A morning post on some of the top mining news releases out this morning and my thoughts on each.

True Gold Mining - (TGM:TSXV) - True Gold has restarted construction at the Karma project in Burkina Faso. First gold pour is expected 10 months from now in March 2016.

Site clean up and some repairs are taking place over the next several days with full construction set to resume at the end of the month.

The Karma project has robust economics with after tax economics of 46.3% a NPV (5%) of $198.8 million at $1250 gold. Phase 2 of the project delivers even better results with an after tax IRR of 213%, NPV (5%) of $69.6 million at $1250 gold.

$62 million has already been spent on project construction with ~$70 million of construction expenditures remaining. True Gold has $32 million in cash and $62 million under the current finance facility that can be drawn upon.

"We are pleased to be returning to work at Karma with the support of the Government of Burkina Faso and leaders in the local community," said Christian Milau, President and CEO, True Gold Mining. "We have said from the beginning of this process that it is our intention to work towards a long-term solution that builds trust with stakeholders in the community and reduces the risk of similar challenges in the future. As we move toward full construction, we remain committed to delivering long-lasting benefits to the local communities and to the country."

"We are grateful for the support and commitment that our employees, shareholders and our valued partners in Burkina Faso have provided over the past several months to get us to this important juncture. Karma is now in select company, with only a handful of gold mines coming on stream globally over the next year," added Mr. Milau.

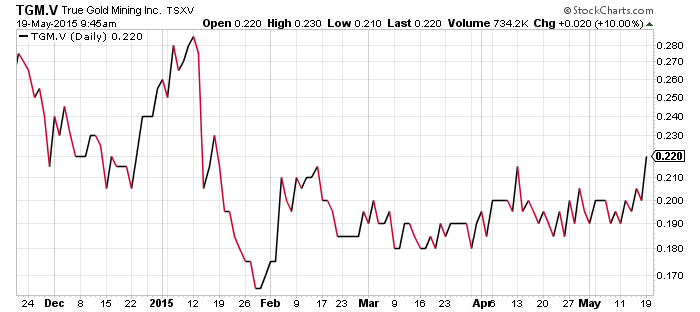

A 6 month chart of True Gold shows the stock fairly range bound since construction was halted on the Karma project in January. Mining stocks usually hold in a fairly tight range during construction and then are re-rated when production (cash flow) starts.

A reminder to investors that Burkina Faso has an election scheduled on October 11, 2015.

Read: True Gold resumes construction at Karma

Related: New True Gold CEO has relevant experience

Imperial Metals -(III:TSX) - Imperial Metals will be borrowing $30 million from Edco Capital Corp. Edco is owned by billionaire investor N. Murray Edwards. Proceeds are expected to be used for ongoing ramp up of the Red Chris mine and working capital.

Imperial filed financials late on Friday which showed a working capital capital deficiency of $35.6-million at March 31st. As a result of the deficiency Imperial would be in default under the senior credit facility in June.

Red Chris is British Columbia's newest mine which is currently ramping up to commercial production. The mine has experienced delays but first concentrate was poured in February.

Production has slowed though due to water supply issues (a shortage of clean water in the tailings impoundment).

Red Chris has always caught my attention as the current mine life is out to 2043 (28 years) with plenty of room for expansion. Once they work through the start up issues the mine will be a cash cow.

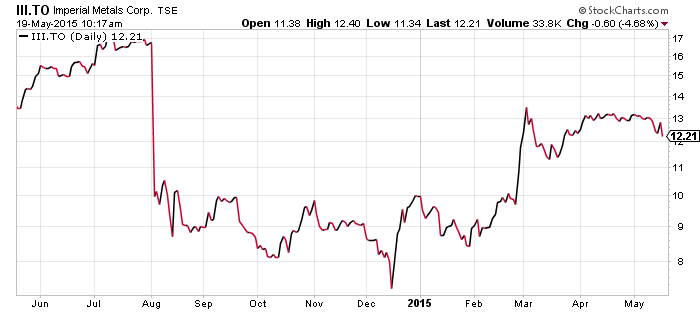

A 1 year chart of Imperial shows plenty of movement. The unfortunate tailings spill at Mount Polley last July instantly cut Imperial stock cut in half. Investors found value as Red Chris starts up though and the stock has since recovered to $12.21.

Uncertainty currently surrounds III stock with the unknown costs of cleaning up Mt. Polley as while as timing on when Red Chris will hit commercial production.

Once these issues get sorted out I would not be surprised to see a much higher share price.

Read: Imperial Announces Loan and Intent to Conduct Rights Offering

Related: Pierre Lebel powers Red Chris mine toward production

Please join us in CEO live.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.