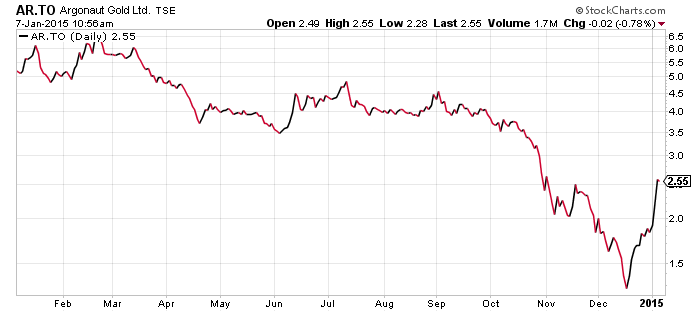

Junior gold producer Argonaut Gold (AR.T) stock has doubled in the last 3 weeks. The shares bounced off an all time low of $1.26 on Dec 16th and are currently trading at $2.46 (at press time). Argonaut released record fourth quarter results this morning, producing 44,321 gold equivalent ounces.

Three reasons why Argonaut has doubled recently:

1. The stock was oversold as a result of index and tax loss selling. Argonaut was deleted from the S&P/TSX composite index, S&P/TSX equal weight global gold index, and the S&P/TSX composite high beta index in December. Index deletions caused forced selling from funds holding Argonaut to keep within mandates.

2. A small move in the gold price has helped. On December 23 gold was trading at $1175 per ounce and is now at the $1212 per ounce. Argonaut is highly leveraged to the gold price as they are a low grade producer (the average grade produced in 2014 was only .33 grams per tonne).

3. The company released record quarterly results with regard to production this morning, after struggling in the third quarter which the company said was partly due to heavy rainfall. Argonaut produced 44,321 gold equivalent ounces in the quarter but investors will have to wait for financial results (March) to determine if they made a profit. Cumulative profit for the first three quarters of 2014 was $3 million.

Pete Dougherty, Argonaut Gold's president and chief executive officer, said: "Over all, 2014 was a challenging year for Argonaut. However, our teams have overcome these obstacles as can be seen in the record production results of the fourth quarter. We are pleased with the efforts made and look forward to 2015. In addition to the strong 2014 operational results, we continued to move forward other projects in our portfolio."

Argonaut Gold shareholders endured a painful 2014 with the stock falling from $6 a share to a low of $1.26.

Will 2015 be a better year for shareholders?

Production guidance for 2015 is between 135,000-145,000 gold equivalent which is flat when compared with 2014 production of 136,706.

Investors will be looking for management to bring costs down and meet the above production targets. Work on developmental projects continues with a PEA expected on San Augustin and a drill program planned on the Magino project in Ontario.

In 2012 the Magino project was purchased for $281 million. A feasibility study released in December 2013 shows an after tax IRR of 18% at $1250 gold with a $356 million CAPEX.

Argonaut is highly leveraged to the gold price with 11.5 million ounces (measured + indicated reserves) and could see some good gains in any potential gold price recovery.

Symbol: AR.T

Share price: $2.54

Shares outstanding: 156.4 M

Market cap:$396 M

I have no position in any of the stocks mentioned. This is not investment advice. As always please do your own due diligence.

“I have no position in any of the stocks mentioned.” Ah, hahahahahahahahahahahahahahahahahahahahahahahaha. Sure, ‘Sparky. And the Moon is made of Green Cheese, isn’t it?