In a tough market for mining equities royalty companies continue to be solid investments, and in fact, outperform producers.

Silver Wheaton (SLW.T) the world's largest silver streaming company, is an excellent example of this. The company reported net earnings of $4.5 million (1 cent per share) for the third quarter this morning. Silver Wheaton is well diversified with 18 operating mines worldwide and 5 development projects.

Some of the advantages of owning a royalty company are:

- they have fixed operating costs

- there are no ongoing capital expenditures or exploration costs

- they have a highly diverse asset base

- they pay a sustainable dividend even at lower metal prices

I was in on a conference call with Silver Wheaton this morning to get their update.

The company continues to generate operating margins of over 70% while having one of the highest production levels in the industry. And, investors worried about the silver decline will be happy to know that 86% of production comes from mines that are in the first quartile when it comes to cash costs.

Quarterly Results:

- Production for the third quarter was 8.4 million ounces which is a decrease of 7% from the 9.1 million last year

- Revenues were strong at $165.9 million consistent with last year at $166.4 million

- Adjusted net earnings were $72.6 million ($0.20 per share) in Q3 2014 compared with $77.1 million ($0.22 per share) last year

- Cash operating margin in Q3 2014 was $14.39 per silver equivalent ounce compared with $16.53 in Q3 2013

However, it wasn't all good news: due to the low silver pricing one of the Company's operators, Mineral Park, was forced to declare bankruptcy. Silver Wheaton took an impairment charge of $37.1 million on Mineral Park, and an additional impairment charge of $31.1 million at the Campo Morado asset as it nears the end of its mine life.

A quarterly dividend of 6 cents per share has been declared.

Silver Wheaton is forecasting growth in production of 35% from current levels before the end of 2018. Hudbay's large Constancia Mine is starting initial production this quarter of which Silver Wheaton has a stream on 100% of silver and 50% of gold produced.

At the end of September, Silver Wheaton had $233 million in cash and a $1 billion dollar credit facility, which along with steady cash flow provides flexibility to acquire more streams.

"The strength of Silver Wheaton's streaming model was once again highlighted in what can only be described as a challenging third quarter for precious metals," said Randy Smallwood, President and Chief Executive Officer of Silver Wheaton. "Despite silver and gold prices falling 19% and 9% respectively in the quarter, Silver Wheaton continued to generate cash operating margins of over 70% while maintaining one of the highest production levels in the silver industry. Additionally, we saw excellent progress at our key growth assets with record production from Vale's Salobo mine as its expansion continued to ramp up, along with Hudbay's Constancia mine which remains on track for first production in the fourth quarter of 2014."

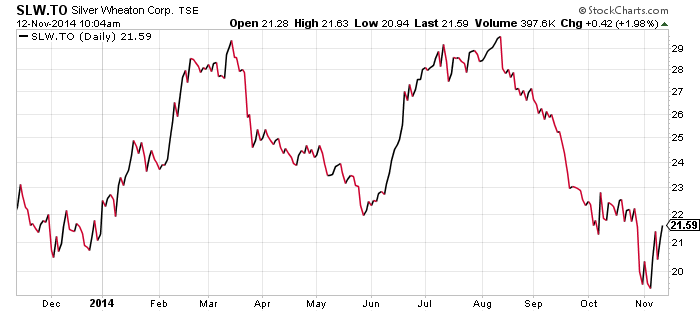

Silver Wheaton stock price is flat on the year after the recent sell off due to lower silver prices. Being even on the year is actually a terrific performance as many silver producers are down 30% or more.

The company has now been in business for 10 years and delivered a 500% return to shareholders, while the silver price is up 140%.

I believe royalty companies will continue to outperform other mining equities in the future and therefore should be a core holding in the precious metals segment of an investor's portfolio.

Symbol: SLW.T

Share price: $21.68

Shares outstanding: 364.35 M

Market cap: $7.9 B

Read: Silver Wheaton Reports Third Quarter Results for 2014

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.