A look at some news releases this morning that caught my eye.

Guyana Goldfields - (GUY:TSX) - Guyana Goldfields will be one of the next gold producers worldwide. This mornings press release has announced that mill testing has started at the Aurora gold project in Guyana. Initial production is expected in mid 2015.

Project construction is ~85% complete and commissioning is under way on the sag mill, power plant generators, and water & air support systems.

Initial production for 2015 is projected at between 30,000 ounces to 50,000 ounces of gold in 2015 and and ramping up to between 120,000 ounces to 140,000 ounces for 2016.

Scott Caldwell, president and chief executive officer, commented: "The commissioning of the mill circuit is a major milestone, which we've been able to deliver on schedule and brings us one step closer to initial production. I am proud of what our team has accomplished in just a little over a year. The energy at site is vibrant and I would like to thank all our employees and contractors for their dedication and excellent work. At this stage in the game, we are so close to production that it has eliminated a large portion of capital overspending risk. Our next focus is producing ounces at or above our target for 2015 gold production and join the ranks of producers."

As of March 31, 2015 $44 million US was left to be spent on the $249 million dollar CAPEX. Guyana held $16 million in cash and cash equivalents as of March 31. Remaining funds from the $160M Trance 1 Debt Facility is $54 million so GUY will need to utilize the facility to complete construction.

At $1150 gold the project is projected to generate an after tax NPV of $533 million and a 25% IRR. Average operating cost including royalties is expected to be $527 per ounce. This is helped by having a grade of 2.74 grams per tonne.

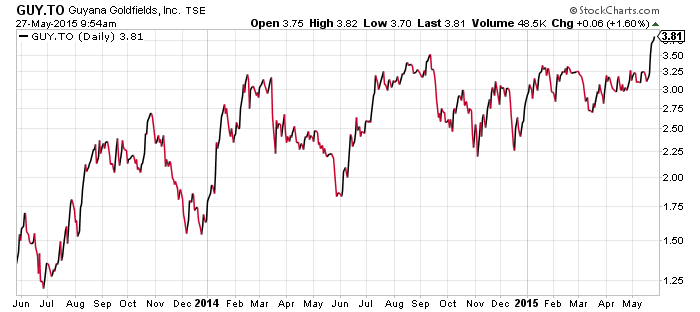

A very strong 2 year chart for Guyana. Gold companies tend to have a re rating as they enter commercial production and cash flow begins.

One thing I have noticed over the past couple years as any companies suffer from slow ramps ups and have issues during start up. This will be one thing to watch for at Aurora.

Scotia Capital has recently upgraded Guyana Goldfields to a focus stock from sector outperform.

Related: This project has awesome economics

Pure Gold Mining - (PGM:TSXV) - Pur Goel has intersected more near-surface high grade gold at the Madsen project in the prolific Red Lake district in Ontario. Drilling is currently focused on two locations Russet South and Fork Zone near the historic Madsen Mine.

Highlights from drilling reported today include:

Russet South - 6.5 g/t gold over 1.3 metres in PG15-034 and 20.0 g/t gold over 0.7 metres in PG15-038

Fork Zone - 8.4 g/t gold over 1.6 metres and 7.3 g/t gold over 2.5 metres in PG15-037

"Despite being Red Lake's 2nd largest past producer, previous operators conducted limited systematic generative exploration around the mine since its closure in 1974," stated Darin Labrenz, President and CEO of Pure Gold. "Our focus is to unlock the exploration potential of this 50 km2 property. Over the past eight months our new geological model has delivered high-grade gold mineralization in two key areas, and we are now building continuity in Russet South and Fork Zone."

A tough one year chart for PGM and the stock is currently at a 52 week low. It seems the market for junior exploration companies has completely dried up unless they have stellar results.

PGM is intercepting gold intercepts but nothing stellar. Management is systematically exploring the large property which is located in arguably the best gold district in the world.

I continue to follow Pure Gold Mining for two reasons solid management and the location of their properties (Red Lake).

Read: Pure Gold hits more near-surface, high-grade gold at Madsen

Related: Haywood Mining Team launches Q2/15 Junior Exploration Report

Please join us in CEO live.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.