This morning Rockwell Diamonds (RDI.T) announced a conditional agreement to acquire additional alluvial diamond properties contiguous to existing properties. The properties will be acquired from Bondeo 140 CC and its affiliates for $28.5 million.

The breakdown of the $28.5 million will be $12 million for the mineral rights and three processing plants and $16.5 million for equipment. The transaction is expected to close in the second quarter of 2015.

The next step will be to raise the $12 million by March 31,2015. This might be a challenge for a company currently with a $15 million market cap, but it is doable.

Rockwell is a small diamond producer that recovers roughly 10,000 carats per quarter. Each quarter the company hovers around break even, earning $345,000 in Q1 and losing $1.5 million in Q2.

The balance sheet was looking a little shaky with a bank overdraft of $963,000 as of August 31, 2014. However, the situation has improved after closing a $4.1 million debenture with 2 insiders on November 19th. The insiders taking part were Daboll Consultants and Mark Bristow. Mark is currently the CEO of Randgold and was previously the CEO of Rockwell in 1992.

No details have been given yet on how the acquisition will increase operations but investors can expect more on a conference call that will be held Wednesday January 7th at 10:30 a.m. Eastern Time.

Commenting on the transaction, James Campbell, chief executive officer and president, said:

"We are delighted to have concluded this agreement, as it represents an exciting growth platform for Rockwell. Our executive and operational management have demonstrated their alluvial diamond production expertise during Rockwell's corporate turnaround and have the capacity to take on these additional assets. We have reviewed a number of consolidation opportunities, and the transaction met all our strategic criteria. Its assets are contiguous to our existing MOR operations, which are known for their gem-quality diamonds. We know the geology of the area. So these new assets offer economies of scale, with the potential to reduce the volatility of our quarterly production results and take us above our target of processing 500,000 cubic metres per month. It will also give us the opportunity to allocate our financial, human and intellectual capital more efficiently across a broader resource base. Furthermore, we have a long-standing working relationship with the sellers of the assets which we are acquiring, who initially brought this opportunity to the table, and we have agreed to work together in order to find additional opportunities that might benefit both parties."

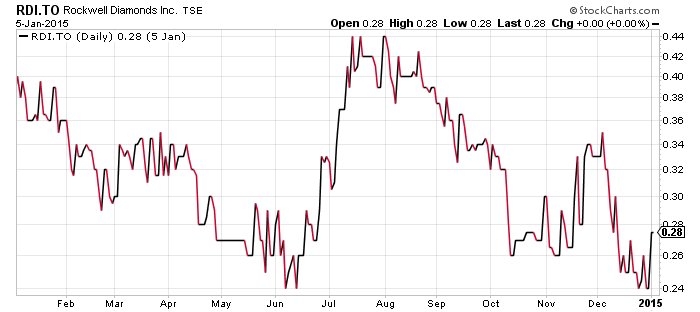

Rockwell has yet to gain much traction in the market and appears to be flying under the radar of diamond investors. The stock trades extremely low volume with most days under 50,000 shares traded.

Many analysts are expecting higher diamond prices in the years to come which bodes well for diamond stocks. One company that has had a tremendous run the last couple years is Lucara Diamond (LUC.T) which is part of the Lundin Group.

Other companies investors can take a look at if they are interested in diamonds include Mountain Province (MPV.T), Stornoway Diamonds (SWY.T), and North Arrow Minerals (NAR.V).

Symbol: RDI.T

Share price: $0.28

Shares outstanding: 54.48 M

Market cap:$15 M

Read: Rockwell to acquire South African diamond properties

Related: Ace of Diamonds: Prospector Gren Thomas on his next big score

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.