A look at a couple of the mining news releases out this morning with some additional comments on each.

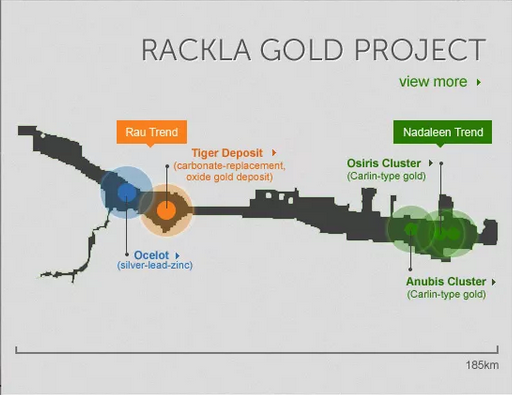

Atac Resources-(ATC:TSXV) - Atac has commenced the summer exploration program at the Rackla project in the Yukon. Diamond drilling is under way and will focus on the Conrad zone and Anubis cluster.

The plan is for a $3 million dollar program which will be funded with cash on hand. As of March 31st, Atac had a working capital position of nearly $20 million.

2015 phase 1 exploration objectives:

- Shallow diamond drilling will continue to test the eastern portion of the Conrad Upper zone, where drilling to date has defined a strike length of 800 metres.

- Diamond drilling will target an untested area between the Conrad Upper and Middle zones.

- Diamond drilling at the newly discovered Conrad Lower zone will step out from hole OS-14-230, which intersected 42.67 metres of 3.03 grams per tonne gold. The true width for OS-14-230 is estimated to be 60 per cent to 100 per cent of the intersected width.

- RAB drilling within the Anubis cluster will target over 20 geochemical anomalies and potentially mineralized structures that lie beneath a thin cover of overburden.

"The Conrad zone is the most advanced Carlin-type gold discovery within the Nadaleen trend and continues to deliver significant gold mineralization from three distinct areas and remains open along strike and at depth," states Graham Downs, Atac's chief executive officer. "The 2015 exploration and drilling program is designed to cost-effectively expand mineralized zones at Conrad and refine targets within the Anubis cluster for future drilling."

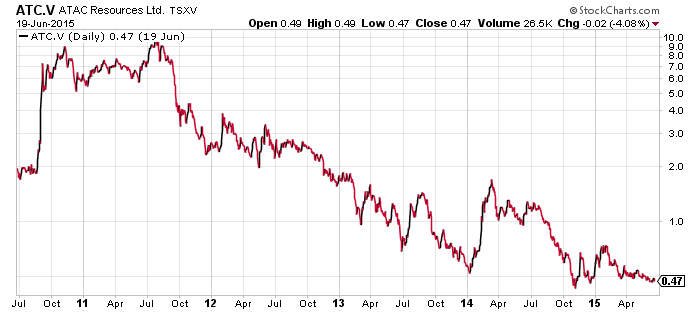

Atac was once the darling of Yukon exploration stocks hitting close to $10 a share back in 2011. The stock is now trading at 47 cents and should be a reminder how volatile this sector is and to always take profits.

Read: ATAC Resources Ltd. Announces Commencement of Drilling - Rackla Gold Project, Yukon

Related: Yukon gold exploration boom and bust survivor ATAC finds additional high grade

Lowell Copper (JDL:TSXV) and Avrupa Minerals (AVU:TSXV) - Lowell Copper will be optioning the Alvito iron-oxide-copper-gold (IOCG) project in southern Portugal from Avrupa Minerals. Lowell can eanr up to 80% of the project by spending $4.4 million on the project and completing a feasibility study in the next 8 years.

The Alvito project covers ~853 sq kilometres of ground in Ossa Morena tectonic zone in southern Portugal. Previous field work includes 144 rock chip samples with 14 samples having greater than 0.4 parts per million gold.

Altius Minerals holds a 1.5% NSR on the property acquired when they purchased Callinan Royalties.

Paul Kuhn, President & CEO of Avrupa, stated that "We are pleased to have attracted a technically strong joint venture partner in Lowell Copper to our Alvito Project. The track records of Mr. David Lowell and other key management and shareholders of the company are impressive and will aid in ensuring that the Alvito project is well-explored."

David Lowell, Chairman & CEO of Lowell Copper, noted that "The Alvito IOCG project has large potential, and we are looking forward to working with the Avrupa team in this prolific mining region of Portugal."

Lowell Copper stock is tightly held and hardly trades any volume with 71.64 M shares outstanding. Lowell has been optioning projects off other companies and is in the business of taking shots to make a discovery.

The company is named after David Lowell arguably the most successful mine funder ever. Mr. Lowell is credited with 15 major discoveries.

Read: Avrupa and Lowell Copper sign option agreement on Alvito Project

Related: Intrepid Explorer: The Autobiography of the World’s Best Mine Finderor Lowell Copper adds another project with home run potential

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.