A quick look at a few of the mining news releases out this morning that caught my attention with some additional comments on each.

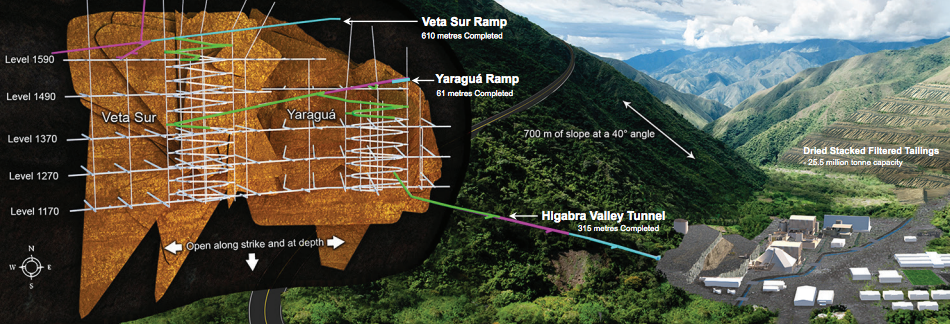

Continental Gold - (CNL:TSX) - Continental has released an additional 20 drill results at the Veta Sur and Yaragua vein systems at the Buritica project in Colombia. The plan is to release an updated mineral resource estimate shortly and these will be the final assays included.

From my analysis of the drill holes the Veta Sur system appears to be getting larger (more ounces) and the infill drilling is also finding higher grade material than in the previous resource estimate.

Veta Sur hosts 1.1 million ounces in the measured + indicated categories at 11.6 AUeq g/t according to a December 31,2013 mineral resource update. Yaraguá is 1.69 million ounces of gold in the measured + indicated categories at 10.6 g/t AUeq.

Highlights:

- Step-out drilling was successful in extending the Veta Sur system to the east, to the west and to depth. These drill-holes also infilled areas of the Veta Sur and western Yaraguá systems over a significant range of elevations.

- In eastern Veta Sur, drilling intersected high-grade veins below or to the east of the current Veta Sur mineral resource envelope. New intercepts include:

- 5.55 metres @ 16.9 g/t gold and 56 g/t silver, including 1.2 metres @ 45.3 g/t gold and 96 g/t silver (BUUY311D02, elevation of 1,133 metres);

- 1.3 metres @ 178.0 g/t gold and 109 g/t silver (BUUY311D03, elevation of 1,058 metres);

- 5.7 metres @ 50.7 g/t gold and 25 g/t silver, including 1.06 metres @ 176.9 g/t gold and 89 g/t silver (BUUY311D05, elevation of 1,085 metres); and

- 4.05 metres @ 21.5 g/t gold and 38 g/t silver, including 1.03 metres @ 68.5 g/t gold and 68 g/t silver (BUUY311D05, elevation of 1,058 metres).

"Veta Sur continues to deliver robust results and we remain confident that this will be reflected in our upcoming updated mineral resource estimate", commented Ari Sussman, President and CEO of Continental.

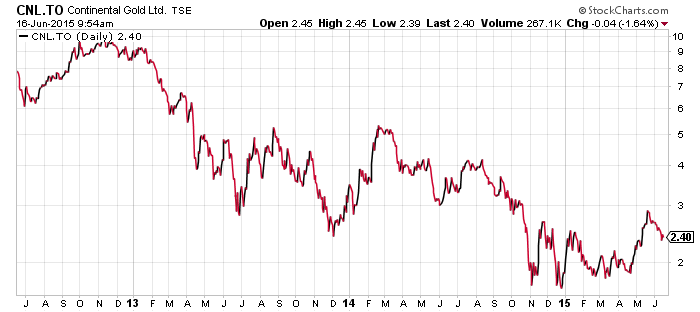

A 3 year chart of CNL stock once as high as $10 back in 2013.

The treasury remains flush with $46 million(as of May 6th).

Upcoming catalysts include:

- Final permitting completed (EIA) (Mid 2015)

- Updated mineral resource estimate (Mid 2015)

- Updated Preliminary Economic Assessment (H2 2015)

- Drilling of Pinguro and Obispo exploration targets (H2 2015)

$CNL is one of the top stocks discussed in CEO Chat and all comments on the stock can be seen at http://chat.ceo.ca/cnl

Related: Continental Gold’s Buriticá Mine On Track for Permitting Completion in Q2 2015

Savary Gold Corp (SCA:TSXV) and Sarama Resources (SWA:TSXV) - JV partners Savary and Sarama have released the best drill intercept to date on the Karangosso zone on the Karankasso project in Burkina Faso.

Savary is the majority owner owning 65% of the project leaving Sarama with a 35% interest. A 15,000m drill program is under way with 10,000m currently complete.

Highlight intercepts, for four of the exploration targets, are presented below:

- 3.33 g/t gold over 41 metres at Karangosso;

- 6.61 g/t gold over 10 metres at Karangosso;

- 2.02 g/t gold over 11 metres at Karangosso;

- 2.30 g/t gold over nine metres at Karangosso;

- 1.97 g/t gold over eight metres at Karangosso;

- 1.94 g/t gold over 11 metres at Karangosso;

- 1.79 g/t gold over 10 metres at Karangosso;

- 13.89 g/t gold over four metres at Kueredougou untested -- new zone;

- 5.21 g/t gold over nine metres at Kueredougou West trend -- new zone;

- 2.52 g/t gold over eight metres at Kueredougou West trend -- new zone;

- 3.53 g/t gold over 15 metres Kueredougou West zone.

Don Dudek, Savary's president and chief executive officer, commented: "Drill results received to date continue to support our view of the excellent exploration potential along the 45-kilometre belt on the property. The current drill program has again extended the areas of known mineralization, discovered new mineralized zones and returned Savary's best intersection to date. High gold grades, the search for a centre-of-gravity zone and the desire to define a material gold resource continues to be our focus in the current drill program. It was great to see the development of a high-grade core at the felsic intrusion-hosted Karangosso zone and a clear indication of its strike continuity to the north. The new discovery at the Kueredougou West trend, as well as the continuity and local higher grades at the Kueredougou West and Kueredougou untested zones are very encouraging. Savary's plan is to immediately follow up these results with a portion of the remaining drill budget and with the reception of additional good results, plan and complete additional holes during the 2015 program."

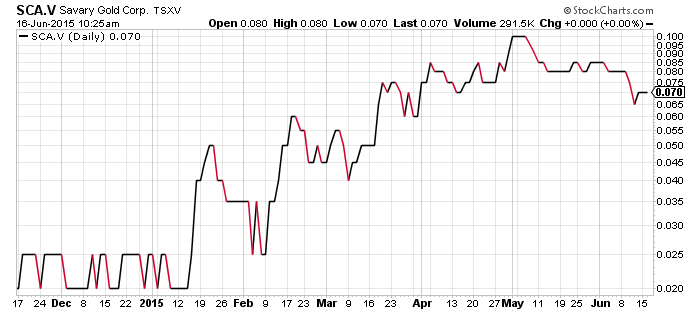

Savary Gold stock caught a bid this year after Ross Beaty became a strategic investor purchasing 28 million units at 5 cents per share in March.

Investors always like to follow the bigger names and I did a post on recent investments by Mr. Beaty before the Savary deal closed.

As far as risk goes we have been reminding readers that Burkina Faso has an election scheduled for October 11th this year.

Read: Savary Gold drills 3.33 g/t gold over 41 metres

Related: Ross Beaty’s latest junior mining investment

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.