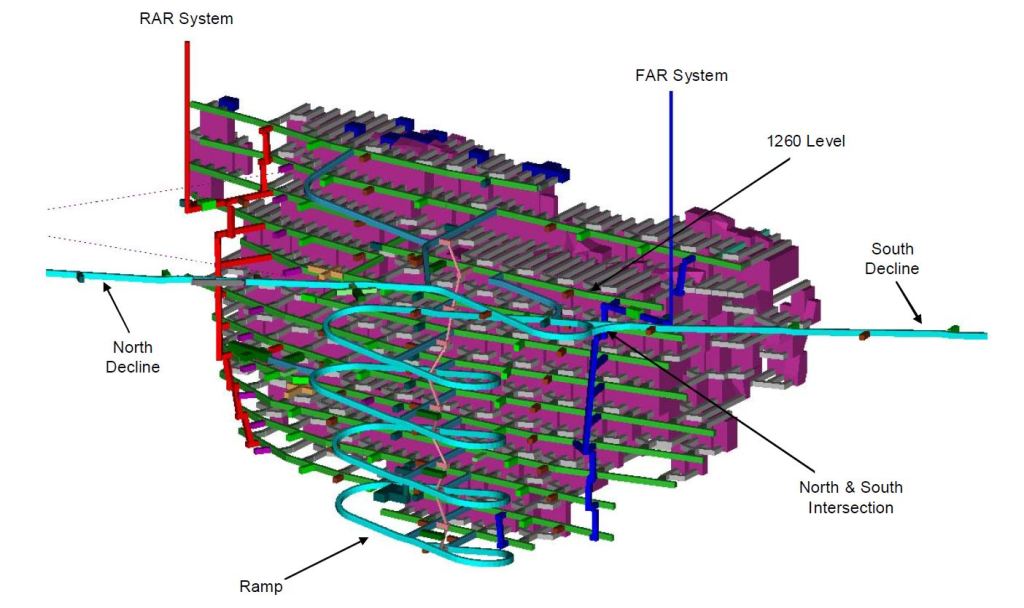

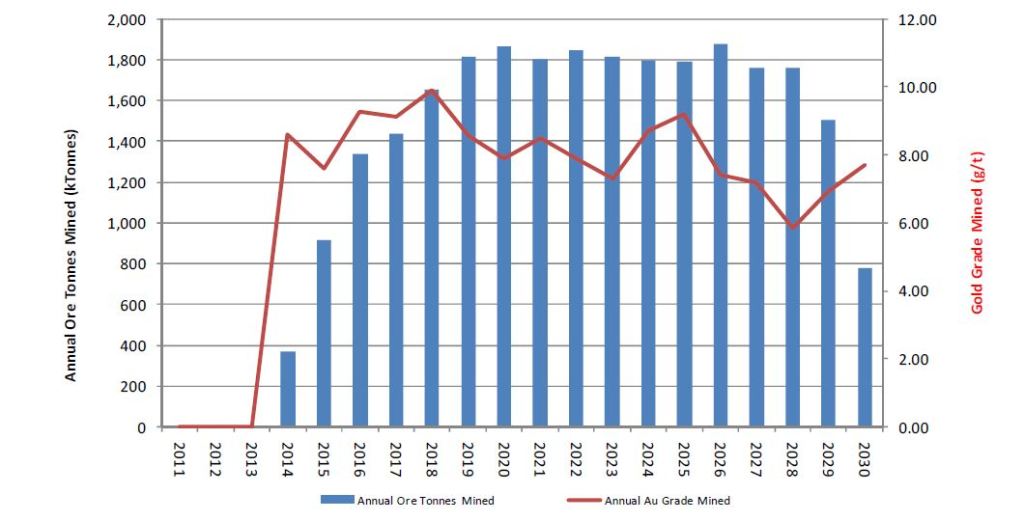

Based on a 2010 pre-feasibility study published by Kinross, the project was envisioned as a two-phase underground operation with a 16 year mine-life. Phase 1 was to be a 2,500 tpd ramping up to phase 2 throughput of 5,000 tpd. The first phase was estimated to cost $707 million with phase 2 costing $413 million. It was expected to produce 379,000 ounces of gold equivalent annually at an average cash cost of $366 per ounce.

According to the release, over $275 million has been spent exploring and developing FDN since its discovery in 2006. FDN holds Indicated resources of 23.5Mt @ 9.59 g/t gold containing 7.26 million ounces and another 14.5Mt @ 5.46 g/t gold containing 2.55 million Inferred ounces.

Lukas Lundin, President, CEO & Director of Fortress commented, "FDN is one of the most significant gold discoveries in the last 15 years and we believe tremendous value can be generated through its development. The value created will benefit not only Fortress shareholders but also the Government and people of Ecuador, who are our most important partners in the project." Mr. Lundin continued, "Our team is very enthusiastic about working on FDN and we are confident in our ability to rapidly advance the project to a construction decision and obtain the required permits to build this world-class gold asset. This acquisition is the first step in the building of our gold company, Lundin Gold, to carry on our previous successes in the gold industry which included the Alumbrera and Veladero gold deposit discoveries in Argentina in the 1990s."

The Lundins expect to move FDN through feasibility to a construction decision quickly, leveraging the considerable exploration and development work already completed.

In a statement to shareholders, J. Paul Rollinson, Kinross' CEO stated: "We believe that Fortress Minerals, as part of the Lundin Group of Companies, is very well positioned to take FDN to the next stage in its development."

"Ecuador has been communicating the potential for mining policy reforms in order to improve international investment in the country's mining sector," the Fortress release stated.

Importantly, the Government of Ecuador has indicated support for the transaction. Given the political environment, certain conditions need to be met before the Lundin Family will invest, including:

- Approval by the Ecuadorian Attorney General

- The government granting an 18-month extension for the company to complete necessary work

- Other regulatory and shareholder approval

The Lundins have never shied away from politically risky projects, but I would suspect the majority of the due diligence on this acquisition was not related to the asset itself but to the political landscape at large and whether or not they would be able to build and operate a gold mine there.

The company expects to close the financing and acquisition on November 25th and mid December, respectively.

This is a transformational deal for the Ecuadorian mining industry. Fruta del Norte represents one of the largest and highest grade undeveloped gold projects in the world.

Torex Gold (TXG:TSX) is a comparable that comes to mind. They hold the El Limon-Guajes project in Mexico which is less than one year away from its first gold pour and hosts 55.2Mt @ 2.79 g/t gold containing 4.9 million ounces in the Measured and Indicated category. They also hold the Media Luna project which hosts 5.8 million gold equivalent ounces in the Inferred category. Torex's current enterprise value is $1.25 billion, or $255 per Indicated ounce ($110 per ounce including all Inferred ounces).

At a $4 issue price and assuming they raise the total $250 million, Fortress will be valued at $410 million (based on pre-acquisition, fully diluted share count of 15.6 million, the issuance of 62.5 million shares in accordance with the raise and a $90 million share payment to Kinross).

If they pay Kinross the full $190 million in cash, they will be left with $80 million cash. On an enterprise value per ounce metric this represents $45 per Indicated in situ gold ounce ($34 per ounce including Inferred). Torex trades at 6x that valuation based on Indicated resources.

Torex has a significantly less risky profile (fully-funded, permitted, 12 months to first gold pour) but at 1/8th the price, Fruta de Norte's high-quality gold ounces, in the hands of the best natural resource developer of our time (the Lundins), looks like great value.

Read: Fortress Enters into Agreement to Acquire the Fruta del Norte Project from Kinross

Related: Lundin's Fortress Minerals halted pending news

Disclousre: Author holds no positions in any of the securities mentioned, however he intends to participate in the Fortress financing. This is not investment advice and may contain erros. Always do your own due diligence.

Why would Kinross sell the best new find in the last 15 years for so little if it would be such a high margin mine? Those stupid MFers paid 20x as much for that crappy Red Back Mining!