A look at few of my top headlines from this morning with some additional comments.

BitGold - (XAU:TSXV) - BitGold has announced a $18.2 million dollar bought deal at $3.65 per share. A syndicate of underwrites led by GMP Securities and including Clarus Securities,Canaccord Genuity, and Dundee Securities Ltd has agreed to purchase the 5 million shares.

Lots of talk early this morning in CEO Live Chat on the deal and if this is the right move for BitGold. Chatters have weighed in on both sides with positive and negative views.

The net proceeds of the offering are expected to be used for brand development, customer acquisition through on-line marketing, event marketing, ATM development and deployment, user interface development across platforms (desktop, mobile, ATM), servicing of customers, and working capital.

All shares purchased will be subject to a 4 month hold period.

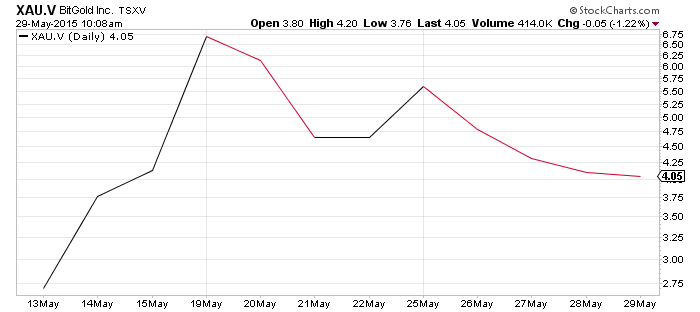

BitGold only became a publicly listed company on May 13 and since then has been the most talked about stock on the TSX Venture. The open was at $2.50 and shares hit a high of $8 on May 20.

BitGold made its first acquisition on May 22nd announcing the purchase of Gold Money for 11.16 million shares orginally valued at $51.9 million ($4.65 per BitGold share) . Note the 11.96 million shares are now worth $44.679 million ($4 per share).

If the acquisition closes BitGold will have $12.5 million in cash and $18 million if warrants are exercised.

Closing the financing of $18.2 million could potentially see a strong treasury of ~$36 million.

Time will tell if BitGold is the next big thing or not. For one thing a fair amount of interest and speculation has been built around the company with a market cap this morning of $147.2 million.

What are your thoughts on BitGold? Are you a shareholder?

Let us know at CEO live.

Read: BitGold Announces C$18.2 Million Bought Deal Financing

Related:BitGold Disrupts Financial Services

Roxgold - (ROG:TSXV) - Roxgold has received approval of a mining convention for the high grade Yaramoko gold project from the government of Burkina Faso. Yaramoko is under construction with first production expected in mid 2016.

The receipt of the mining convention is another positive development for the project especially with an election occurring in Burkina in October of this year.

What is the mining convention?

The mining convention sets out the fiscal and legal terms with respect to the operation of the Yaramoko gold project, including taxation rates applicable to the project, per the 2003 Burkina Faso Mining Code. The convention is valid for 20 years commencing on the date of the grant and may be renewed for subsequent periods of five years. The receipt of the convention also satisfies a key condition precedent associated with the project's debt financing.

"We are delighted to announce the finalization of the mining convention as it signifies yet another positive milestone in the development of Yaramoko," said John Dorward, president and chief executive officer. "We look forward to continuing our development and working with all stakeholders in Burkina Faso to bring Yaramoko into production in mid-2016."

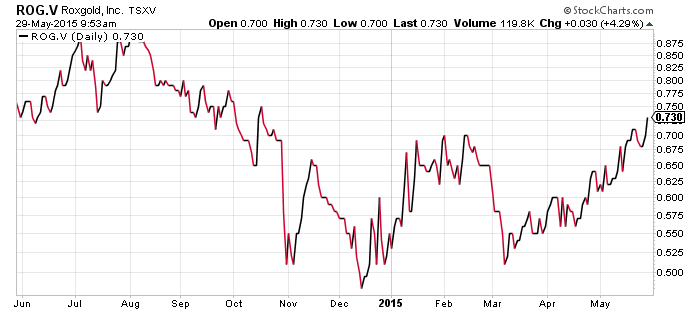

Getting close to a 50% move upwards in Roxgold shares since March.

The Yaramoko mine once in production will be a cash cow and is expected to produce 120,000 ounces of gold in its first full year of production (2016) at an average all-in cost of less than US $590 per ounce.

If investors can stomach the political risk of Burkina Faso (elections in October) Roxgold looks like an excellent low cost producer to invest in.

Read: Roxgold Receives Approval Of Mining Convention For The Yaramoko Gold Project

Related:Roxgold is set to make over US$70 million next year

Please join us in CEO live.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.