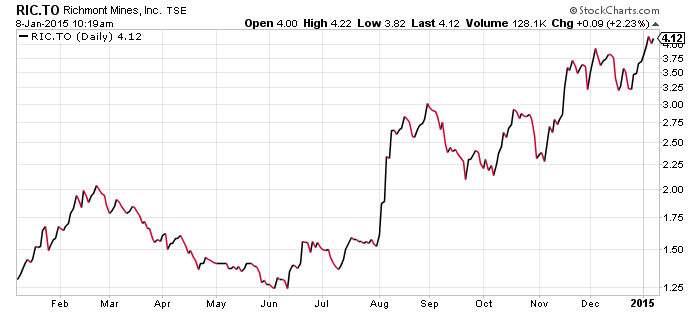

Richmont Mines (RIC.T) is a gold producer whose share price showed an impressive increase in 2014, from the $1.40 level to over $4. This morning Richmont announced high grade drill results from the Island Gold mine and an aggressive exploration budget of $7.6 million for 2015.

The two main reasons for share price appreciation in 2014 were:

1. Strong profitable production - Richmont had a cumulative net profit of ~$6 million in the first 3 quarters of the year, with a net profit of over $4 million in both the second and third quarters.

2. The Island Gold Mine - a new discovery below the current operating mine at depth with reserves of over 1 million ounces at Island Gold Deep. Consolidation of 100% of the mine in August has led to accelerated development.

High grade drill results released this morning were impressive with intersections of 3.93 meters of 19.87 grams per tonne gold and 7.44 grams per tonne gold over 8.49 metres.

Mr. Renaud Adams, President and CEO of Richmont Mines commented: "We are very pleased with recent assay results from our step-out exploration drilling programs at Island Gold. A hole drilled from surface in December reaffirms the potential for extending our existing deep resource to the east as well as below its currently defined 1,000 metre limit. The hole intersected mineralization at a depth of about 1,200 metres, at an approximate 250 metre down plunge from the limits of the currently defined resources. Results such as this reinforce our belief of the potential to grow this deposit both laterally and at depth."

He continued: "Our primary objective in 2015 is to unlock the value of Island Gold. To this end, our exploration drilling will focus on lateral expansion of our current resource base, mainly toward the east, with the objective of increasing the number of ounces per vertical metre down to a depth of 1,000 metres, which would favourably impact our development cost per ounce."

Richmont is set up for another strong year in 2015.

Investors can expect profitable gold production and an aggressive drill program that should provide steady news-flow.

With a $7.6 million drill program comprising of 60,000 meters RIC will be looking to increase resources, and if they can achieve this objective I believe there is more upside potential for the share price. The drill program will be self funded with current cash.

The 1 million ounce resource currently defined is high grade (9-10 grams per tonne) which will help to keep operating costs low when mined.

With a low float of 47.93 million shares outstanding and a growing cash balance of $37.8 million (Sept 30,2014) it won't take much good news to see this stock pop higher in 2015.

Symbol: RIC.T

Share price: $4.12

Shares outstanding: 47.93 M

Market cap:$ 197.9 M

Related: This gold miner is on an absolute tear of late and has just named a new CEO

I have no position in any of the stocks mentioned. This is not investment advice. All facts are to be verified by reader.As always please do your own due diligence.

Amongst other positives, a nice rounded bottom on the technical set up as well…