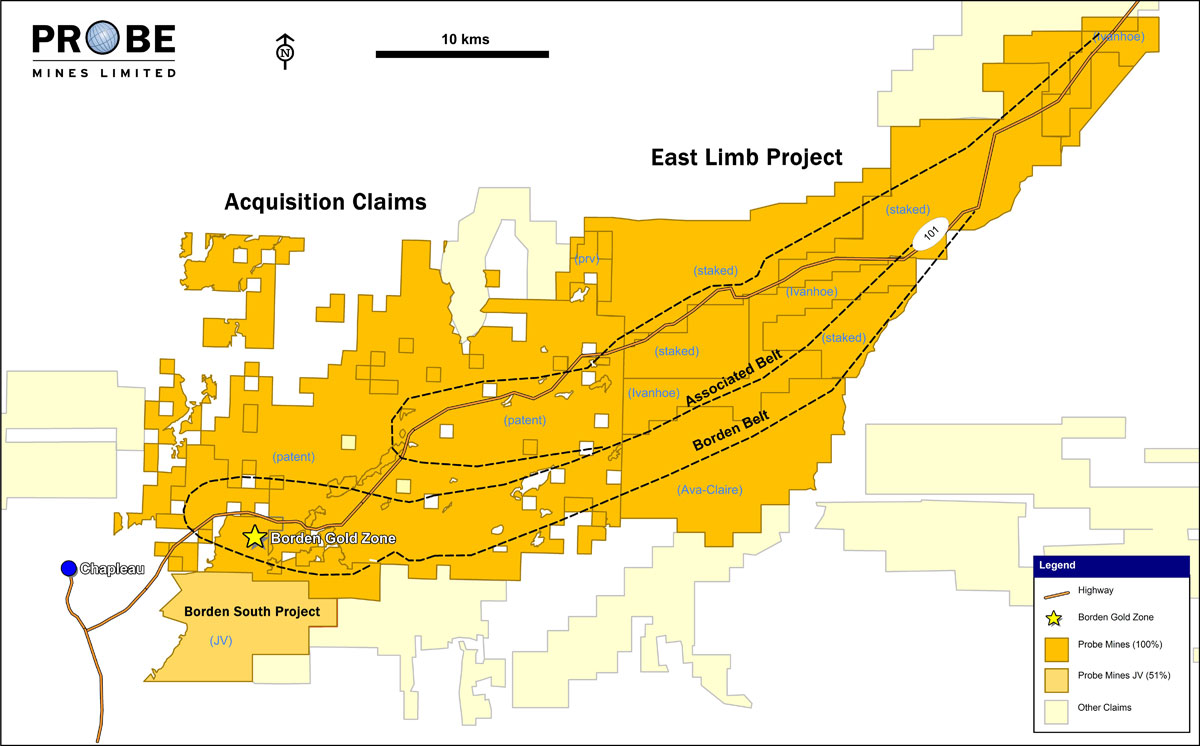

Probe Mines (PRB.V) has acquired 100% ownership of all claims it did not previously own at the Borden gold project in Ontario, Canada. The deal comes at the steep price of $25 million in cash and 6 million common shares of Probe. The 6 million shares are worth ~$15-$18 million and represent 6.6% of Probe's total shares outstanding.

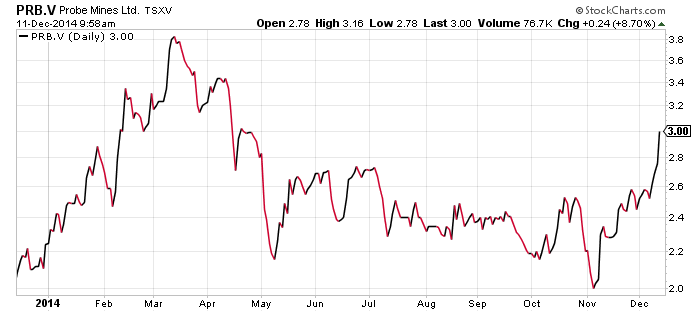

This is significant news for the company and the stock is up 20 cents (7%) at press time.

Probe now controls 100% of a 70 kilometre strike length of the Borden gold belt.

The company has been one of the better discovery stories in the last couple years, going from a grass roots exploration story to a development company with 4.2 million ounces of gold.

Transaction highlights:

- The acquisition consolidates 100-per-cent ownership of the Borden gold deposit

- All the acquired claims are royalty free

- The resultant 786-square-kilometre property package strengthens the land position in the Borden gold district and all of its untapped exploration potential

- The transaction establishes additional near-term catalysts, including drilling in a strategic area of the HGZ on the 'Wedge' claim

- The company's balance sheet remains strong following the acquisition, and an aggressive program is planned for exploration of the deposit and regional claims during 2015.

Strong drill results have been reported on either side of the Wedge claim so far, and a 2015 winter drill program is scheduled to begin immediately. It's clear Probe is expecting to find something but you never know with geology.

The company's goal is to add additional high grade ounces from drilling to incorporate into a preliminary economic assessment (PEA) expected in the first half of 2015.

Jamie Sokalsky, chairman of Probe, commented: "The acquisition of this strategic land package puts the company in an unparalleled position in what we believe to be Ontario's newest gold camp. To own a district-sized property surrounding a new multimillion-ounce deposit with all of its untapped exploration potential is a unique situation that adds considerable value to our shareholders. We are delighted to have worked with our partner, Scierie Landrienne, to settle this transaction and we welcome them as shareholders of Probe."

Probe has held up better than most gold equities this past year. Ontario is one of the best places in the world to explore and mine for gold, and history has shown that if you find a large enough gold deposit in Ontario the odds of a takeover are highly likely.

Acquisitions in the last couple years include:

- Newgold and Rainy River

- Argonaut Gold and Prodigy

- Iamgold and Trelawney

Probe now has $15 million in cash and a $10 million dollar credit line to finance a catalyst rich next 6-12 months which should see winter drilling, a new 43-101 resource estimate, a PEA, and some regional exploration.

The PEA will be key, and if the economics are good I would expect lots of takeover interest from larger gold companies. Of note is that gold producer Agnico Eagle Mines (AEM.T) owns 7.3 million shares of Probe.

Symbol: PRB.V

Share price: $2.96

Shares outstanding: 90.79 M

Market cap: $268.7 M

Cash: ~$15 M

Read:Probe Mines Consolidates 100% Ownership of the Borden Gold District

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.