A summary of what I found to be the top news releases for Wednesday March 15th a fairly quiet day so far.

Dynacor Gold (DNG:TSX) - Great news out of the largest toll mining company (I believe) listed on the Canadian markets. Dynacor has received an expansion permit for the Metallex plant located in Huanca, Peru. The permit allows for a 20% increase in processing from 250 tpd to 300 tpd.

Minor upgrades are expected to be completed before Q3 at a small cost of $200,000 and increased gold production is expected later this year.

Construction of Dynacors second toll mining operation will begin shortly and will be designed to process 300 tpd with expansion potential to 600 tpd.

Jean Martineau, Dynacor's president and chief executive officer, stated: "As of today, Dynacor's total permitted capacity of 204,000 tonnes per year (600 tonnes per day) places the company at the forefront of the gold-ore-processing sector in Peru. We are currently evaluating the feasibility of operating the Veta Dorada (Chala) and the Metallex (Huanca) plants simultaneously. This would enable Dynacor to fast-track another substantial increase in production in 2016. Furthermore, our company will have a clear advantage in the marketplace as compared to its competitors, since it will have two fully permitted mills."

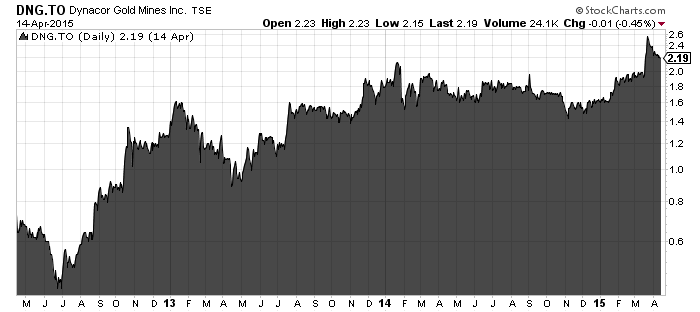

One of the best charts you will see in the gold space over the last 3 years with a slow and steady rise. Dynacor has proven toll mining is a fantastic business to be in. The leading company in the toll mining space now has many smaller companies trying to replicate what Dynacor has achieved.

My list of toll miners include - Standard Tolling (TON), Cortez Gold Corp (CUT), Inca One (IO), Anthem United (AFY) and Gainey Capital (GNC). The business model has been proven can any of these smaller companies replicate the success?

Dynacor has only 36.2 million shares outstanding and $20.8 million in working capital (Sept 30th,2014) and will be growing production. I can't find anything to dislike here.

Argonaut Gold - (AR:TSX) - Argonaut announced first quarter production of 43,255 gold equivalent ounces which is 31% of 2015 guidance. The companies two mines (El Castillo and La Colorada) both performed well in the first quarter with La Colorada having a record quarter.

Investors will have to wait till financial results are released on May 5th but AR did grow the cash balance from $51.4 million at year end to $64 million. (Note: Lots of factors could affect this previous inventories to cash, accounts receivable etc)

Pete Dougherty, Argonaut Gold's President and CEO, said, "Argonaut continued to have strong production in the first quarter of 2015, in which we produced nearly 31% of the full year production guidance. We continue to see the benefits of operating at a higher cyanide concentration in the circuit, by way of improved recoveries. The production results in the first quarter exceeded expectations; however, the Company would like to reiterate that production is anticipated to be higher during the first part of 2015 and will taper off during the latter part of the year. Production guidance of 135,000 to 145,000 ounces during 2015 is maintained. We anticipate that costs will trend higher as we continue to use additional cyanide.

Argonaut stock price was over $10 in 2010 and has been crushed like many of its peers. Desjardins Securities analyst Michael Parkin has a $3 price target on the stock.

Read:Argonaut Gold Announces First Quarter 2015 Production of 43,255 Gold Equivalent Ounces

Related: The hottest gold stock on the planet

Discuss in CEO Live – What is catching your eye today?

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.