Foran`s projects are located in the McIlveena Bay & Hanson Lake Camp in Saskatchewan. (Image: Foran Mining)

Foran Mining (FOM:TSXV) - Foran Mining is out this morning with one of the best drill holes I have seen in awhile in the junior mining space. Drill hole BS-15-239(1) has intersected 2.03% Cu over 104.94m, including 4.11% Cu over 20.35m and 3.16% Cu over 19.00m. This is the second hole completed on the Bigstone property located in east-central Saskatchewan from the 2015 winter drill program.

The Bigstone propery is located 25 km southwest of Foran's McIlvenna Bay deposit and together the projects are called the McIlvenna Bay and Hanson Lake Camp. The McIlveena Bay and Hanson Lake Camp are located fairly close to the Flin Flon and Snow Lake Camps which host multiple past producing mines and 2 current operating mines.

VMS (Volcanic Massive Sulphide) deposits are common in the area and have a tendency to occur in clusters.

This mornings drill hole follows up the first winter drill hole in 2015 which returned some high grade zinc (with 18.4% Zn over 11.78m, including 27.0% Zn over 7.62m). Winter drilling is now complete with 4 holes remaining in the lab and are expected to be released in the next couple weeks.

Drill holes released so far are in line with the historic mineral resource at Bigstone. These were infill holes so I am personally a little bit surprised at the share price reaction.

The Bigstone deposit has an historic mineral resource with both zinc- and copper-rich zones, including a copper zone with an estimated 3.75Mt grading 2.03% Cu and 0.33 g/t Au (1% Cu cutoff), and an adjacent zinc zone with an estimated 0.53Mt grading 9.62% Zn and 15.9 g/t Ag (5% Zn cutoff). Bigstone was previously owned by Cameco who came up with the resource estimate in 1990. Foran is not treating the resource as current.

Foran's flagship project McIlvenna Bay had a recent PEA showing an after tax IRR of 22% and a payback period of 4.1 years. Note the PEA uses slightly higher metal prices than the current spot price of $3.08 copper and $1.06 zinc. The company is currently looking for a partner to fund a PFS on the project.

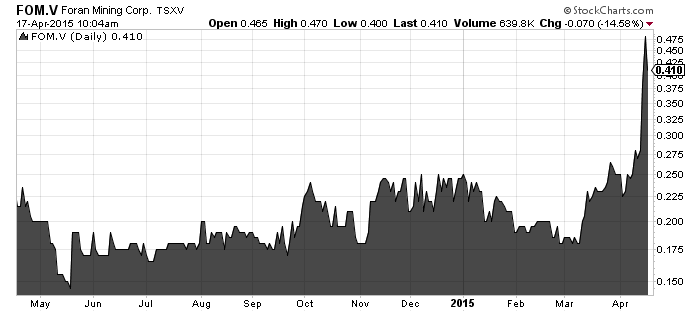

Foran stock has had quite the run in the last week going from 25 cents all the way to 48 before pulling back to 41 today. The stock moved up on low volume and looks like it could have been a leak on the news released today.

This is one of the few development companies with significant exposure to zinc to watch in my opinion.

A January fact sheet showed $3.4M in cash (lower now due to drilling) and 18% management and director ownership.

Related: Video - Foran Mining may sell a McIlvenna Bay project interest to pay for its PFS

Discuss in CEO Live – What is catching your eye today?

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.