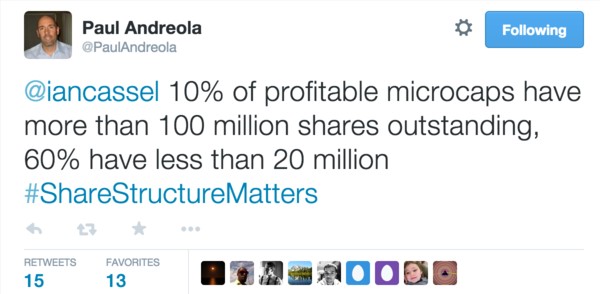

Here’s some smallcap statistics we shared with some fellow investors on Twitter:

The second stat is eye-popping. Over 60%! There’s a pretty strong correlation here.

Subscribers of SCD will know profitability is almost always a requirement for us. It’s one of only two criteria we won’t compromise on. The biggest winners we have seen have all been consistently profitable.

But what could share structure have to do with this? Multiply shares outstanding by the trading price and you get the market value of the company. This is the number that matters. Who cares if a company has a lot of shares out at a low price or a small amount of shares out at a higher price?

Not only should you care — share structure should be one of the key metrics you look at when analyzing stocks.

Go to SEDAR (or EDGAR for US stocks) and pull up a company’s latest financial statements. Check the footnotes for shares outstanding:

Make sure to add in options and warrants to account for dilution. Also consider any debt that could be converted to equity.

You will arrive at a fully-diluted share count. This number tells you more than you think. It tells you the philosophy of the people running the company. And it can tell you a lot about the company’s history.

When a company raises money, they typically do one of two things: issue debt or raise equity. When a company raises equity, they do so by selling shares of the company. They may raise money to pursue acquisitions or invest in growth. They may need to sell shares just to pay the electricity bill.

The share structure is often a reflection of the management team themselves. To have less than 20M shares out, you’d need a management that runs a lean — even bootstrapped — operation. You’d need a company that has been profitable from early on its life.

If you have less than 20M shares out, you know management probably has not given themselves excess equity compensation. They probably haven’t made bonehead acquisitions. And they’ve proved successful in growing a sustainable business. These are all things you’ll want to see when evaluating management.

Share structure can also reflect how much skin management has in the game – If insiders own a lot of stock, they’ll probably think twice before diluting their stake. They’ll make sure any equity deal is a good one for the company. Having alignment with insiders puts the odds in your favor.

There’s also a technical reason to pay attention to share structure. It has to do with supply and demand. If the share structure is tight, there’s less supply for investors to bid on — especially if insiders own a good chunk.

Now if a company’s growing and attracts the attention of an institution, the firm will start looking at ways of getting a sizable position. The first choice will often be to participate in a financing and get shares directly from the company. But if the company isn’t issuing shares, they’ll have go to the market.

And if the share float is tight, they’ll likely have to pay up to get a position. A single fund could send shares of a smallcap up 20, 30, 40%. A few funds piling in could double a stock or more.

Now we would never buy a stock just because it had a tight share structure. But we’re happy to buy an undervalued stock that has the potential to become very overvalued as institutions bid over a small float.

Look back over the last few years at the biggest winners in the smallcap space. There have been five, 100-baggers in the last 5 years (RX.V, DAP-U.V, NHTC, PFHO, WFCF). They all had one thing in common — shares out were less than 25M. PFHO (which we invested in) had just 800,000 shares outstanding! The CEO owned over 60% of them — and was buying more.

The bottom line is share structure tells you a lot more than many investors realize. It tells you how management has funded the company. How well they have done acquisitions. Whether they have run a lean operation or not. And whether or not they have built a sustainable business.

Some management teams treat their shares like toilet paper. Others treat them like gold. Make sure you know which it is before investing. It could be the difference between losing your shirt and finding the next 10-bagger.

Disclosure: Paul, Brandon, and Keith are long DAP-U.V