A look at some of the mining headlines that caught my attention this morning with some additional thoughts on each.

Atlantic Gold - (AGB:TSXV) - Atlantic Gold is out with a solid looking feasibility study at the MRC project in Nova Scotia. At $1200 gold the project economics come in at a post-tax NPV of $168 million and an post-tax IRR of 30%.

I will have to dig a little deeper into Atlantic Gold but at first glance these are some of the better economic numbers I have seen on a gold project using $1200 gold.

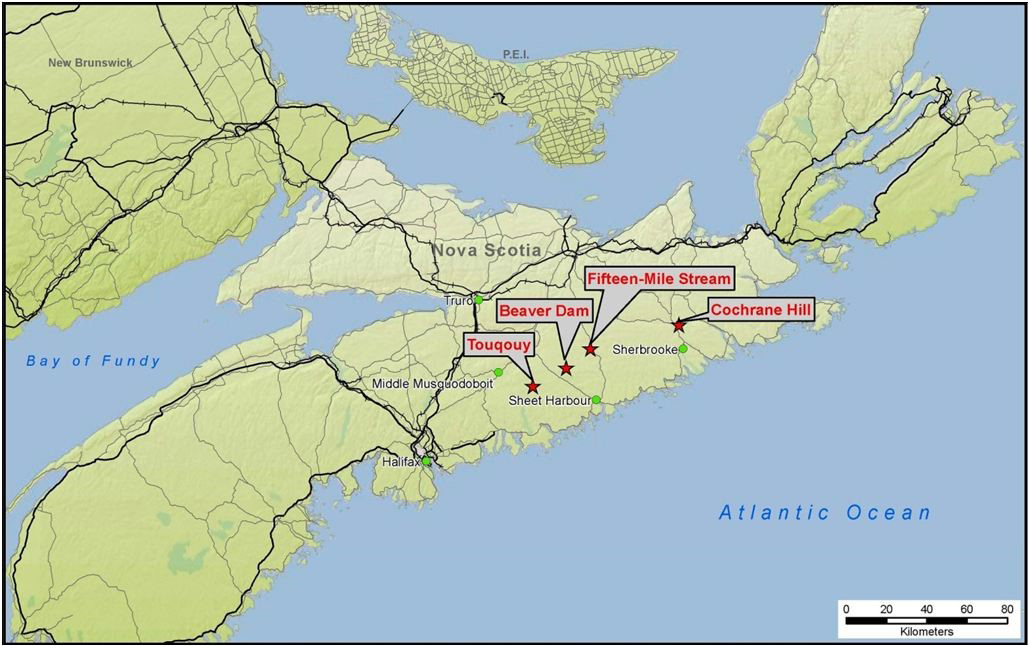

The MRC project comprises of co-development of the Touquoy mine and the Beaver Dam Mine which are located 37 km apart from each other.

A low initial CAPEX of $137 million definitely helps the economics and helps make the project finance-able even in these market conditions. Total life of mine production is expected to be 714,000 ounces at an average grade of 1.44 grams per tonne gold.

Steven Dean, Chairman and CEO noted, "Since the acquisition of the Nova Scotian gold properties in 2014, we have fast-tracked the development of the MRC Project through to the project financing stage with the delivery today of a strong feasibility study. The study includes the design of a central processing facility at Touquoy, which was first designed in 2010, and now completed on a co-development basis of the Touquoy and Beaver Dam deposits. As such, the Company believes the design is well optimized and is confident in its estimates to support the economic analysis within the Study. The results of the feasibility study serve to reinforce the project's viability in a mining friendly jurisdiction, with continued support from local stakeholders and government. These economics, together with the potential production upside from its wholly owned nearby deposits of Cochrane Hill and Fifteen Mile Stream make the MRC Project the premier gold mining project in the modern era of mining in the province."

A fairly range bound chart in 2015 for AGB shareholders.

As of March 31 AGB was well funded with ~$16 million in cash. Cash will be lower now but still significant for a company trading with a market cap of $29 million.

This could be a takeover candidate but no majors operate gold mines in Nova Scotia and I think they would be looking at a bigger asset.

Will be interesting to see what happens with AGB in the near future. If financing can be arranged construction is planned to start in 2016.

Northern Uranium - (UNO:TSXV) - Northern Uranium has provided an update on drilling at the 50% owned North West Manitoba project. UNO is earning into 80% of the project from CanAlaska (CAA:TSXV).

Northern Uranium continues to try and hone in on a potential uranium discovery. It appears they are getting closer.

In this morning's news release scintillometer readings were given which are often a good sign of uranium mineralization (no guarantee though).

Drill hole MG15DD-0016 tested 730 cps with a down hole gamma probe over a 1m interval from 330.1 metres depth.

This compares to Cameco's recent AXA-007 Thelon discovery in which up to 400 (equivalent) cps with limonite alteration was intersected. Northern Uranium has intersected anomalous radioactivity in excess of 400 cps in holes MG15DD-0012, MG15DD-0014 and MG15DD-0016.

UNO has been up and down in 2015 which is typical of mining exploration stocks.

It appears from the news release UNO is getting closer and closer to making a discovery. We will see.

As the increasing radioactivity encountered in hole MG15DD-0016 indicates the drilling is progressing towards a more mineralized source the next hole is being drilled 60 metres along strike to test the mineralization beneath hole MG15DD-0014. The second drill is drilling another anomaly and is presently at 303 metres depth.

Read: Northern Uranium Drill Hole MG15DD-0016 Intersects Highest Gamma Radiation Results to Date

Related: Fipke, Ulansky take uranium hunt outside the Basin

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.