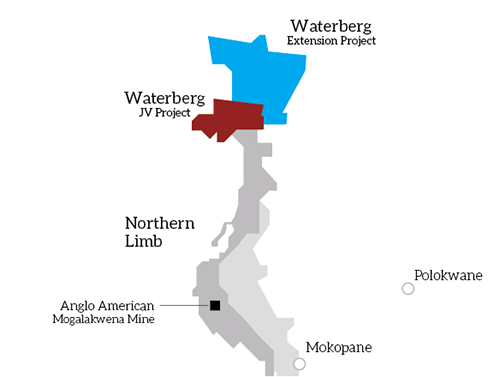

Platinum Group Metals (PTM.T) has had 24 drill rigs turning on the Waterberg joint venture and Waterberg Extension projects. The drilling program has been successful at expanding and detailing the Waterberg T, F and Super F Zones. An updated resource estimate is under way which will be followed by a Pre-Feasibility study.

Platinum Group owns 49.9% percent of the Waterberg joint venture. Japan Oil, Gas and Metals National Corporation (JOGMEC) owns 37% and the remainder is owned by private empowerment partner Mnombo Wethu Consultants Pty Ltd.

In June 2014 a resource estimate was released with an inferred resource at the Waterberg Projects of 29 Million ounces of platinum, palladium, rhodium and gold, ("4E") in the "T" and "F" layers. (287 million tonnes grading 3.15 g/t 4E (0.94 g/t Pt, 1.92 g/t Pd, 0.04 g/t Rh, 0.25 g/t Au,) 30%, 61%, 1%, 8% respectively).

Drilling Highlights (since June)

- Waterberg JV - WB123 80m of 4.80 g/t 3E

- Waterberg JV - WB161 46.79m of 3.76 g/t 3E

- Waterberg Extension - WE048 2.9m of 3.12 g/t 3E (confirms extension of T zone)

6000 drill assays remain outstanding from the ongoing drill program.

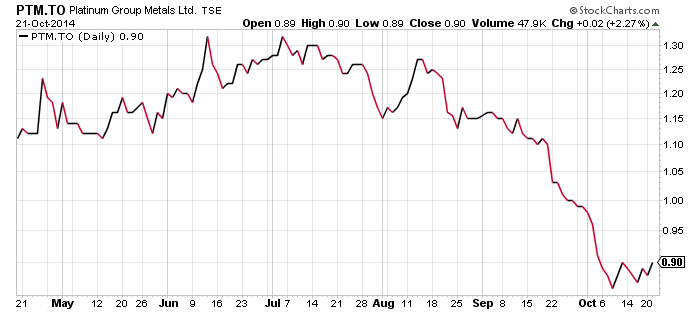

Platinum Group Metals stock price has dropped with most of the other resource stocks in the last several weeks. Very few platinum stocks are listed for investors to trade and Platinum Group Metals is one of the 'go to' names in the sector. Upcoming catalysts investors should watch for are the pending assays, an updated resource estimate, the pre-feasibility study (Q2 2015), and first initial production from the WBJV mine (late in 2015).

Symbol: PTM.T

Share price: $0.90

Shares outstanding: 551.3 M

Market cap: $485.1 M

Read: Platinum Group Metals Updates The Waterburg Joint Venture and Waterburg Extension Projects

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.