There has been a solid but quiet performer in the commodities sector recently. Flying largely under most investors’ radar is zinc, up 3.9% in 2014. It's often overlooked because as an “industrial” metal it doesn’t have the same shine as “precious” metals. According to many analysts, zinc is setting up nicely to continue its upward run in value, and at today’s levels offers an interesting option for savvy investors to enjoy potentially substantial returns.

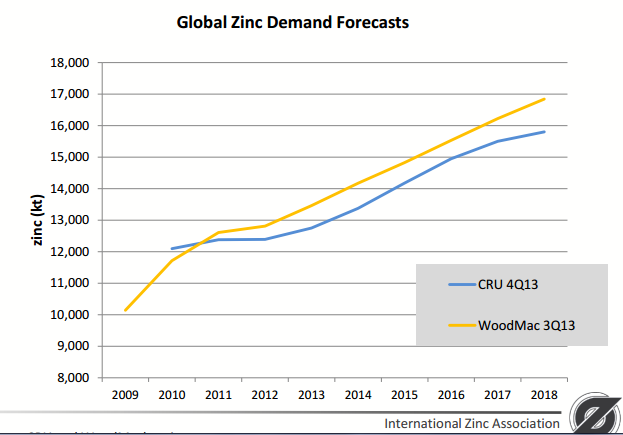

The zinc market demand is currently between 13-14 million tonnes a year, with projected growth of 5% a year. Roughly half of all zinc is used for protecting steel from corrosion (galvanizing). It’s an overlooked but important end use: industry experts estimate that if steel was left unprotected it would cost an industrial country’s economy at least 4% of GDP each year.

About 17% of zinc demand comes from zinc-based alloys that support the die casting industry. From bathroom fixtures and door and window hardware to office equipment and tools as well as automotive and countless electronic components, zinc castings are everywhere.

Zinc Price

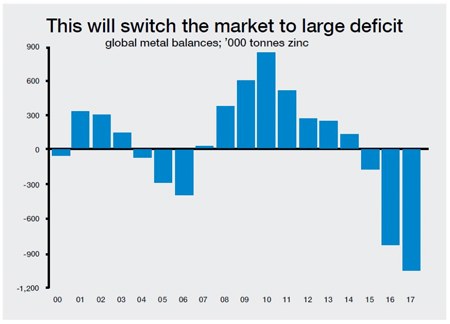

The market is already in a supply-demand deficit and has been for the last couple of years. Stockpiles are rapidly declining. In 2014, zinc output lagged consumption by 296,000 tons, according to the International Lead and Zinc Study Group.

Scotiabank commodities analyst Patricia Mohr has a price forecast of $1.60 per pound for zinc in 2016 as the deficit increases. That’s 72% higher than today’s price of $0.93 cents per pound and could have investors scrambling for zinc names.

Zinc stockpiles have already been cut in half in the last year and currently sit at ~458,000 metric tonnes.

Upcoming zinc mine closures will certainly hasten the decline in stockpiles. Of particular importance will be the closure of MMG’s Century Mine in Australia, which is winding down at the end of June. In 2014, Century supplied 465,696 tonnes into a market size of 12 million tonnes (3.8% of world supply).

Later this year, Vedanta Resources’ Lisheen mine in Ireland will also close, removing ~150 thousand tonnes from the market.

Don Lindsay, CEO of Teck Resources, one of the world’s largest zinc producers, recently stated, “It’s starting to look like 2006 all over again.” He’s referring to a powerful move that took place with the zinc price that year. Stockpiles went from the 600,000-tonne level to below the 100,000 -tonne level briefly before rising again during the financial crisis. Zinc was up 51.6% in 2005 and 125.7% in 2006. It may be setting up for a similar price move in the near future.

Pipeline

Zinc exploration and development companies must fill the pipeline for future zinc demand. But there are only a handful of quality zinc development projects in the world, which could very easily lead to takeovers in the space at significant premiums - especially for higher-quality names. (Note: most zinc development companies have issues, be they metallurgical, permitting, capex or grade.)

In 2011, with zinc down 25%, Nyrstar Resources saw an opportunity and decided to go shopping. Nyrstar understood that the fundamentals for zinc were setting up favourably so the company purchased two Canadian-listed zinc companies: Breakwater Resources and Farallon Mining. Breakwater was taken over for $663 million in cash (a 44% premium) while Farallon was purchased for $443 million in cash (a 23% premium). Nyrstar may have jumped the gun a little but zinc has had three straight years in the green since the acquisitions.

With the aforementioned two takeovers, Nystar essentially cleaned out the primary zinc producers on the TSX, leaving only Trevali Mining (TV:TSX) as the pure production play.

John MacKenzie, Anglo American’s former head of copper, is planning to launch his own public vehicle soon - and is eyeing zinc. He is reviewing takeover targets ahead of a planned $300m to $700m mining float later this year.

“Because zinc has been so unfavoured there’s been very limited development, particularly by the majors, so there’s relatively little high-quality supply coming online,” MacKenzie told Global Mining Observer.

Next down the food chain for investors are the zinc development companies.

Canada Zinc Metals (CZX:TSXV)

Canada Zinc Metals is one investment option for those looking into the zinc space. Here are four reasons why investors might want to consider CZX:

- Primary commodity (zinc) has strong fundamentals for a price rise.

- Strong management with a proven track record of success.

- A high-quality project with expansion potential.

- A solid balance sheet with no need to raise money anytime soon.

Let’s delve a little deeper into these factors:

Supply Crunch

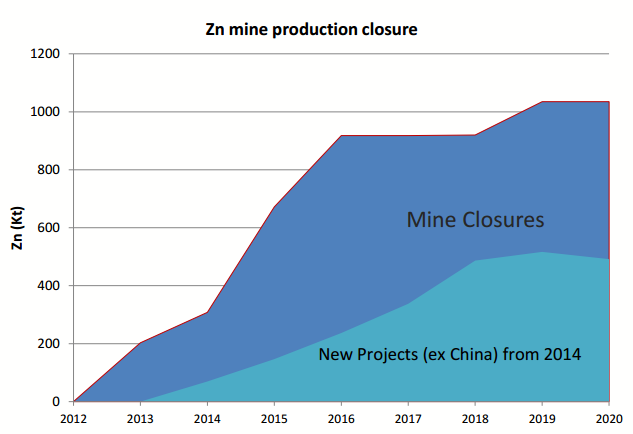

The fundamentals for the zinc price look extremely strong in the next 6-24 months. Large zinc mines are beginning to close down and it’s likely we will see the deficit in the zinc market begin to grow. No new large mines are in the pipeline to replace those coming offline.

Source: Wood Mackenzie 4Q’13 and MMG Analysis

Source: Wood Mackenzie 4Q’13 and MMG Analysis

Demand is expected to remain strong at 5% growth per year for the next couple of years, underpinned by continued growth in the Chinese steel sector and a trend towards value added steels.

If these forecasts hold true, the market will need to somehow find the production equivalent to what the Century mine put out last year (465,696 tonnes) just to keep up with demand.

Glencore, a large zinc producer, stated at its recent AGM ”An additional 3-3.5Mt of zinc supply (is) needed over the next 5 years to balance the market.”

China, the world's largest zinc producer, is still a wildcard in the zinc market but many analysts do not believe that the Chinese can increase production enough to replace the mines coming offline. China is very secretive when it comes to publicizing production numbers of commodities. What we do know is that China wants to reduce its pollution issues, but to what extent this effort slows down mining is anyone’s guess.

Economics 101 holds that when demand exceeds supply the price of whatever is in demand will rise. The zinc market has been in deficit for the last couple of years. Stockpiles have been rapidly declining and are half of what they were last year. Zinc has had a 16% move in the last 3 years but many analysts believe that is just the beginning.

Zinc’s last major supply/demand deficit occurred in 2004 with zinc quadrupling in 2 years (going from $0.50 to $2).

Management

Canada Zinc Metals is founded by Varshney Capital Corp - a Vancouver based merchant bank and venture capital firm. The group has had plenty of success in the resource space and in other investments.

The group is one of the founding shareholders of Mountain Province Diamonds (MPV:TSX), a soon to be diamond producer. Mountain Province is partnered with De Beers on the Gahcho Kue Project in the Northwest Territories. Construction is well underway with production expected in the first half of 2016. Gahcho Kue will be the world’s largest and richest new diamond mine. For those who invested in Mountain Province in the early 2000s, the stock is currently a 13-bagger.

The team at Canada Zinc Metals has all the members needed to bring this project through the development phase. Ken MacDonald, VP Exploration, recently led the team responsible for all mine permitting to bring the Mt. Milligan copper-gold mine in B.C. into production.

On the board of directors CZX can rely on the experience and expertise of Henry Giegerich, who played a key role in the development of the Red Dog mine in Alaska. Teck Resources Red Dog is currently one of the largest and highest grade zinc mines in the world.

Management has made it no secret that a takeover is a possibility. The shareholder base is among the strongest in junior mining with four major companies holding positions - Tongling Nonferrous Metals Group, Lundin Mining, Teck Resources and Korea Zinc.

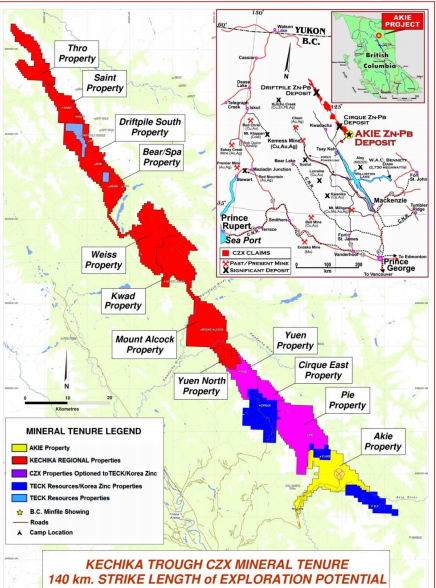

The Akie and Kechika Regional Projects

Canada Zinc Metals owns a large land package in northeastern British Columbia in the Kechika Trough. British Columbia is known as one of the top mining jurisdictions worldwide. The Kechika Trough hosts several zinc-silver-lead projects and is an extension of the world class Selwyn basin from the Yukon. This is a district-scale play as management has locked up close to 140 square kilometers of land in the belt.

Image source: Canada Zinc Metals

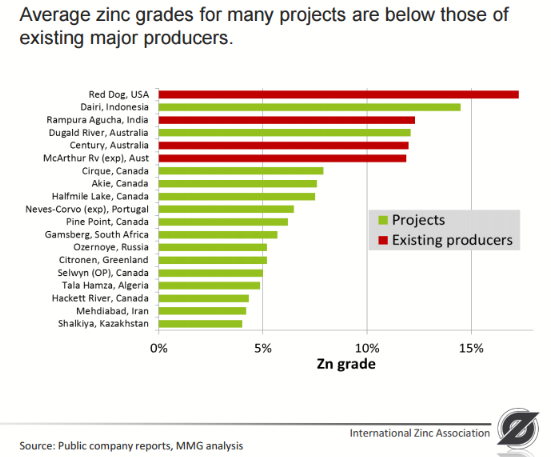

The Akie property hosts the Cardiac Creek deposit, which is one of the top undeveloped zinc-lead-silver projects in the world. A 2012 NI 43-101 resource shows an indicated resource of 2.35 billion lbs of zinc at 8.38%, 470 million lbs of lead at 1.68%, and 5.6 million ounces of silver at 15.30 g/t, as well as an inferred resource of 2.65 billion lbs of zinc at 7.38%, 480 million pounds of lead at 1.34%, and 6.05 million ounces of silver at 11.6 g/t.

The deposit is open for expansion in all directions . An aggressive 5,000-metre drill program is planned for this summer. The drill program will focus on two main goals:

- Increase the size of the deposit.

- Increase the confidence in the current indicated and inferred resources.

Grade is a very important characteristic to keep in mind when investing in mining projects. The chart below shows that the Akie project is one of the highest-grade undeveloped projects in the world.

The Akie project is 116 sq km in size and is located within 20 kilometres of Teck and Korea Zinc’s Cirque deposit.

Also take note that the Cirque deposit, owned by Teck and Korea Zinc, is next to Akie on the chart. It would not be a stretch for either of these companies or both these companies to be thinking of taking over Canada Zinc Metals to consolidate the area.

Infrastructure for the project is very good and is an advantage over a majority of its peers. A 50-person modern facility camp was built a few years ago. The project is accessible year round by road which connects to the town of Mackenzie. The easy access to Mackenzie is strategic because the town has access to rail that connects to Teck’s smelter in Trail. The Teck smelter is one of the largest integrated zinc-lead smelters in the world. As well, rail access is available from Mackenzie to Prince Rupert which is home to a deep-sea port that would allow for shipping of concentrates overseas. With respect to power, B.C.’s largest hydroelectric dam is located just south of the project on Williston Lake.

Canada Zinc Metals’ largest shareholder, Tongling Nonferrous Metals Group (35%), is hungry for concentrate and owns a zinc and lead smelter in the city of Tongling (Anhui Province). The smelters are located right on the banks of the Yangtze River with direct ocean access to and from Prince Rupert.

Other CXZ regional claims in the area have been optioned to JV partners Teck and Korea Zinc. The partners are expected to spend ~$1 million on the optioned claims this year (Pie, Yuen, and Cirque East). Teck has the option to earn up to 70% on these claims by spending $8.5 million in exploration by September 2019.

The entire 140 sq km belt is highly prospective for new discoveries. Several of the properties have had significant historical drill results. The focus for the moment remains on Cardiac Creek and letting JV partners drill some of the optioned regional claims.

Financial Position

Canada Zinc Metals has a strong balance sheet with ~$10 million in working capital. This summer’s work program is expected to total $2 million which will leave CZX with $8 million in the bank. In an extremely weak financing environment for junior mining companies, this is a tremendous advantage.

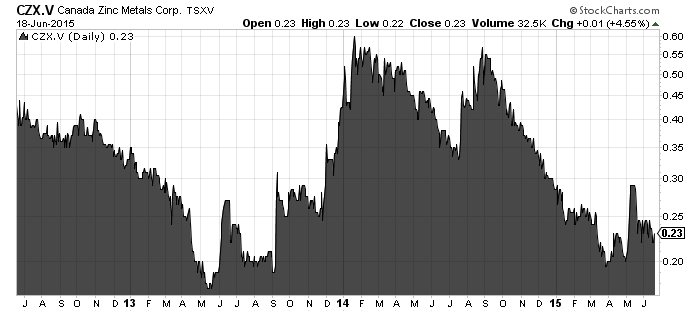

Canada Zinc Metals is trading at 23 cents, close to a 5-year low. The share price was 55 cents back in September and has been more than cut in half with no fundamental reason for the sell off.

Investors should watch zinc inventory levels as they will drive the zinc price, but as mentioned earlier, the commodity looks set to see a major increase in price. With the space looking like it’s going to heat up, Canada Zinc Metals (CZX:TSXV) should definitely be on a zinc bull’s watchlist.

Symbol: CZX:TSXV

Share price:$0.23

Market cap: $35.1 M

Working capital: ~$10 million

Shareholders: Tongling Nonferrous Metals Group,Lundin Mining,Teck Resources and Korea Zinc

Here is a link to today’s drilling news: Canada Zinc Metals Commences 5,000 Meter Drill Program at Akie

CEO.CA is proud to have Canada Zinc Metals as a sponsor and this makes us biased in our coverage of the company. Junior mining stocks such as Canada Zinc Metals are highly volatile and risky. They are not suitable for most investors. This article is not a recommendation to buy or sell any security. Always do your own due diligence and consult a licensed investment advisor before making any investment decisions. Visit Canada Zinc Metals' profile on www.SEDAR.com for important information and risks.

Disclaimer and Information on Forward Looking Statements: Please read carefully before proceeding. All statements in this report, other than statements of historical fact should be considered forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often, but not always identified by the use of words such as "seek", "anticipate", "plan", "continue", "estimate", "expect", "may", "will", "project", "predict", "potential", "targeting", "intend", "could", "might", "should", "believe" and similar expressions. Much of this report is comprised of statements of projection. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Risks and uncertainties respecting mineral exploration companies are generally disclosed in the annual financial or other filing documents of those and similar companies as filed with the relevant securities commissions, and should be reviewed by any reader of this article. In addition, with respect to any particular company, a number of risks relate to any statement of projection or forward statement.

Cautionary Note Concerning Estimates of Inferred Resources: This article may use the term "Inferred Resources". U.S. investors are advised that while this term is recognized and required by Canadian regulations, the Securities and Exchange Commission does not recognize it. "Inferred Resources" have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of "Inferred Resources" may not form the basis of feasibility or other economic studies. U.S. investors are also cautioned not to assume that all or any part of an "Inferred Mineral Resource" exists, or is economically or legally mineable. Mineral resources which are not mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.