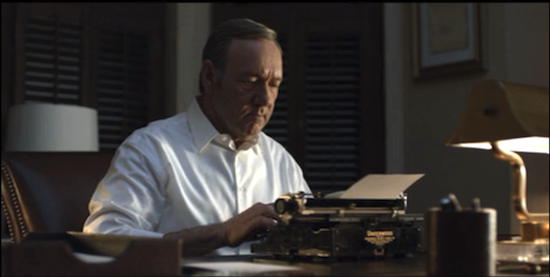

President Frank Underwood on the HBO Drama, House of Cards, uses a typewriter to compose his most important messages. I use CEO Chat

Okay, I don't know if that's true. But I am about 100x more prolific in our new investors app, chat.ceo.ca, than I am on this blog.

Here are a couple of examples from the past 24 hours:

Just got off the phone with Glen Kuntz, CEO of Mega Precious Metals #MGP. Here are my notes: Multi-asset Canadian gold, tungsten and copper exploration company. About 3 million ounces at approx 1.5 g/t Au + Tungsten credits in Manitoba at district-scale camp called Monument Bay. 3.5% NSR on Twin Lakes for first 1 million ounces, then 4.5% to Franco Nevada, Kinross. Regional exploration suggest there are other Twin Lakes on the 300 sq km property, not encumbered by royalties. Approx $50 million spent on exploration and infrastructure to date. 5000 meter drill program ongoing and re-assay of 30,000 meters of old core to add ounces and tungsten credits (not currently in resource). Approx $2 million cash with about $7 million market cap and $3 million of $40 million convertible facility drawn, not due for another four years, and can be repaid in shares. Not a proven mining camp like Red Lake or Flin Flon (yet). Somewhat remote. Important First Nations relationships. Government driving $3 billion infrastructure in the region (dams, roads, connects the communities. Gives company access to people, services, power). Non-core assets include 1.3 million ounces at 1.2 grams per tonne open pittable at surface North Madsen project, Red Lake Ontario. Blue Cariboo asset in Nunavut has 3 million tonnes at 3% copper. Open for expansion. Doing a deal on these assets could help MGP finance Monument Bay. As well, they could attract a strategic partner like Carlisle #CGJ has done. CEO Glen Kuntz believes a high-grade starter operation at 5000 tonnes per day would cost approx. C $300 million to build, after 2 years of feasibility demonstration. He’s working on corporate initiatives from strengthen balance sheet and move projects forward from cheap Thunder Bay HQ. Pinetree #PNP still owns 20%. Pacific Road owns another 20% (in convertible note, not liquid). Shares down 90% since 2011; investors out of love with non-near term cash flow gold stories. I'm going to consult some former stakeholders, incl. Clive Johnson, whose Bema Gold, owned the project once. Sheldon Inwentash ex Pinetree CEO, Richard Patricio new Pinetree CEO, Pat Dicapo of PowerOne Capital for current thoughts. No position in #MGP now. Subscribe to http://ResourceOpportunities.com to learn whether we do or don't initiate one. Here's the latest Mega corporate presentation: http://www.megapmi.com/assets/files/corporate_presentations/2015/MGP_March_2015_v3.pdf

Tom Meyer, base metals analyst at CIBC lowered his price target on Turquoise Hill #TRQ to C $4.00 from C $4.50 this morning, citing ongoing negotiations with Mongolian Govt to restart underground development. Meyer rates the company Sector Performer. Turqoise Hill is guiding 175-195kt of copper and 600-700 kHz of gold for 2015 production, compared to 148.4 kt of copper and 561 kHz of gold produced in 2014. Meyer commented, "We believe the main catalyst for the shares is the ability of management to reach a timely agreement with the Mongolian Government to re-start the development of the underground. This agreement should facilitate subsequent catalysts in obtaining project financing and resuming construction activities. Given the importance of the underground to the overall value of the company, we believe these ongoing uncertainties will continue to act as an overhang on the shares." He continued, "TRQ shares trade at a P/NAV of 0.85x compared to its peers at 0.81x. The world-class nature of the operation & the potential for expansion suggest a premium could be justified. However, above-average political risk, a minority shareholder discount, expansion & project finance uncertainty suggest a discount is appropriate."

Are you on chat.ceo.ca yet? We have hundreds of smart investors and writers actively participating and new features added almost daily. Watch this become something special. Scratch that, it already is. Come and join us!