A look at some of the mining headlines crossing the wires this morning with some additional thoughts.

Zenyatta Ventures - (ZEN:TSXV) - Zenyatta is out with the much anticipated PEA on the Albany hydrothermal graphite project in Northern Ontario, Canada. The PEA has returned results of a base case after-tax Net Present Value at a 10% discount rate of $438 Million yielding an after-tax Internal Rate of Return of 24%. Due to the positive results ZEN will proceed with moving the project to the pre-feasibility stage.

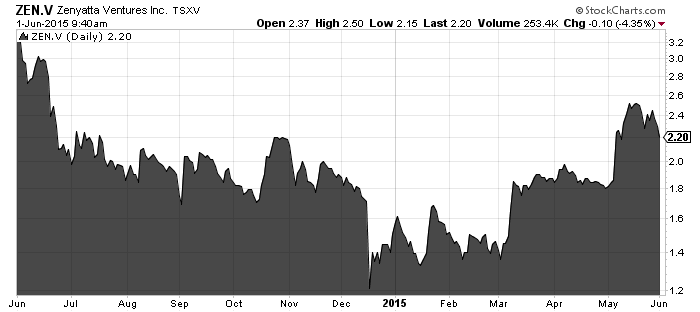

The market was expecting better as ZEN stock is down 13% in early trading to $2 a share.

PEA Highlights:

- Open-Pit, Life of Mine (‘LOM’) of 22 years based on less than 50% of the Indicated & Inferred Mineral Resources. Underground mining of Inferred Resources below the sill are not included in this study. The deposit is open at depth;

- 3,000 tonne per day open-pit mine and process plant to produce 30,000 tonnes of high purity (>99.9% Cg) graphite annually;

- Price of purified graphite @ $7,500 per tonne and operating costs of $2,046 per tonne showing a margin of $5,454 per tonne;

- Total LOM gross revenue of ~$4.8 Billion and an after-tax cash average annual cash flow of $110 Million;

- Initial Capex of ~$411 million.

Aubrey Eveleigh, President & CEO at Zenyatta commented, "The Company is exceptionally pleased with the strong PEA results presented by RPA and will now proceed to a pre-feasibility stage where further project definition and optimization is expected. This is a very important milestone for Zenyatta that started with the discovery of a rare graphite deposit in 2011 and has now gained global recognition for its unique purity and crystallinity. Zenyatta's early stage study has resulted in extremely encouraging economics that will support discussions with potential strategic partners and financiers."

A 1 year chart shows Zenyatta in a trading range between $1.80- $2 for most of the last year. The dip earlier this year would have been a good opportunity to buy the anticipated news (PEA) and then sell now. I personally think the stock will now settle back in the $1.80 - $2 rang again with no major catalysts on the horizon.

Zenyatta also provided some context on the graphite market in the release. They believe the market is very promising as new application increase demand. Estimated annual production of 30,000 tonnes of high-quality graphite product from the Albany deposit represents ~7% of the 2017 market demand estimate.

Read: Zenyatta Announces Positive Preliminary Economic Assessment for Albany Graphite Project

Rockhaven Resources - (RK:TSXV) - Rockhaven has started a 15,000m drill program at the Klaza project in the Yukon. The 2015 work program will also include geotechnical, metallurgical, and environmental studies.

The drilling will primarily focus on expanding and better defining the recently announced maiden inferred resource estimate containing 948,348 oz gold and 21,780,313 oz silver at an average grade of 4.19 g/t gold and 96.23 g/t silver using a 1.5 g/t gold cut-off.

The goal is to grow the resource to about 2 million ounces which management thinks is very attainable.

The drill program will be fully funded and may be expanded depending on results and financing conditions. Rockhaven closed a $4.41 million dollar private placement with Strategic Metals (SMD:TSXV) in March. Strategic now owns 48,847,500 which is 46% of the company.

"We are excited to begin our fully-funded 2015 program which we expect will significantly expand the current high-grade gold and silver resources outlined within two of the nine main zones on the Klaza property. The drilling will also assess the potential at some of the seven other sub-parallel zones at which only broadly spaced drilling and trenching have been done," stated Matt Turner, Rockhaven's CEO. "Engineering and permitting studies will ramp up to systematically advance the Klaza project towards development."

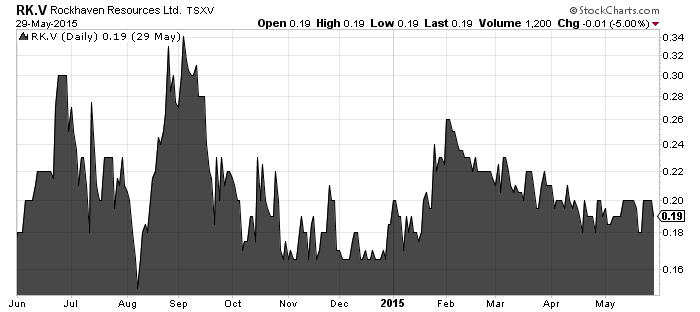

A quiet winter period for Rockhaven stock with no exploration occurring the in winter in the Yukon. Action could pick up now that drills are turning and assays will be released all summer.

Rockhaven is one of the few mining companies to pay for an exhibitor booth at the Cambridge House show which is on today. You can find them at booth #518.

Read: Rockhaven Commences 15,000 m Diamond Drill Program at Klaza Project, Yukon

Watch: Matt Turner, CEO of Rockhaven Resources (RK.TSXV)

Please join us in CEO live.

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.