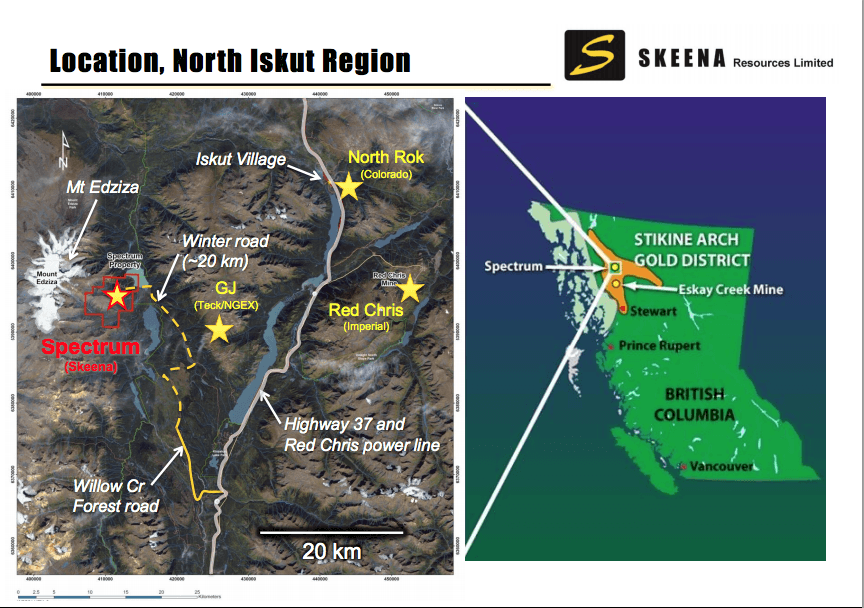

The high-grade Spectrum gold project in British Columbia's Golden Triangle will see a $3.5 million, 10,000-12,000 metre drill program this summer thanks to $8.1 million in financings by its operator, Skeena Resources (SKE.V).

Skeena is led by American businessman Walter Coles, CEO, and Canadian Mining Hall of Famer geologist Ron Netolitzky, Chairman. Mr. Netolitzky helped find and develop two mines nearby to Spectrum, the Snip and Eskay Creek mines, both owned by Barrick.

The goal of this summer's drill program is to establish a NI 43-101 compliant resource for Spectrum before the end of the year, the company said. According to Skeena's May 2015 marketing presentation, their corporate goal "is to establish a 2-3 million oz. Au resource grading 12+ g/t in multiple closely spaced, steeply dipping, parallel zones."

The financing is significant for Skeena, worth just 6 cents per share and $11.8 million by market capitalization prior to today's closing. It sold 66,966,666 Non-Flow Through shares at 6 cents and 32,250,000 Flow Through shares at 8 cents for gross proceeds of $6,598,000. Additionally, Skeena sold an 8.7% project earn-in for $1.5 million to a company affiliated with Mr. Netolitzky, Boss Power. The project interest can be converted for 25 million Skeena shares ($1.5 million / 25 million shares = 6 cents per share, same as today's financing). No warrants were included in the financings.

Skeena is also looking at other high-grade, post discovery resource acquisitions in the Golden Triangle region, it said.

Here's the news release: Skeena (SKE.V) Closes $8.1 Million of Funding... and here's to gold exploration catching a bid.