Greenville Strategic Royalty (GRC.V) reported it's first profitable quarter this morning, earning net income of $529,000. Management has successfully added 22 royalties since July 2013 averaging ~2 per month and they are discussing paying a dividend to shareholders.

Grenville provides royalty based financings to small businesses usually for between $1-$2 million. In exchange they receive a royalty based on gross sales of between 1 and 4 per cent.

Many of our readers are familiar with royalty companies in the resource space like Franco Nevada, Royal Gold, Silver Wheaton, and Sandstorm Gold. The royalty business model is very successful and these companies have outperformed gold producers during this downturn.

An investment in Greenville Strategic Royalty has the following advantages over precious metals royalty companies:

1. Immediate cash flow - The small businesses GRC is investing are already generating cash flow. Mining royalty payments are usually up front payments to build the mine.

2. Diversification - Greenville has investments in several different industries thereby reducing risk, whereas mining royalty companies are dependent on commodity pricing.

"Our growing portfolio of royalty investments generated strong revenue, net income and adjusted EBITDA during the quarter," said William (Bill) R. Tharp, president and chief executive officer of Grenville. "This is a milestone quarter for the company, with material improvements to the diversification of the portfolio and corresponding growth in both investment pace and individual deal size. As a result of these positive results, rapidly increasing revenues and, most importantly, material adjusted EBITDA, along with strong future growth prospects, the company is now focused on delivering its next significant milestone, the design and implementation of a plan to return capital to shareholders in the form of a regular dividend. With a solid foundation set in place, the company will continue to build on its successes while managing the business to achieve our target average royalty payment per $1-million invested of $250,000."

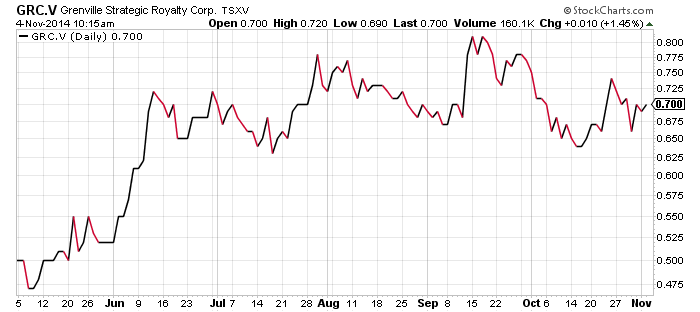

The six month chart shows a rise in the stock price from 47 cents to 70 cents.

The company is cash flow positive and royalty income continues to increase quarter over quarter. Add the fact that management is discussing paying a dividend and you have a strong indication that Greenville is on the right track.

If you're looking for some portfolio diversification with an early stage company Greenville is a good bet.

Symbol: GRC.V

Share price: $0.69

Shares outstanding: 59.37 M

Market cap: $41 M

Read: Grenville Strategic earns $528,558 in Q3 2014 or If you're tired of resource stocks check out this royalty company

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.