The ultimate goal of any gold producer should be to make money for shareholders. After looking at a fair number of recent quarterly results, it appears that very few gold companies are accomplishing this currently.

One company that is delivering profits in its first year of production is Klondex Gold (KDX.T).

Klondex operates the Midas mine and Fire Creek project in Nevada. Production costs at the mines were only $613 per gold equivalent ounce on production of 33,339 gold ounces and 364,435 silver ounces. This lead to a net profit of $7.22 million ($0.06 per share).

Two reasons why Klondex is having success.

1. People

The team at Klondex has a proven track record and lots of experience on the technical side of running mines. Under promising and over delivering is rarely seen in the industry and Klondex has already increased production guidance by 10,000 ounces for the year. Management and board are also closely aligned with shareholders by personally owning shares (6%). Recently CEO Paul Huet mentioned that he and his wife have ~ $800,000 worth of savings which is all in Klondex stock. He mentioned in the United States he had to actually sign a legal document to do this declaring that he was indeed sane.

2. Projects

The grade at the projects is first class compared to most mines around the world (<2 g/t). Fire Creek is probably the highest grade mine in the world at 41.6 g/t while the Midas operation is a very respectable 12 g/t. The high grade ore leads to lower cash costs, therefore profits. The Midas mill acquired from Newmont earlier in the year is running efficiently and has lead to substantial cost savings. Each of the projects has considerable room for growth in finding more resources.

Paul Huet, Klondex President and CEO commented: "The third quarter operational results continue to transform Klondex from a development company into a profitable low-cost precious metals producer. The strength of our first three quarters of production allows us to increase our targeted production to 95k GEOs recovered. I am very grateful for the dedicated efforts of the Midas and Fire Creek teams as they continue to produce exceptional operational results. We anticipate that even within the current volatile gold price environment, Klondex will continue to generate positive cash flows from operations, further strengthening our balance sheet.

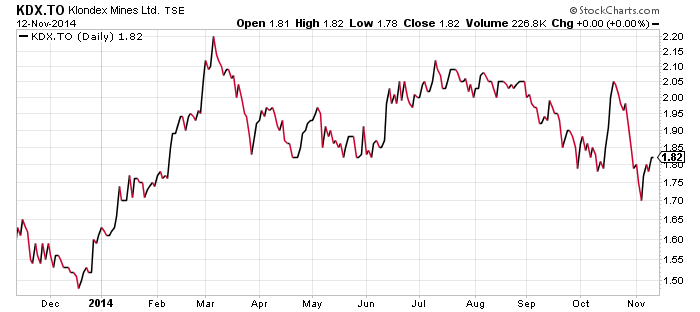

Klondex stock is performing well this year (2014) as they make the step from explorer to producer. Shares are currently trading at $1.81, up from the $1.50 level at the beginning of the year.

Management has done a tremendous job in the first year of production of generating free cash flow for shareholders.

Upside remains in the stock with upcoming catalysts:

- increased gold production guidance for the year (strong fourth quarter)

- an updated mineral resource estimate for Fire Creek this quarter

- an pre feasibility study on Midas in the first quarter of 2015

A study done by Bloomberg and US Global investors on 2nd quarter earnings shows how profitable Klondex is compared to peers.

Symbol: KDX.T

Share price: $1.82

Shares outstanding: 121.47 M

Market cap:$ 221.1 M

Read: Klondex Reports Q3 Production Cost of US$439 per Ounce Sold with By-Product Credit or Plenty of upside for this new high grade gold producer in Nevada

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.