It is now a virtual certainty that the ECB will announce some sort of large scale asset purchase program (LSAP) on January 22nd. What's not clear is the exact size of the program and which assets will be targeted. There is a lot of speculation calling for the ECB to snap up 500 billion euros of AAA-rated debt in order to 'force' investors out into riskier lower rated debt. However, there are also many who are calling for an open ended program of purchases that would not commit the ECB to any specific set of assets, size, or timeline.

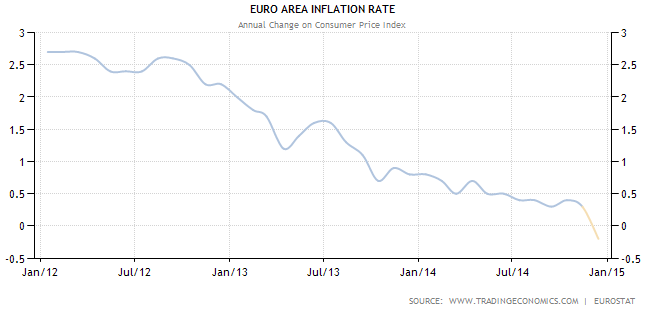

Regardless of the exact details of the announcement there can be no doubt that the ECB is plunging deeper into the murky waters of supporting markets under the guise of stimulating eurozone economies. The specter of deflation is the ECB's #1 excuse to launch LSAPs and one that is not likely to go away anytime soon:

If 500 billion euros is announced on the 22nd we can be certain that it is simply the beginning of a 2-3 trillion euro program much the same as it was for the US Federal Reserve when it embarked on QE in March 2009.

What is the purpose of the ECB's QE program? To weaken the euro currency in order to make exports from weaker euro area members more competitive on the global arena and to stimulate risk taking in the financial markets. Much the same as it was for the Fed in early 2009, the ECB will be trying to gradually reverse the pernicious deflationary trend through altering market participants' behavior and psychology.

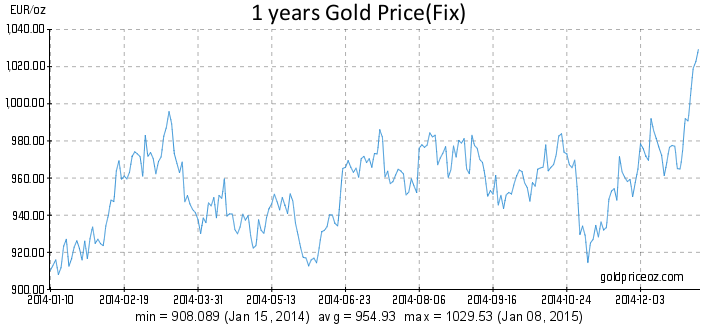

From my vantage point, this new step out onto the 'skinny monetary policy branch' by the ECB only further strengthens the secular bull market thesis for gold. As we have already begun to see with the Fed, there is no turning back or 'normalizing' of monetary policy once a central bank has begun meddling in markets through bloating its balance sheet.

Technically speaking, in US dollar terms gold is at a key crossroads near $1220/oz with a decisive move above $1240/oz on a daily closing basis required to confirm that indeed a fresh uptrend has begun on the daily time frame. However, in euro terms gold has broken out from a 14-month bottoming process in the past couple of weeks:

Next up is some long term support/resistance near 1050 euros/oz.

Read also:

Bloomberg - ECB Weighs Bond Purchases Up to 500 Billion Euros to Juice Economy

Mish - Another Run on Greek Banks Begins; Buy Gold