New Gold (NGD.T) has made an offer to acquire Bayfield Ventures (BYV.V) in an all-stock deal worth $16.6 million. The deal has been speculated since New Gold bought Rainy River in May 2013.

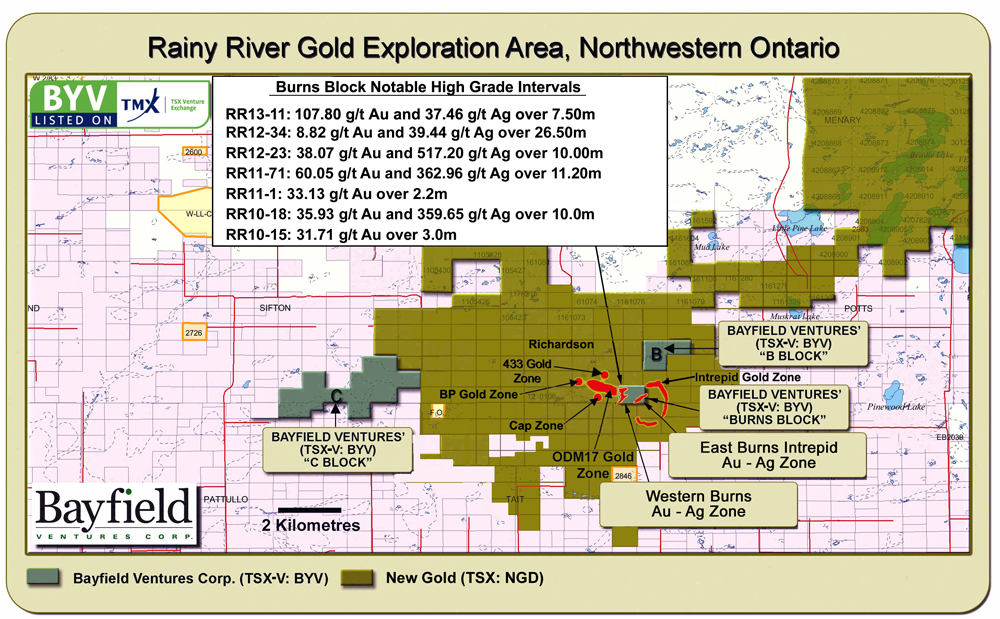

Bayfield holds a strategic land package surrounded by the New Gold (previously Rainy River) claim block.

In the past, New Gold management has shown that they like to consolidate land positions and districts, which likely fuelled the speculation. After acquiring the Blackwater deposit in BC in 2011, management bought out a couple of juniors that held land in the area.

New Gold is offering stock, 0.0477 of a New Gold common share for each Bayfield common share held. The deal values Bayfield at 21 cents per share or ~$16.6 million which represents a 47% premium to Bayfield's 20-day VWAP.

Bayfield did have a small resource of ~210,000 ounces of gold and 2.2 million ounces of silver on their most strategic block, the "Burns Block".

The Burns Block is adjacent to the east of New Gold's ODM17 gold-silver deposit and to the west of their expanding Intrepid gold-silver zone.

CEO.ca reached out to Bayfield for comment:

"In addition to providing investors with retained exposure to our properties, it also offers access to New Gold's strong balance sheet and current and future operating cash flow to develop the Rainy River project. The deal values Bayfield's gold equivalent ounces at over $65/oz which is much higher than the majority of the recent precedent transactions." - Jim Pettit, Chairman and CEO.

Bayfield has been closely correlated with the Rainy River project ever since the junior hit high-grade gold intercepts right on the border of the Rainy River deposit in the fall of 2010 which saw their share price skyrocket from the $0.40 to over $1.40 in a matter of days (the good days). Shares were never able to recover as the gold market dissolved and exploration stories became a "no, no" for investors.

The deal took longer than expected to materialize but New Gold had the benefit of being able to wait; they held the surface rights on two of the properties (one being the "Burns Block") while Bayfield held the mineral rights. Additionally, New Gold had to rework the Rainy River scoping studies to adjust for the lower gold price environment and the fact capex dollars aren't as easy to come by as they once were.

"The acquisition of Bayfield further consolidates our position in the Rainy River district," stated Hannes Portmann, Vice President, Corporate Development said in the release. "By adding these three properties within and adjacent to our project area, it simplifies our development plans, increases our gold and silver mineral resources and adds to our prospective land package."

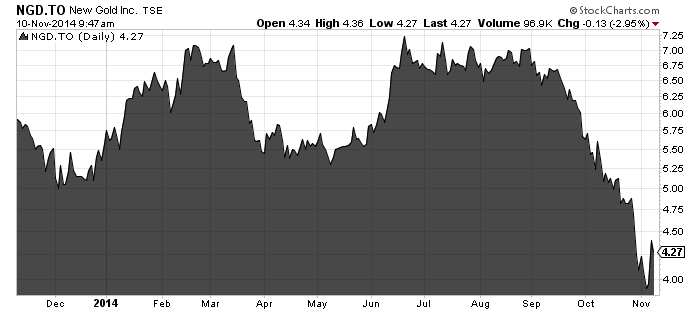

Like most gold equities, New Gold stock has been on a steep down-trend since early September, reflecting the falling gold price. Adding to further downward pressure on the stock, New Gold owns 30% of the El Morro project in Chile with partner Goldcorp, and they are having problems with environmental permitting. In fact, Goldcorp recently announced they were withdrawing their EIS application for the project amid the murky political situation surround the project.

New Gold has $416 million in cash and is well set-up for future growth with the Rainy River and Blackwater projects in the pipeline. Rainy River will be developed first as the economics of the project are better than the much higher capex Blackwater project.

If/when the gold market turns, New Gold will be a top name to watch in the mid tier space.

Symbol: NGD.T

Share price: $4.24

Shares outstanding: 503.63 M

Market cap: $2.1B

Read: New Gold to Acquire Bayfield Ventures

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.