Tahoe Resources (THO.T), the world's highest grade silver producer, announced an updated mineral reserve and feasibility study for the Escobal mine in Guatemala this morning. Tahoe is one of a just a few primary silver mines in the world generating a profit at current silver prices.

The mine is especially profitable compared to its peers as it benefits from high grade material of ~350 grams per tonne silver which allows for an all in sustaining cash cost of sub $10 per ounce.

Tahoe went into production earlier this year and is on track to produce approximately 20 million silver equivalent ounces per year. If they reach this target they will be the worlds 3rd largest silver mine behind Cannington and Fresnillo.

Announcements in this mornings press release include:

- An 18% increase in Measured and Indicated reserves to 443.9 million ounces at an average grade of 346 grams per tonne.

- Inferred mineral reserves of 9.3 million ounces at an average grade of 224 grams per tonne.

- Proven and Probable mineral reserves of 350.5 million silver ounces at an average grade of 347 grams per tonne.

- Average annual production of 19.1 million silver ounces and 22.4 million silver equivalent ounce (first 10 years of mine life).

- CAPEX of $24.3 million for mill expansion to increase through put from 3500-4500 tonnes per day.

* of note is the updated reserve estimate uses $22 silver

Tahoe is going to move forward with mill expansion and expects to be at the 4500 tonnes per day level before the end of 2015.

Chief executive officer and vice-chairman Kevin McArthur said, "The primary purpose of this feasibility study was to provide support for the mineral reserve estimate and the details of the life-of-mine plan."Escobal achieved commercial production in January, and our goal is to produce 20 million ounces of silver in this first year of production. Escobal forms a strong economic foundation for the future growth of the company,"

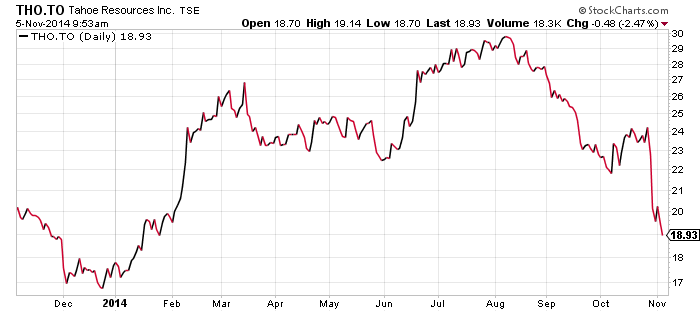

Tahoe stock had a good run from the beginning of 2014 to August as they entered production at Escobal. The pull back of $10 a share since then is the result of the silver price, as operationally everything appears to be fine. Investors should pay attention to operational performance when Q3 earning are release on November 11th.

Management owns ~4% of the stock and is focused on generating free cash flow so they can pay a dividend. Goldcorp a owns ~40% of the stock after selling the Escobal project to Tahoe in 2010.

Four reasons why Tahoe is on the top of my list for silver stocks:

- Management is first class, led by CEO Kevin McArthur, former CEO of Goldcorp

- They have a large asset (350 million ounces P+P) that will produce 20 million ounces a year of high grade silver (350 g/t)

- Their all in sustaining cost is below $10 which will generate strong free cash flow even at lower silver prices

- A dividend policy is expected to be in place later this year

Symbol: THO.T

Share price: $19.10

Shares outstanding: 147.43 M

Market cap: $2.8 B

Read: Tahoe Resources Announces Escobal Mineral Reserves or Are primary silver producers making money at the current silver price?

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.