Rio Alto Mining (RIO.T), a profitable junior gold producer has announced a revised initial CAPEX on the Shahuindo gold project in Peru. The initial CAPEX is estimated at $70 million with first gold production in 2016.

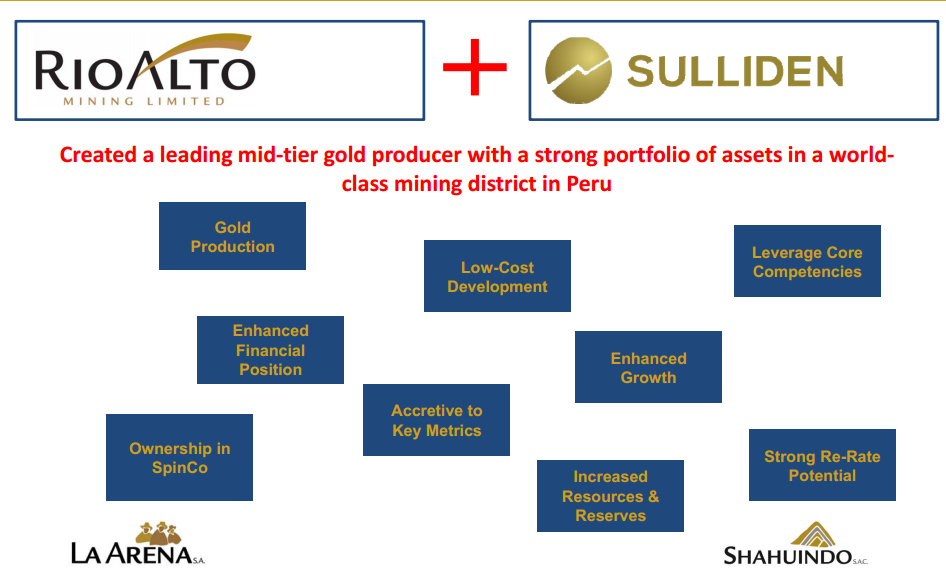

Rio acquired the Shahuindo project when they merged with Sulliden Gold in June. The Shahuindo project combined with the currently producing La Arena mine is expected to help turn Rio Alto into a leading mid tier gold producer.

The Shahuindo project is located in close proximity to the La Arena mine and will benefit from management's previous experience building La Arena.

The initial CAPEX estimate announced this morning is a significant reduction from the $132 million CAPEX estimated by Sulliden in 2012. The $70 million estimate from Rio Alto incorporates a number of changes based on RIO's experience with the La Arena mine.

Changes include:

- contract versus owner mining

- dump leach as opposed to the 2-stage crush + agglomerate route selected by Sulliden

- using a smaller (4 million tonne) "starter" leach pad requiring limited cut/fill as compared to Sulliden's plan for a large valley-fill leach pad

The same contractors used to build the La Arena mine Stracon GyM will be the principal contractors for the Shahuindo project.

An updated reserve and resource estimate is expected in the third quarter of 2015. Once this estimate is released more guidance will be given on estimated production for 2016 and more details will be released on CAPEX and timing for the future expansion of the project.

"First gold is expected from Shahuindo by January 2016. Rio Alto's management team is enthused about building its second mine in Peru whilst maintaining the strong performance and low cost of production at the Company's nearby La Arena Gold Mine. The Company is in an enviable position being able to start-up its second mine in Peru for a modest capex of $ 70M given the low gold price environment the industry is currently experiencing. We continue to focus on wealth creation for all shareholders of our Company and stakeholders in Peru despite the many challenges our industry currently faces," commented Alex Black, President & CEO.

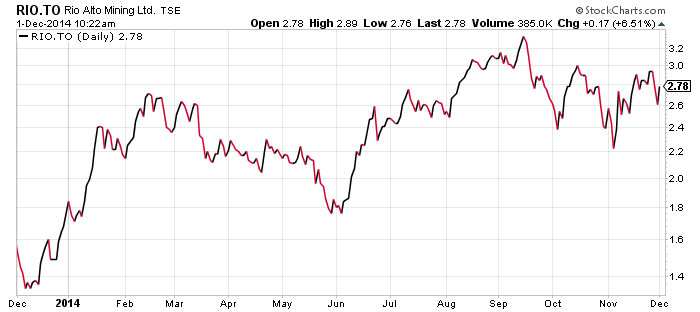

In a challenging year for gold equities RIO stock has performed very well in 2014, doubling in price. One reason why the share price has doubled is that RIO has posted a net profit in every single quarter. Cumulative net earnings for the first three quarters of 2014 are $48.4 million.

Shareholders take note: Rio Alto is a profitable gold producer moving forward with a strong growth plan.

Symbol: RIO.T

Share price: $2.80

Shares outstanding: 331.39 million

Market cap: $927.9 million

Read: Shahuindo Stage 1 Project Capex Estimate, US$ 70m First Gold Production By January 2016

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.