Solitario Exploration and Royalty Co (SLR:TSX) and Ely Gold (ELY:TSXV) - Waterton has purchased the Mt. Hamilton gold project in Nevada off partners Solitario and Ely Gold for $30 million USD. Solitario owns an 80% interest and will receive $24 million with Ely holding 20% and receiving $6 million.

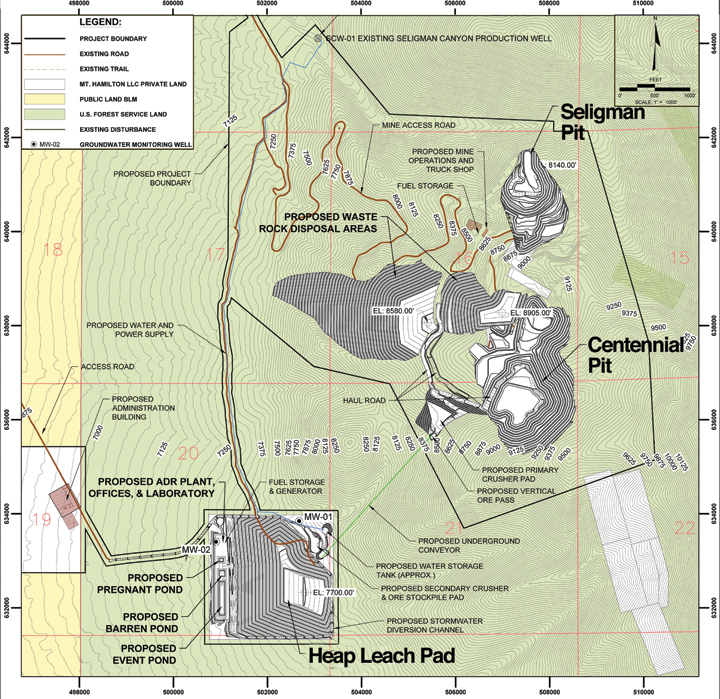

An updated feasibility study was completed on the Mt. Hamilton project in October 2014 showing an after tax IRR of 20.6% and a payback period of 3.6 years. The initial CAPEX is estimated at $91.7 million with an additional $29.8 million in sustaining costs over the life of the mine. Average annual gold production of 68,600 ounces is expected on a 7 year mine life. All major federal and state permits have been received for the project.

Waterton is a private investment firm focused on mining and metals. Waterton has $1 billion in capital to deploy in its Waterton Precious Metals Fund II. The Waterton Precious Metals Fund I first launched in 2009 and has made numerous investments with Fund II being oversubscribed raising $1 billion in April 2014.

Here is what Waterton looks for when making investments.

- Producing assets employing proven technologies and mining methods;

- Permitted, development assets with first production targeted within 18 months;

- Advanced development assets with near-term opportunities to secure permitting approvals;

- Assets located in stable jurisdictions with key infrastructure in place;

- Assets held primarily by public companies.

Investments I have found (quickly this morning) previously made by Waterton include Chaparral Gold Corp ($59 million hostile bid), a loan to Klondex Mines, purchasing the Hollister mine in Nevada (formerly Great Basin Gold), and a credit facility with Atna Gold.

So the question for investors to ask is who is Waterton looking at next?

One common theme I have noticed is that they have made several investments in Nevada. One would have to think they are taking a serious look at the assets of Midway Gold.

Solitario will now go shopping for assets with the $24 million and hope the market will focus on the partnership they have on the high grade Bongara zinc project in Peru. Zinc fundamentals are beginning to line up for a price move in zinc as major mines close down.

Chris Herald, president and chief executive officer of Solitario, stated: "We are pleased to have successfully progressed Mt. Hamilton through feasibility and permitting and believe that Waterton is well positioned to see the project through the next phase of its development. It is extremely exciting for Solitario to be able to monetize its Mt. Hamilton asset during exceedingly difficult market conditions. Upon closing the transaction, Solitario will have a very strong balance sheet to focus towards new potential opportunities. Perhaps more importantly, we will now be able to highlight our fully carried to production interest in the high-grade Bongara zinc project being advanced by Compania Minera Milpo SAA, our Peruvian partner. In total, approximately $60-million (U.S.) has been invested in exploration and development on the Bongara project to date, and we look forward to ongoing success as Milpo progresses the asset through prefeasibility during 2015."

Ely will have more cash ($6 million) than its current market cap ($3.6 million) and will focus on the 100% owned Green Springs Project in Nevada.

Trey Wasser, president and chief executive officer of Ely Gold, stated: "We are pleased to have reached this agreement with Waterton, representing a successful conclusion to nearly eight years of development work on the Mt. Hamilton project. Solitario has proven to be an excellent joint venture partner. We wish to thank them for their hard work and perseverance in some very difficult markets. This sale will provide Ely with the capital to focus on advancing our 100-per-cent-owned Green Springs project, located just seven miles south of Mt. Hamilton. Green Springs is fully permitted for exploration, and we expect to begin a drill program late this summer."

Related: Roulston: the mining revolution may not be publicized

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.