Subscribers to Eric Coffin's HRA newsletter were tipped LIO (now 50 cents) six weeks ago at 20 cents. 3 month trial subscriptions are just $9 here.

Lion One Metals (LIO-V, LOMLF-Q, LLO-ASX)

The Bullet Points:

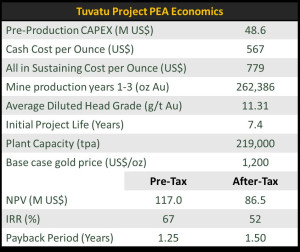

- Lion One Metals just released a very impressive Preliminary Economic Estimate for their Tuvatu project indicating an after-tax IRR of 52% (payback in 1.5 years) and an after-tax NPV over four times the size of Lion One’s current enterprise value.

- Capital requirements for start-up are light at under $50 million.

- Lion One has ALL REQUIRED PERMITS for a mining operation at its Tuvatu project in Fiji. This is a huge leg up. Permitting is a 2 to 5 year process in most jurisdictions.

- Cash operating cost of $567/ounce and all-in sustaining cost of $779. Tuvatu will produce an average 57,000 ounces during its seven year mine life with peak production above 90,000 ounces in years two and three.

- Lion One will mine higher grade stopes. Management plans drilling to replace ounces produced, expand the overall resource and move ounces into higher confidence categories on an ongoing basis. This is classic underground mining technique.

- Tuvatu’s location and local skilled mining work force translate to low infrastructure costs.

- The PEA is THE LAST STUDY EXPECTED PRIOR TO DEVELOPMENT. Management will now focus on putting a finance package together and constructing the Tuvatu mine.

- Management ability to transition from exploration to production is a “make or break” characteristic for mine developers. Lion One’s leadership has been directly involved with numerous successful mine start-ups.

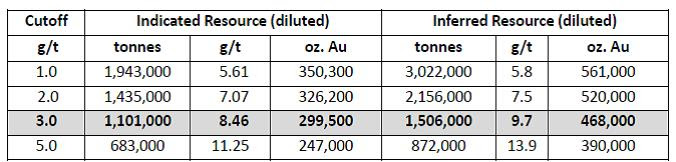

Sometimes simple is best. Lion One is focused on the high grade Tuvatu gold project in Fiji. Tuvatu contains a 760,000 ounce gold resource open to expansion in most directions plus many other lightly drilled veins and prospects that can add ounces and potential mine life. Lion One management had a direct hand in the start of a score of mines on three continents over the last thirty years. Fast tracking Tuvatu to production before growing the resources further looks like the best way to maximize shareholder value and management has committed to doing just that.

I’ve followed Lion One in the HRA Advisory publications for some time now. I moved LIO up to Strong Buy in the HRA Special Delivery alert service at 20 cents back in April when the company received its final required permit to mine at Tuvatu. It was added to the broader HRA Journal list early in May.

The initial market reaction to the permit approval was muted but the stock strengthened as traders recognized the implications of that permitting success. Miners can spend years going through the permitting process after proving up a resource. With Tuvatu, the process is getting turned on its head. Lion One received all its permits before releasing the PEA. That tells you a lot about the high regard Fiji’s government has for Lion One management and the effort LIO put into relations with local stakeholders since day one.

The table on the right lists the main findings of the Tuvatu PEA. It’s a very impressive set of numbers. The key to the mining plan laid out in the PEA is grade. Lion One will focus on the higher grade areas of the currently defined resource first. This “front end loads” the production profile, allowing for higher revenues in the first years of production and rapid payback of capital.

The table on the right lists the main findings of the Tuvatu PEA. It’s a very impressive set of numbers. The key to the mining plan laid out in the PEA is grade. Lion One will focus on the higher grade areas of the currently defined resource first. This “front end loads” the production profile, allowing for higher revenues in the first years of production and rapid payback of capital.This is the “old school” way of growing a mining company. For centuries, miners would prove up a few years’ worth of production, get a mine started and deal with growing the resource and extending the mine life later. Scores of mines world wide – particularly high grade underground operations – that have operated for decades began with only a few years of “official” resources. The industry moved away from this model when it focused on low grade bulk tonnage operation that require billions in start-up capital. The market we’re in makes that sort of operation impossible for any but the world’s largest mining houses to even consider financing.

HRA has always maintained that miners would return to the high grade model. Big open pits got the glory for a while but many of the world’s most successful and profitable operations are actually high grade underground mines. I’ve seen the sector moving back to our way of thinking as underground operations under development accrue higher and higher market values. I expect Lion One to continue the trend.

The Middle of Nowhere? Not Really.

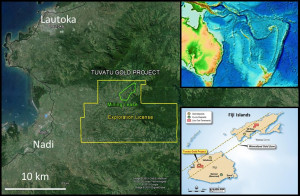

Fiji may sound like the last place you would look for a gold mine, or any other type of mine for that matter. It’s not though. Mining is actually quite important to the Fijian economy and the locals are supportive of well-planned operations that are sensitive to the environment and have small footprints, as underground mines do. Fiji is part of the Pacific “Rim of Fire” that hosts some of the world’s largest mineral deposits. The island of Viti Levu that Tuvatu is located on lies on a large NE trending regional structure that hosts a number of gold and copper-gold deposits. The most important deposit in the region is the Vatakoula gold mine, located 75 kilometres NE of Tuvatu and occupying the same regional trend. Like Tuvatu, Vatakoula is a high grade vein type deposit. It has operated intermittently since the 1930s and has cumulative production of over 7 million ounces of gold with over 4 million ounces remaining in reserves.

Fiji may sound like the last place you would look for a gold mine, or any other type of mine for that matter. It’s not though. Mining is actually quite important to the Fijian economy and the locals are supportive of well-planned operations that are sensitive to the environment and have small footprints, as underground mines do. Fiji is part of the Pacific “Rim of Fire” that hosts some of the world’s largest mineral deposits. The island of Viti Levu that Tuvatu is located on lies on a large NE trending regional structure that hosts a number of gold and copper-gold deposits. The most important deposit in the region is the Vatakoula gold mine, located 75 kilometres NE of Tuvatu and occupying the same regional trend. Like Tuvatu, Vatakoula is a high grade vein type deposit. It has operated intermittently since the 1930s and has cumulative production of over 7 million ounces of gold with over 4 million ounces remaining in reserves.

Vatakoula, like Tuvatu, occupies the area of an extinct volcano. The past volcanic activity was probably both the heat engine that drove mineralized fluids into the area and the source of the “ground preparation” in the form of fractures created during the volcanic caldera’s growth that created easy pathways to travel for gold laden fluids.

Vatakoula is still operating though it’s getting to the end of its mine life. The average grades being mined there now are quite a bit lower than the mine plan grades for Tuvatu and most of the higher grade structures have shallow-20-30 degree dips which is tricky and inefficient for underground mining. By contrast, Tuvatu’s gold bearing structures are steeply dipping which allows the miners to use gravity to do some of the work and decreases the potential dilution.

The long running Vatakoula operation will, inadvertently, be another big cost saver for Tuvatu. Vatakoula provides the region with a mining culture and has trained many skilled local miners. These miners are qualified and trained in excactly the sort of mining conditions using the same techniques that will be applied at Tuvatu. It’s no secret that Vatakoula is nearing the end of its life. Miners will be happy to find a new mine to work at and Lion One foresees no problems staffing Tuvatu with highly qualified underground and mill personnel.

Tuvatu is only 25 kilometres from the regional center of Nadi and 15 kilometres from an international airport. A partially sealed road allows you to drive right up to the portal entrance and power lines and water cross the site. Fiji’s power grid is all powered by diesel generators so Lion On plans to install its own to ensure a consistent power supply. All this existing infrastructure is a big advantage for Tuvatu and one reason LIO has been able to keep the capital cost of the project manageable.

Tuvatu – Lots of Room to Grow.

I mentioned above how Lion One is following the tried and true method of putting an underground operation into production then continuing to upgrade and expand resources. Narrow vein deposits take a lot of drilling to prove up and it’s often more efficient to do that drilling from within the underground workings. The drill holes are shorter and therefore cheaper and underground drills, unlike surface drills, can drill both “up” and “down”. That means miners can effectively drill fans of holes at different angles from a single drill station to prove up additional tonnage or increase the level of confidence on existing zones.

That’s great in theory but only works in practice if the project has targets to drill. Luckily, that’s not a problem at Tuvatu.

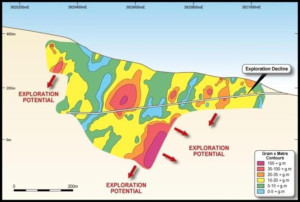

There will be plenty to keep the drillers busy for a long time to come. The first graphic below is a long section along the trace of the current exploration decline. The colors display gold grade times width in different parts of the section based on drill results to date. As you can see from the shading the gold zones are still open to expansion in most directions.

There will be plenty to keep the drillers busy for a long time to come. The first graphic below is a long section along the trace of the current exploration decline. The colors display gold grade times width in different parts of the section based on drill results to date. As you can see from the shading the gold zones are still open to expansion in most directions.

There are several historic drill intercepts of over an ounce per ton gold across two to four metres that are up to 100 metres below the current resource. We also know from Vatakoula that this type of deposit can carry grades for several hundred metres of dip. There is potential immediately surrounding the existing resource that will be much easier to test once new underground development provides well located drill stations.

Stepping back a bit we can see there is even more potential in the immediate vicinity of the current resource. The lower graphic is a Google Earth image that shows the outline of the mining lease. The red lines are known veins that have been traced on surface. The existing resource is within the cluster of veins hear the NE (upper right) corner of the licence.

As you can see from the graphic there are scores of veins that are still largely undrilled. Most have been traced on surface by mapping or trenching. This includes the main vein sets in the resource. Several of them have been traced with outcrop mapping and trenching for a kilometre or more in both strike directions from the current resource. There are a number of other veins that have reported 20 g/t plus grab or channel samples from vein segments traced for 2-300 metres. Remember that all the veins shown in the map above are within the existing mining licence which means they are already permitted. Any vein within the licence that is proved up can be added to the mine plan when it makes the most sense to do so. I don’t know if Tuvatu will ever approach the 11 million ounces in resources and cumulative production that Vatakoula boasts but I am comfortable it will be a multiple of the current 0.75 million ounce resource.

As you can see from the graphic there are scores of veins that are still largely undrilled. Most have been traced on surface by mapping or trenching. This includes the main vein sets in the resource. Several of them have been traced with outcrop mapping and trenching for a kilometre or more in both strike directions from the current resource. There are a number of other veins that have reported 20 g/t plus grab or channel samples from vein segments traced for 2-300 metres. Remember that all the veins shown in the map above are within the existing mining licence which means they are already permitted. Any vein within the licence that is proved up can be added to the mine plan when it makes the most sense to do so. I don’t know if Tuvatu will ever approach the 11 million ounces in resources and cumulative production that Vatakoula boasts but I am comfortable it will be a multiple of the current 0.75 million ounce resource.

One other important point to note concerns metallurgy. The metallurgical recoveries assumed in the financial model is 86%. This is based on the average gold recoveries from a number of early metallurgical studies. More recently, ongoing optimization programs have been yielding recoveries of up to 95% mainly through reprocessing and finer grinding which the mill will have the capacity to do. The mining and milling costs per tonne don’t change so if you can increase recoveries the difference goes right to the bottom line. If LIO can succeed in delivering 90% plus recoveries at a commercial scale that will have an outsized impact on both NPV and cash cost.

Management: Lots of Successes and Lots of “Skin in the Game”

Everyone knows how important both management and share structure are to the success of a speculative company. In the case of Lion One, management and structure are excellent and intertwined. Walter “Wally” Berukoff, Lion One’s founder, chairman and largest shareholder, is a serial entrepreneur who has had a lot of success in several fields, not the least of which is mining. Those of you that have followed the mining sector for a while may recognize the names Northern Orion, Miramar Mining and La Mancha Resources. Berukoff founded all three of these companies that, collectively, were responsible for the development to production of over a dozen mines on two continents. More to the point, all three of these companies were ultimately taken over by larger entities, providing an exit opportunity for all shareholders. The collective value of the three M&A transactions these companies were involved with is about $3 billion.

Getting a takeover offer for a company that monetizes its value for all shareholders is the Holy Grail for a promoter in the resource space, or any other space for that matter. Only a handful of promoters manage to accomplish this feat even once and those that do can write their own ticket on their next deal. Berukoff has done it three times.

You can call in a lot of markers when you have that sort of track record. The way that Lion One has been financed to date is a strong indication of the level of credibility that management has. All of the monies raised by Lion One were at $1.00 and $1.55 and $4.5 million of that money is still on hand. The shareholders of the companies that were taken over to create the current Lion One (X-Tal and Avocet) endured large reverse splits to make the deals happen so their cost base is also high. There really isn’t any “cheap stock” in this deal.

Berukoff is Lion One’s biggest shareholder, holding one third of the stock. That stock wasn’t cheap either and if it’s not already obvious, Berukoff is not the type to sell off shareholdings piecemeal. He likes to build companies and sell them. There are a number of other large shareholders who seem content to hold the stock and give management a change to build Tuvatu. There are some traders and weak hands in LIO as there are in any deal but Lion One has a float and share structure most resource juniors can only dream of after four years of bear market.

Berukoff believed in Tuvatu and was clearly frustrated waiting to have some concrete numbers he could promote. Now that the PEA is out, Berukoff and Mann have real numbers they can go to their rolodex with and it’s a very big rolodex. Expect to see a lot more eyeballs on this story going forward.

Bottom Line Time:

The past three years have been brutal for the mining sector. Many companies have been forced to rethink or abandon their business models. What worked five years ago doesn’t work now. Companies followed by HRA that have had recent success all realize that and none more so than Lion One.

Past success gives Lion One management a lot of willing listeners. PEA numbers that tick all the boxes with 50%+ IRR and mine life to payback period ratio above four means Tuvatu will be on the short list for many finance groups. Add to that a very manageable capex budget and I think Lion One will be fielding a lot of offers to finance Tuvatu to production. One of the biggest pitfalls for development level companies in year four of a bear market is huge equity dilution inherent in a mine financing package. Indeed, it’s been a deal killer lately for many, many companies. Relative to most deals out there the minimum equity dilution required for a mine finance package is low for Lion One and management has only begun to market the project. It all adds up to two words that are key drivers for successful mine developers right now: “financeable” and “practical”. Projects with those two attributes go to the top of the list for funding groups. The fact Tuvatu already has all permits in place and could move to construction almost immediately is a major bonus. As the market understands just how near term an opportunity this is Lion One’s market value should continue to climb. This one has a short fuse.

Interested in this type of stock?

Subscribers ALWAYS Read About the Best Ideas First!

Test Drive the HRA Journal - a 3 Month Subscription for Only $9!

I very occasionally send out emails like this to the HRA Free List. I ONLY do these when I am writing about a company that is already followed in HRA and that my subscribers already know about. In other words, if you’re hoping to get pick after pick just by being on the Free List, don’t get your hopes up. Lion One is a perfect example. HRA Journal subscribers got a six page report at half the current price – a month ago –and HRA Special Delivery subscribers got an alert moving LIO to Strong Buy when the stock was trading at 40% of its current level – about two months ago.

HRA looks for companies with potential to at least double over 1-2 years based on exploration success, resource growth and development of metals deposits for production or take over by larger companies. HRA also uncovers high risk/high potential exploration plays, "swing for the fences" trades that can yield returns of hundreds or even thousands of percent.

Now is the time to find opportunity in the resource sector. Companies with superior management and projects have never been cheaper. HRA specializes in finding just that kind of undervalued company. 22 early stage HRA picks have been taken over in the past eight years.

Click Here Now to Subscribe At This Extremely Low Trial Price - Only $9!

HRA Special Delivery Alert and the HRA Journal are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset expansion and/or new discoveries.. These are high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in HRA publications. We may, or may not, own securities and/or options or warrants to acquire securities of the companies mentioned herein .HRA's publisher, Stockwork Consulting Ltd will be compensated for the rental of third party email list and the preparation and distribution of this report to those lists. HRAs editor owns shares in Lion One and may benefit from share price gains.. You should never invest in a speculative - or any other - stock without doing your own rigorous due diligence and consulting with and independent third party investment professional. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given.

Published by Stockwork Consulting Ltd. Box 84900, Phoenix AZ, 85071

customerservice@hraadvisory.

Subscriptions/Customer Service 1-877-528-3958