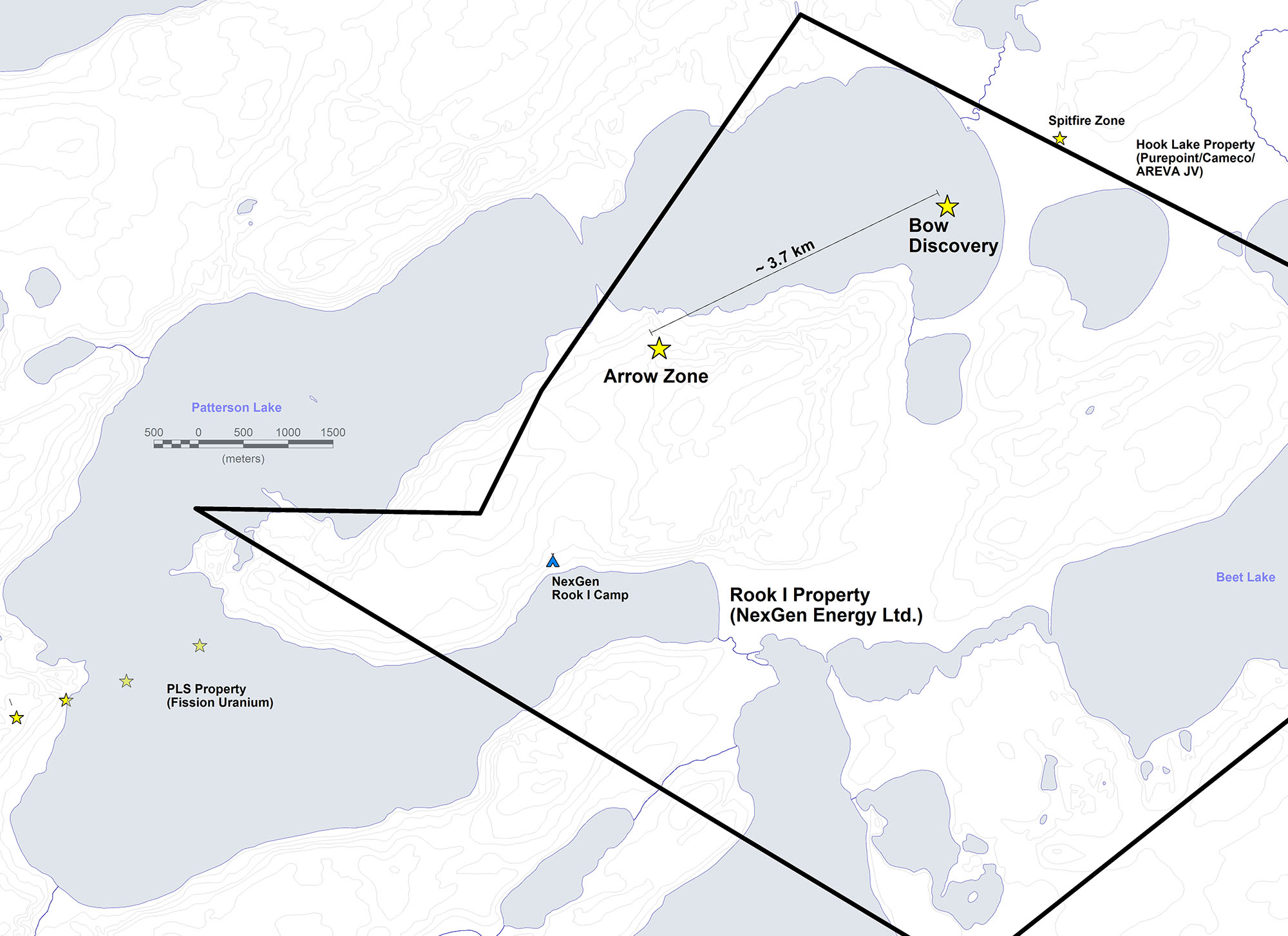

NexGen Energy property map showing the distance between the Arrow Zone and Bow Discovery. (Image: NexGen Energy)

NexGen Energy makes a new discovery, Odin Mining has impressive drill results from Ecuador, and Fission Uranium keeps rolling along.

NexGen Energy - (NXE:TSXV) - Positive drill results continue to come in from junior uranium explorer NexGen Energy. News this morning is that drilling 3.7 kilometres away (north-east) from the Rook 1 property has intersected off-scale radioactivity. The new discovery has been named 'Bow' and is coincident with a radon anomaly that tracks a VTEM conductor for 730m by 140m. The radon anomalies provide compelling drill target(s) as it is the highest in the area and located 80m south of drill hole BO-15-10.

Drill results:

- Hole BO-15-10 intersected 2.5 m total composite mineralization including 0.10 m off-scale radioactivity (>10,000 to 10,200 cps) within a 5.0 m section (206.5 to 211.5 m);

- BO-15-02 intersected 3.0 m discrete mineralization (202.0 to 205.0 m) from <500 to 1350 cps associated with a sheared, pyritic graphitic pelitic gneiss (mylonite).

Garrett Ainsworth, NexGen's Vice-President, Exploration and Development, commented "Drill holes BO-15-02 and -10 have already defined a 66 m strike length of mineralization at our Bow Discovery, which underpins the immense potential to discover additional mineralization to the northeast and along trend from the Arrow zone.

Leigh Curyer, Chief Executive Officer commented, "This new discovery of uranium mineralization at Bow is another significant step forward in unlocking the substantial prospectivity of the Rook I property. Coupled with the rapid development at Arrow discovered just over 12 months ago, it is incredibly exciting for shareholders to now have two discoveries developing in proximity to one another."

The winter drill program has been extended to 20,000 metres and will continue to provide steady news flow for investors. An initial resource estimate is expected before the end of the year. NexGen is the leading junior uranium exploration company in my opinion and if your interested in uranium should be on your radar.

Read: NexGen Discovers Off-Scale Radioactivity at Radon Anomaly 3.7 km Northeast from Arrow

Related: Video: Garrett Ainsworth, VP EX, NexGen Energy (NXE.TSXV) SIS Presentation

Odin Mining (ODN:TSXV) - Phase 1 drill results have been released from the Cangrejos project in southern Ecuador. Drill results showed continuous nature of mineralization with hole C14-47 intersecting 405.10 m of .66 g/t gold and .09% copper right from surface. A total of 9 holes were released with several of the holes hitting long intercepts of copper and gold mineralization.

Odin originally came on to my radar when Ross Beaty purchased 22.1% of the stock in a private placement last July. Successful resource investors are starting to invest again in Ecuador with the Lundin's also putting money to work starting Lundin Gold and buying the Fruta del Norte project off Kinross.

Ecuador for the last several years has scared off investors due to regulatory and taxation regime of the government. Changes are expected to be made from the government but no timeline is in place.

Next up for Odin is the starting of a metallurgical testing program. Odin managements sees the potential of an economic deposit in the right fiscal environment. Odin is also looking at other projects in the area and plans to remain focused on gold in Ecuador.

Related: Leo Hathaway and Brent Cook on Finding Odin Mining's Fatal Flaw

Fission Uranium (FCU:TSX) - Fission continues to release good results from the winter drill program at the PLS property with 15 mineralized holes released this morning. With each set of assays the deposit continues to grow and expand. The highlight of this morning's news was that an high grade step out has been intersected 30m north of the R600W zone.

Ross McElroy, president, chief operating officer and chief geologist for Fission, commented: "PLS continues to impress and surprise us, for example with the results at R600W. Not only is the main high-grade zone growing, but the intersection in PLS15-356 of a new, possibly parallel, high-grade interval 30 metres to the north is a validation that R600W is host to a very considerable amount of strong uranium mineralization. We are also extremely pleased with the continued expansion of high-grade mineralization in the R780E zone and the eastward expansion of the R1620E zone."

A nice little lift in the FCU share price recently hitting a 3 month high as assays continue to deliver. Drilling is expected to continue until the end of April. A PEA is expected out this summer along with additional drilling. FCU remains a takeover target in my opinion.

The uranium price remains just under the $40 level. Long term fundamentals look extremely strong with the amount of nuclear reactors under construction. In the short term I do not see any big catalysts though as the market awaits a potential restart of Japanese reactors.

Related: Fission Uranium hits a home run with maiden resource estimate: 105 million pounds out of the gate

Discuss in CEO Live

This is not investment advice.All facts are to be checked and verified by reader. As always please do your own due diligence.