Peeyush Varshney’s Canada Zinc Metals (CZX:TSXV), one of the very few premier zinc development companies, is well positioned to benefit from an upturn in the zinc price, which many analysts are predicting will start in the next few years.

The main catalyst for an increase in the price of zinc will be the closing of major zinc mines, as the ore becomes depleted. For example, the Century Mine in Australia is closing this year, which will remove ~4% of world zinc supply in the second half of the year. Meanwhile zinc demand is rising, which augurs well for the price of the metal.

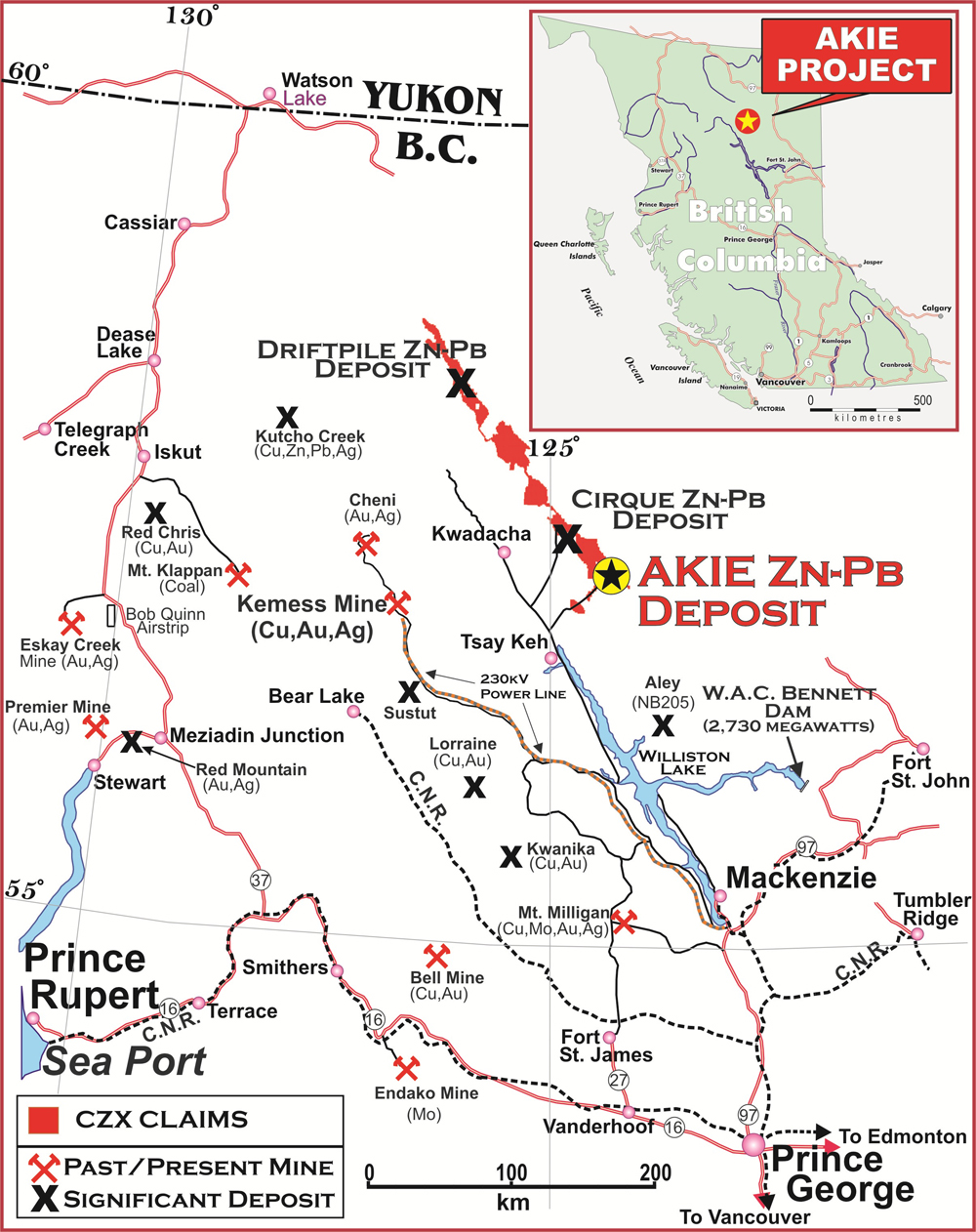

Canada Zinc Metals is a large land holder in the Kechika Trough (silver-zinc-lead) in British Columbia, Canada. The Kechika trough hosts the 100% owned Cardiac Creek (Akie) deposit as well as several promising regional properties and exploration targets.

Akie is an advanced stage project with a NI 43-101 deposit of 12.7 million indicated tonnes grading 8.38% zinc for 2.35 billion pounds of zinc as well as 470 million pounds of lead and 5.6 million ounces of silver. An inferred resource of 16.3 million tonnes grading 7.38% zinc adds an additional 2.65 billion pounds of zinc, 480 million pounds of lead, and 6.05 million ounces of silver. The deposit remains open for expansion along strike and at depth. Engineering and baseline studies are ongoing.

The team has primarily been doing surface drilling to move the project forward the last couple years while being cautious to protect the treasury in the current challenging environment for juniors. It appears the end game for management is to have this world class project taken over - and that may very well be what transpires. Major mining companies looking for zinc deposits have limited options as many zinc deposits out there are challenged with infrastructure (ie. remote), jurisdiction, CAPEX, and permitting issues.

Major mining company Teck Resources is one of the largest zinc producers in the world and is active in the area. Teck and Korea Zinc have an option to earn up to 70% in CZX's Pie, Cirque East and Yuen properties. To earn the full 70% interest, $8.5 million in exploration expenditures must be spent before September 30, 2019.

Teck also operates one of the world’s largest fully integrated zinc-lead smelters in Trail, B.C. Ore from the Red Dog mine in Alaska (one of the world’s largest zinc mines) is sent to Trail for processing.

Other key targets in the Kechika Trough owned by CZX include the Mt. Alcock property and the Pie project. Both projects have had drilling in the past which has shown promise.

Canada Zinc Metals stock is currently trading at 26 cents, down from 57 cents last summer. With 152 million shares outstanding the current market cap is ~$40 million. CZX holds ~$11 million in working capital to continue development of its projects. The company has an impressive list of key shareholders, including Tongling Nonferrous Metals Group, Lundin Mining, Teck Resources and Korea Zinc.

Management is currently formulating the plan for the 2015 season but it is likely to include a $2 million to $3 million drill program and further field exploration work.

As the zinc space heats up, Canada Zinc Metals (CZX:TSV) is one of the leading zinc plays to have on your watchlist.