The Athabasca-basin in Northern Saskatchewan is the world's most prolific uranium producing region.

For several decades, small "junior" companies have explored the Basin for economic uranium deposits, with the lucky few being taken out by larger companies at substantial premiums.

Shares in Fission Uranium are up over ten fold over the past three years when accounting for spinouts after the company's 2012 Patterson Lake South discovery (PLS).

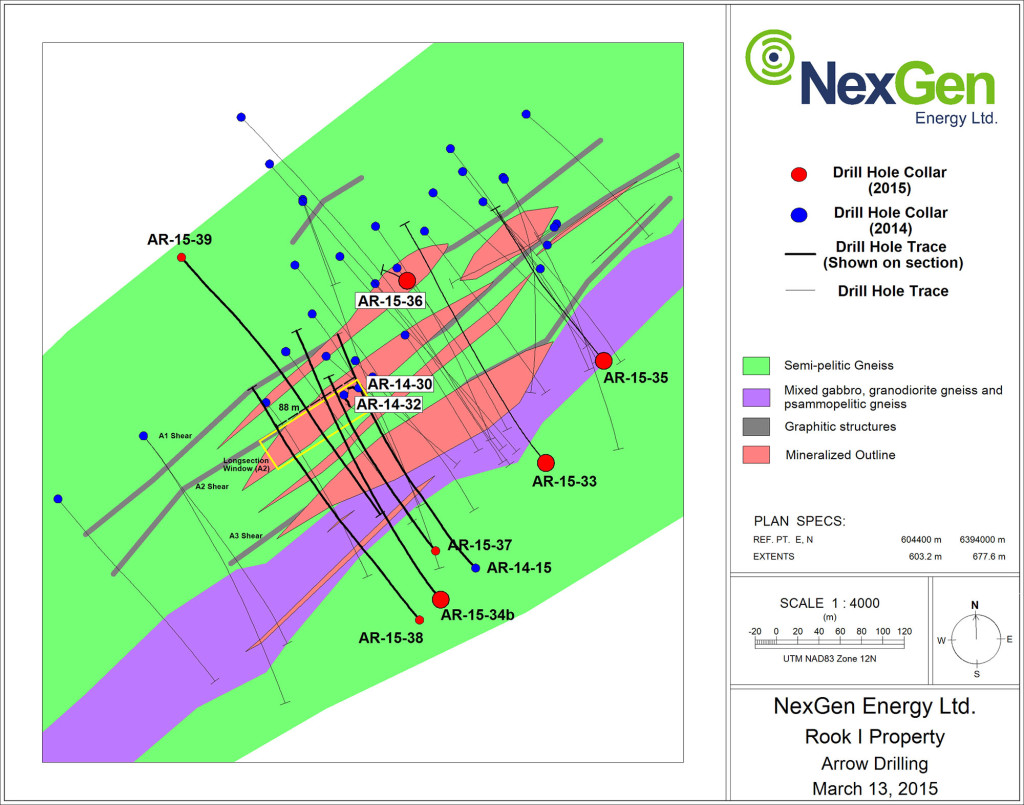

Immediately next-door to PLS, NexGen Energy began exploring the Rook 1 property and incredibly made its own high-grade uranium discovery in 2014.

NexGen's VP of Exploration, Garrett Ainsworth, was a key figure in Fission's PLS discovery, and presented at our recent Subscriber Investment Summit in Toronto.

He told us to watch out for assay results from the company's AR-15-34b angled hole, which returned this morning NexGen's largest continuous interval of high-grade uranium drilled to date at Arrow.

AR-15-34b (angled hole) helps to confirm the continuity of grade at the A2 shear (70m @ 2.2% U3O8).

The hole was drilled as a 30 metre step-out to the southwest along the high-grade core of the A2 shear.

The dimensions of this zone are coming together and some uranium analysts believe pounds of uranium in the ground are adding up fast.

Rob Chang at Cantor Fitzgerald calculates this hole could equate to 1.9 million pounds of U3O8 alone.

David Talbot of Dundee Securities continues to recommend investors buy NexGen shares with no price target. In a report published Tuesday morning, Mr. Talbot commented on NexGen's drilling.

"Located in favorable basement rocks, drilling is starting to delineate a series of near vertical, parallel and en echelon stacked zones of high grade mineralization. Arrow consists of multiple stacked parallel lenses within a 515m x 215m x 720m package, and is open in all directions."

Three drill rigs are turning on NexGen's property with the third rig targeting a large radon gas anomaly 400 meters Northeast and along strike from Arrow. In recent years, radon anomalies have been effective for explorers looking for uranium with the drill.

The company is 2/3rds through a $8 million 18000 meter Winter drill program, and NexGen has $15 million cash on hand according to Dundee's estimates.

Here is a link to the news release: NexGen Reports First Assays From Winter Program: Drills Most Continuous High-Grade Uranium Intercept over 2% U3O8 in the A2 Shear at the Arrow Zone

I am a shareholder in NexGen Energy, have a few friends working there, and they are a past web site and conference sponsor, which makes me rather biased. Definitely consult an investment advisor prior to making an investment decision - this is not investment advice, and also check SEDAR to get a better handle on the risks facing NexGen. Always do your own due diligence.

Forward-Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities laws. Generally, but not always, forward looking information is identifiable by the use of words such as "will" and planned" and similar expressions. Forward-looking information is based on the then current expectations, beliefs, assumptions, estimates and forecasts about the Company's business and the industry and markets in which it operates. Such information is not a guarantee of future performance and undue reliance should not be placed on forward-looking information. Assumptions and factors underlying the Company's expectations regarding forward-looking information contained herein include, among others: that general business and economic conditions will not change in a material adverse manner; that financing will be available if and when needed on reasonable terms; that the Company's current exploration activities can be achieved and that its other corporate activities will proceed as expected; that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner.

Although the assumptions made by the Company in providing forward looking information are considered reasonable by management at the time the forward-looking information is given, there can be no assurance that such assumptions will prove to be accurate. Forward-looking information also involves known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information, including, among others: risks related to the availability of financing on commercially reasonable terms and the expected use of the proceeds; changes in the market; potential downturns in economic conditions; industry conditions; actual results of exploration activities being different than anticipated; changes in exploration programs based upon results of exploration; future prices of metal; availability of third party contractors; availability of equipment and supplies; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry; environmental risks; changes in laws and regulations; community relations; and delays in obtaining governmental or other approvals or financing. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. NexGen undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking information.