The Lundin name has been synonymous with large deals in the mining space (Lundin Mining and Fortress Minerals) as well as big new oil discoveries in Norway (Lundin Petroleum) over the past few weeks, however, today that trend was bucked with their African oil explorer (aptly named Africa Oil (AOI:TSX)) trading to new 52-week lows after the company released mixed results from the aggressive exploration program in Kenya.

The company announced a slurry of well results which included those from new basin opening exploration wells in Kenya.

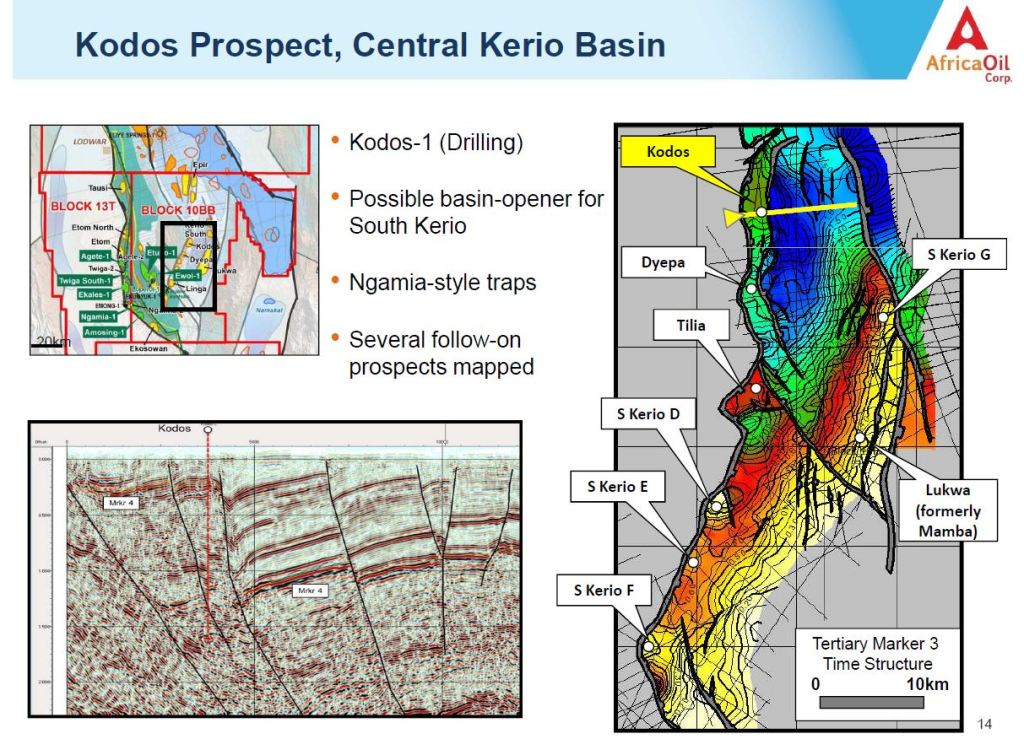

The Kodos-1 well on Block 10BB was drilled to total depth of 2,500 metres but was a bit of a disappointment. Although they encountered hydrocarbon shows, the first well into this new basin (known as Kerio) was drilled into an unfavourable reservoir which the company attributes to the well being located too close to the basin bounding fault.

The Kerio Basin is located northeast of the South Lokichar Basin. Their 50% partner and block operator Tullow Oil was also encouraged by the initial results and the two companies are now reviewing the data and plan to follow-up drill in early 2015.

Although the Kodos-1 well didn't hit commercial oil rates, AOI and Tullow believe oil is close (Image: Africa Oil)

Keith Hill, Africa Oil CEO commented, "We are encouraged that the first well in the Kerio Basin encountered hydrocarbon shows which indicates the presence of an active petroleum system. We believe the reservoir will improve as we move away from the basin bounding fault and believe that the Epir-1 well should intersect this section in the North Kerio Basin directly on trend. We are still of the view that the basins nearby the proven Lokichar Basin are highly prospective and should have similar geology due to a similar geological history. We look forward to drilling basin opening wells both here and in the large North Turkana Basin."

Tullow's Exploration Director, Angus McCoss, reiterated a similar statement: “The Kodos-1 well is the first test of the Kerio Basin and hydrocarbon shows provide encouragement, indicating the presence of an active petroleum system. The potential of the Kerio Basin remains highly prospective and the rig is now moving to drill the next well, Epir-1, in a sub-basin to the north of Kodos-1."

Africa Oil also released the results of the Ekosowan-1 well which was also drilled on Block 10BB and similarly to Kodos-1 is thought to have been drilled too close to the basin bounding fault. This well did, however, intersect a 900 metre oil column in tight sands. A down dip appraisal well between the Ekosowan-1 well and the Amosing field is in the works.

These two wells (Kodos and Ekosowan) appear to be following a similar pattern which led to the discovery at Twiga. In 2012, after discovering a 240 metre net oil column at the Ngamia-1 well, the company drilled the initial Twiga well which was drilled too close to the basin bounding fault, but then in a follow-up well proved to hold substantial oil. Mr. Hill believes this will likely be the case at Kodos and Ekosowan.

The Sakson PR-5 rig which drilled the Ekosowan-1 will now be replaced by the new SMP-106 rig which is currently mobilising to the Engomo-1 well location. This well will be the first test of the North Turkana Basin in Block 10BA. This prospect is in the largest basin in Africa Oil's portfolio and is directly onshore from Lake Turkana where the company says it has seen numerous oil slicks and seeps.

Appraisal of the company's best field in the basin, the Ngamia field, continued with Ngamia-4 encountering 120 metres of hydrocarbon pay including 80 metres of net oil. This well was drilled 1.1km west of the Ngamia-1 discovery well.

As part of the comprehensive release, Africa Oil also announced the results of four flow tests on the Twiga-2A well on Block 13T.

They achieved rates between 150 and 3,270 bopd under natural flow with no depletion. This is the highest oil production rate seen to date in Kenya. The company believes, with optimized equipment, they will be able to achieve 10,000 bopd rates from this well. Further appraisal wells are being planned with Tullow (also 50% operating partner on Block 13T).

The SMP-5 workover rig which was used at Twiga-2A is now being moved to the Amosing field to begin extended well testing on the Amosing-1 and 2A well to help provide dynamic flow characteristics of the Amosing stacked reservoirs.

"We continue to build certainty and resources in the main Ngamia / Amosing field areas and the data obtained from the 3D seismic and the Ekosowan well should allow us to expand this area further," Mr. Hill stated in the release.

Shares traded down to a new 52-week low of $3.61 but rebounded slightly to $3.69 at the time of writing.

On the call, Mr. Hill said everyone at the company is "dismayed by the current share price" and stated that he believes the current share price doesn't even fully value what they have proven and that it attributes nothing to the exploration potential.

With oil recovering slightly but still off dramatically for the year and the market having no time for slightly bad news, this offers an attractive entry point into a high-risk, high-reward oil exploration play led by one of the most successful groups in the natural resources sector.

As of June 30th, the company had $350 million in cash plus another $43.5 million farmout carry with Marathon Oil and no debt.

Read: Africa Oil Kenya Operations Update and Conference Call

Disclosure: Author bought a position today at $3.66 as a extremely high risk speculation. This is not investment advice. Always do your own due diligence.

Buuhu keith hill… Will you have the balls to cash in your 1,49$ options due in a months time after the last 2 years horrible return for long term shareholders?

Of course you will…