Now that Lundin Mining is acquiring the Candelaria mining complex more in Chile, development optionality exists for NGEx (Photo: Mining Press Chile)

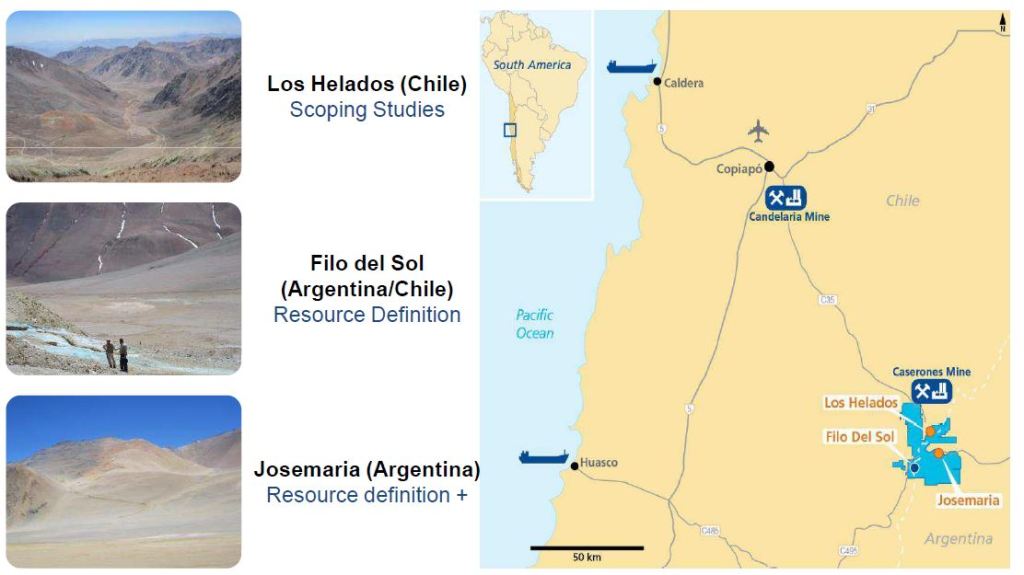

NGEx Resources (NGQ:TSX) is the only pure-play mineral exploration vehicle in the Lundin Group of Companies, one of the most successful natural resource development groups in the world. NGEx is developing a trio of staggeringly huge copper deposits on the Chilean-Argentine border that contain a total of over 28 billion pounds of copper and 19 million ounces of gold resources (only two of the deposits have resource estimates on them).

The company delivered their first economic study (a PEA) on the Los Helados project in Chile to the market yesterday. The Los Helados project is 60% owned by NGEx (operator) and 40% owned by Pan Pacific Copper who recently starting producing from the nearby Caserones copper mine.

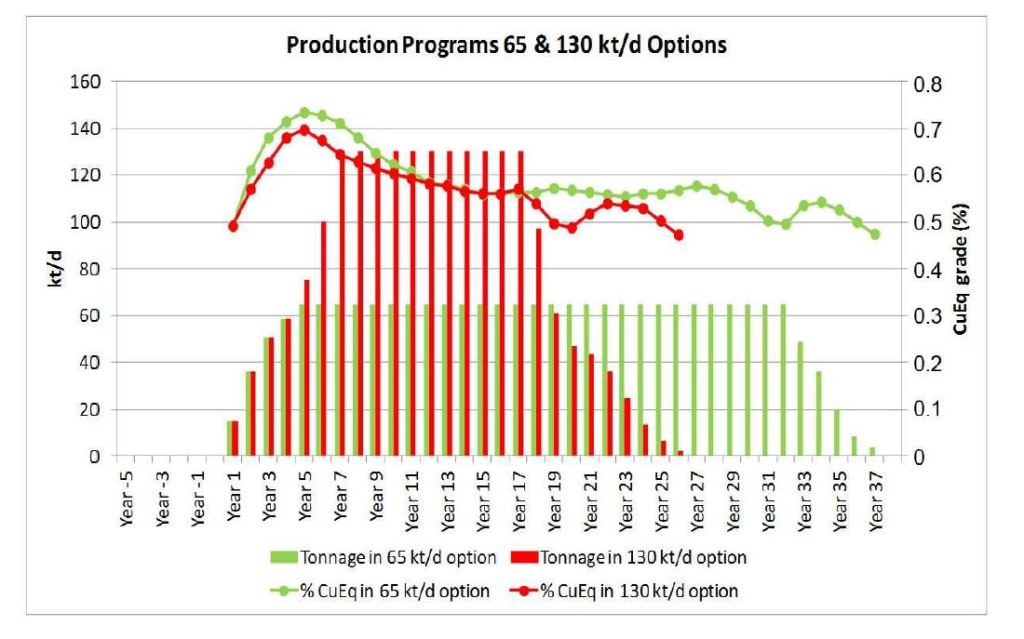

The Los Helados PEA assumes a stand-alone operation under two potential operating scenarios; one at 65,000 tonnes per day (tpd) using a single SAG mill and one using two mills at 130,000 tpd.

Highlights include:

| 130,000 t/d Option | 65,000 t/d Option | |||

| Pre-Tax NPV (8%) & IRR | $923 million NPV 10.8% IRR |

$723million NPV 10.4% IRR |

||

| After-Tax NPV (8%) & IRR | $429 million NPV 9.4% IRR |

$324 million NPV 9.2% IRR |

||

| Metals Prices | $3.25/lb Cu $1,300/oz Au $21.50/oz Ag |

$3.25/lb Cu $1,300/oz Au $21.50/oz Ag |

||

| Initial Capital Expenditures | $4.3 billion | $3.1 billion | ||

| LOM Sustaining Capital Expenditures | $1.3 billion | $1.3 billion | ||

| LOM C-1 Cash Costs (net of by-product credits) | $1.10/lb Cu sold | $1.13/lb Cu sold | ||

| Nominal Mill Capacity | 130,000 t/d | 65,000 t/d | ||

| Mine Life | 26 years | 37 years | ||

| LOM Average Annual Metal Production | 115,000 t Cu 133,000 oz Au 675,000 oz Ag |

81,000 t Cu 93,000 oz Au 474,000 oz Ag |

||

| LOM Average Process Recovery | 89.4% Cu 80.2% Au 51.0% Ag |

89.4% Cu 80.2% Au 51.0% Ag |

The company ultimately decided to model an underground block caving mining operation. They looked at an open-pit only scenario as well as a hybrid scenario, but ultimately went with the underground operation in order to optimize the production profile and economics of the project.

The 65,000 tpd operation will take 4 years to ramp up to full-scale production whereas the 130,000 tpd scenario would take 6 years.

NGEx's CEO, Dr. Wojtek Wodzicki says "The key outcomes of this study are a clear well defined solution utilising a solid, standard mining method and an industry accepted processing flowsheet."

Given this report is a 'first pass' economic study, the company has identified a number of areas of improvement.

Among the most significant improvement to capital returns is the opportunity to realize operating synergies from nearby copper mining facilities. One of these facilities is the Candelaria mining complex which sister company Lundin Mining (LUN:TSX) is in the process of acquiring. Candelaria comes with a full desalination plant which would eliminate NGEx's need to build their own.

Infrastructure, specifically desalination and power, makes up a huge portion of the capex requirements at Los Helados., which is why we feel the potential synergies between Candelaria and Los Helados are huge.

Another possibility for cost savings come from Pan Pacific's Caserones mine which is located just 20 kilometres north of Los Helados.

Dr. Wodzicki continued, "Our previous work defined a robust resource with excellent metallurgy. The PEA builds on that strong base with a suggested mining and processing solution that indicates that Los Helados has the potential to become a large, low cost mine producing a highly desirable, clean, gold-silver rich copper concentrate for 26+ years. In addition to working on Los Helados, exploration remains an important aspect of the NGEx business model and we are confident that we can continue to add to our resource base through exploration on our other projects."

Los Helados represents one of very few remaining large, long-life, low cost copper projects in the world.

The Lundin's are now in the process of securing a foothold in the copper industry in Chile which provides NGEx with new opportunities there.

The PEA moves the company into the developer category, officially, which should trigger a re-rating of the company's shares. However, due to the size and scale of NGEx's project portfolio and now the official capex numbers being made public, the market still wants clarity in terms of how the $300 million company will develop a potential $4.3 billion project.

With Candelaria under the Lundin umbrella, I suspect management is well-advanced on what a potential integration of operations might look like.

Furthermore, with NGEx's project partner Pan Pacific Copper now finished the construction and ramp-up of their Caserones mine, more focus will likely turn to Los Helados and Filo del Sol (both of which they hold a 40% interest in).

NGEx has one more key catalyst before year-end: the release of the maiden resource estimate on the significantly higher-grade Filo del Sol deposit. This estimate is expected in the coming weeks and may surprise investors who think the company's portfolio consists of just low-grade, bulk tonnage material.

Author owns shares in NGEx. Always do your own due diligence.