Alacer Gold (ASR.T) has released fourth quarter production numbers and guidance for 2015. The good news for Alacer shareholders is 2014 was another strong year of production generating free cash flow at the Copler mine in Turkey. The bad news is production fell off sharply from 2013 production of 271,063 ounces with 227,927 ounces produced in 2014. In 2015 production guidance is even lower at between 185,000 and 200,000 ounces.

Alacer owns 80% of the Copler mine which is one the lowest cost producing mines in the world. The cash flow from the mine has allowed Alacer to build up a cash position of $347 million with no debt.

The building cash position will be needed to fund $633 million in CAPEX as Alacer transitions from mining oxide ore into sulphides in late 2017. Economics on the sulphide project are robust with a 20 year mine life generating an IRR of 20.5% at $1300 gold.

Once sulphide production starts management expects gold production to jump back up around 250,000 ounces per year for 2018-2020.

Rod Antal, Alacer's chief executive officer, stated: "Copler has delivered another excellent year of production and cost performance. This strong performance is a direct result of the process improvements and operating team's continuing efforts to optimize the Copler orebody. Most importantly, the year's accomplishments were achieved without a lost-time injury. Copler will continue to generate operating free cash flow in 2015 with production between 180,000 and 200,000 ounces at industry-low all-in sustaining costs of $775 to $825 an ounce. We are continuing to pursue initiatives to realize value beyond the existing mine plan, with reoptimization efforts underway to take advantage of the expanded heap leach pad capacity and extend oxide production beyond 2017. The results of this work will be announced at the end of the first quarter 2015."

Alacer could be an interesting takeover target. In September they announced they had been approached by 3rd parties but nothing has materialized yet.

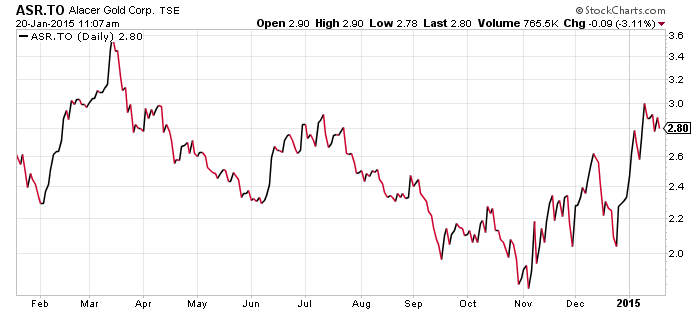

The stock was a high as $12 just a few years back at the end of 2011.

Once the Sulphide project is built free cash flow coming in will be fantastic with $197 million estimated in 2018.

Alacer is also excited about some exploration properties they have in the portfolio partnered with Lidya Madencilik San. Ve Tic A.S. A $22 million dollar exploration program is forecast to be spent in 2015 with Alacer responsible for $10 million.

Alacer in my opinion is an interesting stock to watch going forward. What do you think?

Discuss Alacer in CEO.ca chat here

Symbol: ASR.T

Share price: $2.79

Shares outstanding: 290.41 M

Market cap: $810.2 M

Read: Alacer Exceeds 2014 Production Guidance and Provides 2015 Guidance

I have no position in any of the stocks mentioned. This is not investment advice. All facts are to be verified by reader.As always please do your own due diligence