Seabridge Gold - (SEA:TSX) - Seabridge Gold has released exploration plans for the 2015 season at the huge KSM project in British Columbia. Drilling this summer is fully funded (20,000m) and will test three areas Mitchell, Deep Kerr, and Iron Zone in hopes of finding additional mineralization.

Drilling will begin at the Mitchell deposit in June which hosts 1.4 billion tonnes (P+P) of .60 g/t gold and .16% copper. The central part of the deposit has a zone of higher-grade gold and copper which has been scheduled for early exploitation in the mine plan, to facilitate rapid payback of capital. A couple deep holes are planned to test the plunge projection of the high grade centre of Mitchell with additional holes to follow if successful.

Deep Kerr continues to get larger and remains open to the south and at depth. Drilling plans for Deep Kerr are designed to expand both the length and width of block cave shapes that confine the current resource estimate. If drilling is successful extending the block cave shapes could increase the potential mining rate for this higher grade material, thereby generating a significant economic benefit to the project.

At Iron Cap the focus will be the focus will be on additional drilling to the north which remains open. Also Seabridge is exploring innovative drilling techniques to test deeper extensions from surface.

Seabridge Chairman and CEO Rudi Fronk noted that the 2015 program at KSM is considerably smaller than previous years, reflecting the completion of the environmental assessment process which culminated in provincial and federal approvals in 2014. "The EA application process required a significant share of our spending but that work is finished. This year, the emphasis is focused on drilling what we believe could immediately enhance both gold and base metal production scenarios," he said, "by adding further higher grade material in easily accessible locations and reducing waste rock generation."

"This summer, we expect to conclude our three year core zone exploration program which so far has added nearly a billion tonnes of better grade material. We believe we have left the best to last. The potential under Mitchell has been our top exploration target for more than four years but earlier attempts to drill it ran into technical difficulties. We believe we now have a reliable solution that will enable us to complete holes into this high value target," Fronk said.

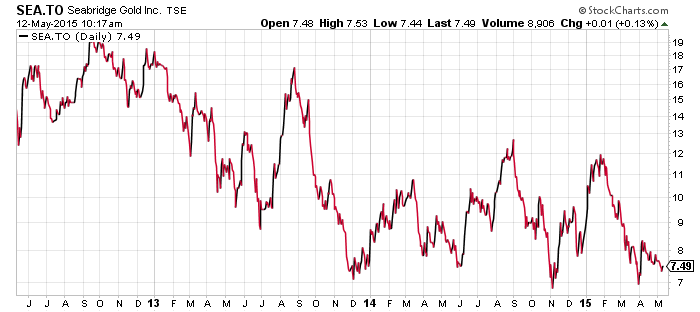

A 3 year chart of Seabridge shows lots of volatility in the share price. Seabridge has done a tremendous job of moving the KSM project forward in the last couple years. Over 11 million ounces of gold and 10 billion pounds of copper have been added over the past 2 years at grades much higher than reserves as well as key permits being received.

The stock price has declined significantly though showing Seabridge is highly leveraged to the gold price.

A major issue with Seabridge is the $5.3 billion dollar capex which results in only a 11.5% IRR at $1330 gold and $3.45 copper. These numbers simply won't get it done in the current commodity environment.

It will be exciting to see this summer if the drill bit can turn up some higher grade material to improve the project economics. Seabridge management seems to think they can.

It is not a secret that Seabridge will need a partner for this project or be taken out. Several CA's have been signed with major mining companies.

Read: Seabridge Gold Aims for 3rd Core Zone Discovery at KSM in 2015

Related: Seabridge gets approval for massive KSM project

Discuss in CEO Live – What is catching your eye today?

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence