BitGold - (XAU:TSXV) - Bitgold Inc., the savings and payments platform for gold that has taken Canada's capital markets by storm this past week, is out with news this morning that they will acquire GoldMoney for 11.16M shares. The transaction is initially valued at $51.9 million CAD based on the $4.65 closing price on May 21st.

GoldMoney will add over 135,000 user sign ups and over $1.5 billion in assets under vault management to the BitGold platform.The question for investors is how many of these 135,000 users are active? The ones active should be interested in the BitGold platform I would have to think.

I did notice the GoldMoney website states "We're trusted by over 20,000 customers" so maybe the 135,000 are just free sign ups? Hard to put a value on GoldMoney and if this is worthwhile investment for BitGold in my opinion as the company is private and no financial data is available.

“We are thrilled by the potential of this BitGold and GoldMoney combination, two companies with shared values and a common vision and purpose,” said Roy Sebag, BitGold CEO. “You will not find a precious metals asset manager with more integrity than the one built by Geoff and James Turk and the GoldMoney team. With the technology of the BitGold platform we can expand the GoldMoney legacy of trust, security, and a client centric purpose to new markets, growing from a much stronger base and benefiting all stakeholders. Combining the first global e-marketplace for gold with the latest and most innovative, we instantly become the world’s largest and most active bullion money service.”

“The combination of BitGold and GoldMoney has the potential to create significant value for the clients and shareholder of both companies,” said James Turk, founder of GoldMoney. “We created GoldMoney with the vision of making gold accessible for savings and payments, a vision that BitGold is rapidly expanding in a new era of cloud computing and mobile technology. Together we will continue to operate GoldMoney with the same level of security, integrity and premium customer service, but GoldMoney clients will now have access to expanded payment options, a gold debit card, and the many applications and features being developed by this innovative team. Josh and Roy understand money and gold as well as anyone I’ve met. Their energy, vision, and dedication to expand this platform are truly remarkable. I am honored to be joining the combined board along with two of my fellow GoldMoney directors, Mahendra Naik and Hector Fleming.”

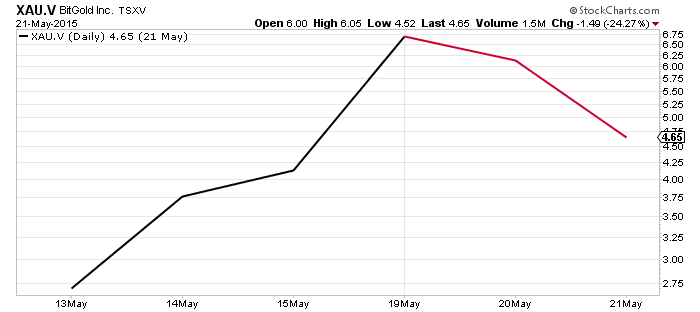

BitGold has had some crazy volatility since listing on May 13th hitting a high of $8 and a low of $2.35. The initial PP for the IPO consisted of $6,000,000 worth of subscription receipts at 90 cents with a 1/2 warrant at $1.35 for 18 months. These investors are looking at a 5-8 bagger in the first week of trading something not seen in junior mining for a long time.

The stock is halted this morning following the acquisition news but I would expect it to resume trading at some point today. Market bids so far look like the stock will open higher when it resumes.

It will be interesting to see where the stock settles over the next couple months. One of the key factors for the stock moving forward in my opinion will be the monthly Key Performance Indicator reports with the first one to be out in mid June.

A mobile APP is in development and is scheduled to be released this summer.

The cash position is strong with $9 million as of March 31st and up to an additional $5 million expected from warrant exercises.

As with any Fintech stock the valuation can get extremely high based on hype and not really factoring in fundamentals. Strong shareholders are behind the stock including Sprott, PowerOne, Sandstorm Gold, and Soros Brothers Investments LLC.

BitGold has been actively discussed on CEO Live and you can find the conversation here. What do you think is BitGold the next big thing or is it over hyped?

Related: BitGold Disrupts Financial Services

Please join us in CEO live.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.