Detour Gold (DGC.TSX) reported a small loss of $800,000 after the bell today. Gold production for the quarter was 115,334 ounces meeting management expectations. Cash costs came in at $941 per ounce sold which is within the company's guidance of between $900 and $975 for the year. The asset is one of the best in the gold space with 15.5 million ounces in mineral resources and a projected mine-life of over 21 years.

Detour continues to ramp up production at the mine and I believe it will be the next producer in Canada to receive a takeover offer, likely from Goldcorp (G.TSX).

What's the hold up on the offer? Well, despite the weak gold price, the company has struggled to ramp up the giant mine. Although they sold 106,334 ounces this quarter at an average realized price of $1,278, they did so losing money because it cost them $1,296 to sell each ounce they produced (including $350 per ounce in depreciation expense).

A gold hedge is in place from August to December covering 100,000 ounces at a contract price of $1,287 per ounce which should help protect Q4 earnings despite the declining gold price.

A positive operational sign this quarter was that the mill was running above nameplate capacity of 55,000 tonnes per day (tpd) for 44 consecutive days. The company maintained full year guidance of 450,000 to 480,000 ounces of gold.

At full-scale production, the mine is expected to produce 660,000 ounces of gold at average cash costs of $723 per ounce (life-of-mine).

Detour still has a lot of work ahead of them and expect to end the year spending between $125 and $135 million on the project. They have to increase the mining rates which were at their lowest for the year this quarter as a result of low drilling productivity and delays in explosive loading which, the company says, impacted shovel productivity and utilization.

The mill availability also needs to be improved as shut-downs have been common in order to replace and/or fix equipment.

"Overall, our third quarter operational results were in line with our forecast with gold production standing at 339,864 ounces for the first nine months of the year. Based on the current ramp-up progress, we remain on track to be within our production and total cash costs guidance for 2014," said Paul Martin, President and CEO. "We are extremely satisfied with the recent performance of the plant and remain confident in further improving mill availability during the fourth quarter. Our focus is now on the mine operations to further increase mining rates."

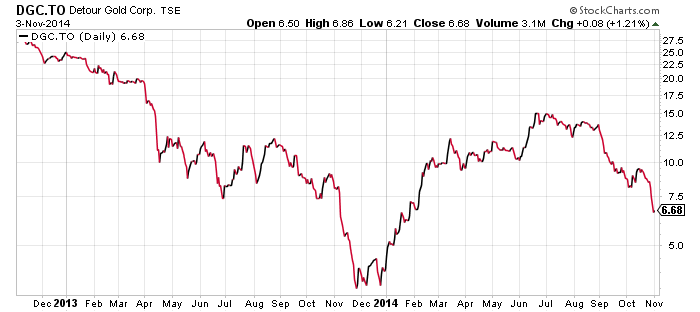

Owning Detour shares has been a wild ride the last 2 years with the stock ranging from a high of $27.50 all the way down to a low of $2.88 late last year.

I believe Detour is an excellent takeover candidate for Goldcorp, once management has worked through the ramp up 'growing pains'.

Goldcorp attempted a bid on a similar size company, Osisko, in early 2014 but lost out to Agnico-Eagle and Yamana in a very public bidding war after Goldcorp initiated a hostile bid. Osisko was acquired for its Canadian Malartic mine in Quebec which produces 600,000 ounces of gold annually and hosts a global resource of +10 million ounces of gold.

Osisko was jointly acquired for $3.9 billion. The current enterprise value of Detour is less than half of that, or approximately $1.5 billion.

The next logical move for Goldcorp would be to make a bid for Detour, and this could happen as early as next year if Detour can continue to show operational consistency at the mine.

Goldcorp brought a couple new mines on-line this year and will have increased cash flow generating capacity in 2015 as capex requirements slow down.

In addition, Goldcorp could be in the market for a long-life, large-scale asset in a stable jurisdiction and Detour fits this bill.

Detour does have $760.2 million in debt and interest of which $500 million in principal associated with a 5.5% convertible note is due in 2017. A sliding gold price is something to watch as this is a low grade, bulk-tonnage asset (<1 gram per tonne).

The 20 analysts that cover Detour have an average target price of $15.41 per share and nobody believes the company is worth less than $11.25 per share (October 14, 2104).

Shares have outperformed the Market Vectors Gold Miners ETF (GDX) this year, trading up 27% versus the index's negative return of 21%.

Paulson & Co, the hedge fund led by Wall Street legend John Paulson, owns 14% of the company's shares.

Management will host a conference call on Tuesday, November 4, 2014 at 10:00 AM E.T. The details of the conference call are as follows:

- Via webcast, go to www.detourgold.com and click on the "Q3 Results Conference Call and Webcast" link on home page

- By phone toll free in Canada and the United states 1-800-319-4610

- By phone International 416-915-3239

The conference call will be recorded and playback of the call will be available after the event by dialing toll free in Canada and the United States 1-800-319-6413, or internationally 604-638-9010, pass code 1532 (available up to November 30, 2014).

Symbol: DGC.TSX

Share Price:$6.68

Shares outstanding: 157.8 M

Market cap: $1.04 B

Net debt: $470 M (as of Sept 30th)

Read: Detour Gold Reports Third Quarter 2014 Results

I have no position in any of the stocks mentioned. This is not investment advice. Thoughts in this article are my opinion and should be taken as is. As always please do your own due diligence.

I would put my money on Chesapeake gold (CKG). Detour’s cost per ounce is too high!