Red Eagle Mining (RD:TSXV) is set for a transformational year at the Santa Rosa project in the heart of Colombia's gold district. The catalyst investors are waiting for is the environmental license permit. Receipt of this permit is imminent and if/when awarded will be a game changer, not only for Red Eagle, but for Colombia's overall mining sector. If/when the permit is received Red Eagle will be the first modern underground gold mine in Colombia, and will help Colombia send the message to global investors that mining there is open for business.

Colombia has stated they are a country committed to turning the mining industry into a pillar of the economy. The government is trying to strike a balance between raising regulatory standards and continuing to encourage new investment. The goal remains building a modern and efficient mining industry. Healthy and safety remain a top priority.

Large-scale mining has been declared by Colombia’s President Juan Manuel Santos and ministers in his administration as the South American country’s engine of economic growth. With all of this being said on February 18th thousands of miners recently have taken to the streets demanding reform of the mining code and to formalize informal mining.

Colombia was once the largest gold producer in the world. An estimated 350,000 small and medium miners are still producing coal and gold (artisanal miners). Mining is the second largest recipient of foreign direct investment a and is 2.3% of Colombia’s GDP. Mining royalties is one of the Colombian government biggest sources of revenue.

Red Eagle meanwhile is all set to go and has been eagerly waiting the last permit. The latest from management is that the final remaining permit (environmental license) is expected before the end of Q1. Project financing is nearing completion and this may be announced even before the permit is received.

Red Eagle is looking to raise $80-$85 million to complete an initial CAPEX of $74.2 million and have additional funds for drilling. A debt financing is in the works for $60 million and the rest will be raised via equity. Large shareholder Liberty Metals & Mining is expected to maintain its 19.9% interest when the equity financing takes place. If everything goes according to plan construction will commence in Q2 with initial production in 2016.

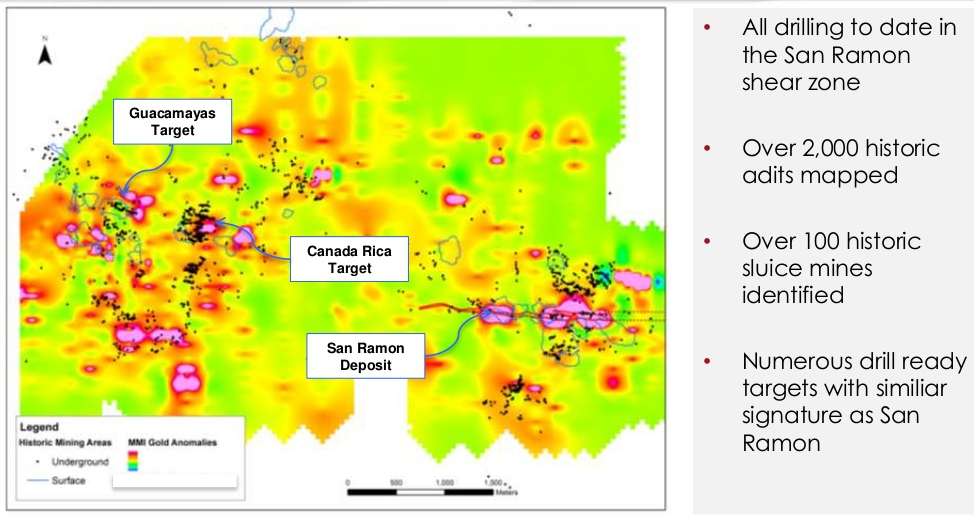

The Santa Rosa project is 100 square kilometers in the Antioquia Batholith. Antioquia is a well establish gold mining district with close to 150,000 gold and coal artisnal miners. The plan is to build a small plant that can be scaled up in close proximity to the San Ramon deposit. The San Ramon gold deposit has some of the best economics in the world.

San Ramon hosts 405,000 ounces of proven+probable reserves grading 5.20 grams per tonne gold. A September 2014 feasibility study showed robust economics of a 52% IRR with a net present value of $108 million and a 1.5 year payback period at $1300 gold. The all in sustaining cost is among the lowest in the industry at an estimated $763 per ounce.

The plan is to build the mine at initial rates of 1000 tonnes per day with the ability to scale up to 2000 tonnes per day. The reserve base is small but Red Eagle management believes this issue will be solved with future drilling. The large property consists of numerous targets that are similar to San Ramon. Also they believe more ounces will be found at San Ramon as it is open at depth and to the east and has only been drilled on close enough spacing to delineate reserves to the 200m level. Deeper drilling has confirmed the mineralization continues to at least 600m. Drilling is expected to take place later this year.

$55 million has been spent on the project so far and Red Eagle currently trades at a market cap of 20 million. Once in production Red Eagle could cash flow nearly $60 million per year at $1300 gold and an 1,900:1 (USD:COP) exchange rate. The current exchange rate is 2,485 which will result in significant savings compared to the Feasibility Study.

We believe there is potential upside in the share price of Red Eagle at these levels. However, that upside is vulnerable to securing the environmental permit, the gold price, and how effective management is at raising capital and offsetting their small reserves with future drilling.

Major shareholders of Red Eagle include Liberty Metals and Mining, Appian Natural Resources Fund, Management, and Ross Beaty.

Symbol: RD.V

Share price: $0.325

Shares outstanding: 77.7M

Market cap: $32.5M

Cash: ~$2 million

Red Eagle will be at PDAC at booth 3149 stop by and have a listen to the story.

The Colombian National Agency of Mining will be presenting at PDAC on Monday, March 2nd from 8:00 am - 12 noon in room 206B.

“Mining royalties is one of the Colombian government biggest sources of revenue.”

“Large-scale mining has been declared by Colombia’s President Juan Manuel Santos and ministers in his administration as the South American country’s engine of economic growth.”

Why do I get the feeling that the government officials might be more interested in tax revenues than in “economic growth” ?