Many of us are aware that 400 billionaires appear on Forbes’ list of the wealthiest Americans. But if you had to guess what percentage of them is self-made, what would you say? A quarter? A third?

Many of us are aware that 400 billionaires appear on Forbes’ list of the wealthiest Americans. But if you had to guess what percentage of them is self-made, what would you say? A quarter? A third?

Before I give you the answer, let me posit which way Thomas Piketty might lean.

If you’re unfamiliar with the name, Piketty is the socialist economist whose book Capital in the Twenty-First Century was published a little over a year ago. It was an instant bestseller and elicited much debate not just in academic circles but also the popular media.

In the book, Piketty argues that capitalist societies naturally incubate wealth inequality, leading to a scenario in which a small minority of the population owns most of the wealth. Because rich families can assume a greater amount of investment risk, their return on capital multiplies at a much faster clip than the general economic growth rate. To offset the effects of what he sees as rising inequality around the globe, Piketty—in typical socialist fashion—therefore prescribes a global wealth tax, with rates as steep as 80 percent.

So back to the initial question: What percentage of American billionaires are self-made? Piketty might guess only a very small fraction, pointing to the progenies of vast family fortunes—the Waltons, the Koch brothers, the Mars family. With so much wealth accumulated at the very top of the pyramid, he might say, there’s no room left for new money.

He would be sorely mistaken.

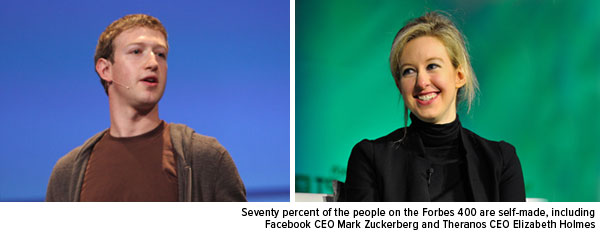

On the contrary, 70 percent of those who show up on Forbes’ 2014 list created their own wealth. Nearly three out of every four billionaires, then, are self-made entrepreneurs and innovators, far from being born with a silver spoon in their mouths.

What’s more, this figure is actually up from 1984, when fewer than half were self-made. If Piketty’s theory held any water, we would expect to see the same powerful families dominating the Forbes 400 decade after decade—the Rockefellers, the Carnegies, the Vanderbilts—with few new entrants.

But that’s not the case. Among the most recent newcomers is 31-year-old Elizabeth Holmes, CEO of Theranos, a health care technology company she founded at the age of only 19. The tenth-wealthiest person is cofounder and CEO of Facebook Mark Zuckerberg, also age 31.

Indeed, success in America is an equal opportunity player, blind to gender, race, age and background. Some of the wealthiest, most powerful people come from poverty and overwhelming hardships. Think Starbucks CEO Howard Schultz, who grew up poor in the Brooklyn projects. Think investor George Soros, who emigrated from war-torn Hungary as a penniless young man. Think media mogul Oprah Winfrey, who was raised in such dire impoverishment that she often had to wear a potato sack to school. Like countless others, they proved socialist thinkers like Piketty wrong and attained the American Dream.

But how?

It’s not just about intelligence, not just about unique talents, not just about luck—though these certainly help. Instead, as Richard Koch and Greg Lockwood point out in their 2010 bookSuperconnect: Harnessing the Power of Networks and the Strength of Weak Links, what high performers share above all else is a relentless propensity to connect with others in high places and foster such relationships. Pursuing the attention of and surrounding yourself with successful people helps build the scaffolds that can raise you up to the next level. Today, this is made even more achievable with social networking platforms such as Facebook and LinkedIn.

It’s not just about intelligence, not just about unique talents, not just about luck—though these certainly help. Instead, as Richard Koch and Greg Lockwood point out in their 2010 bookSuperconnect: Harnessing the Power of Networks and the Strength of Weak Links, what high performers share above all else is a relentless propensity to connect with others in high places and foster such relationships. Pursuing the attention of and surrounding yourself with successful people helps build the scaffolds that can raise you up to the next level. Today, this is made even more achievable with social networking platforms such as Facebook and LinkedIn.

None of this is to take away from the fact that many people in the U.S. and elsewhere continue to struggle in poverty. Piketty is commended for trying to address this problem, but his solution doesn’t square with reality. No country has ever succeeded at taxing itself into prosperity. As Winston Churchill observed, that would be like a man standing in a bucket and trying to lift himself up by the handle.

Instead, it should be part of the role of business to drive prosperity, as it did for 70 percent of the Forbes 400. Doing so is not only morally right, but it also represents a huge opportunity to build a new demographic of consumers and investors.

Fund portfolios are actively managed, and holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more of U.S. Global Investors Funds as of 3/31/2015: Facebook Inc., Starbucks Corp.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Interesting article, but I’m always concerned when one side professes to be “morally right.” Philosophy and economics are not synonymous in my opinion.