The last 4 years have seen a +75% sell off in the resource sector, and this veteran mining entrepreneur believes its time to capitalize from the carnage.

Henk Van Alphen’s Wealth Minerals (TSX WML.V ) has a plan to build a portfolio of gold projects in stable geopolitical jurisdictions with low exploration risk, attractive grade, and potentially low capital requirements.

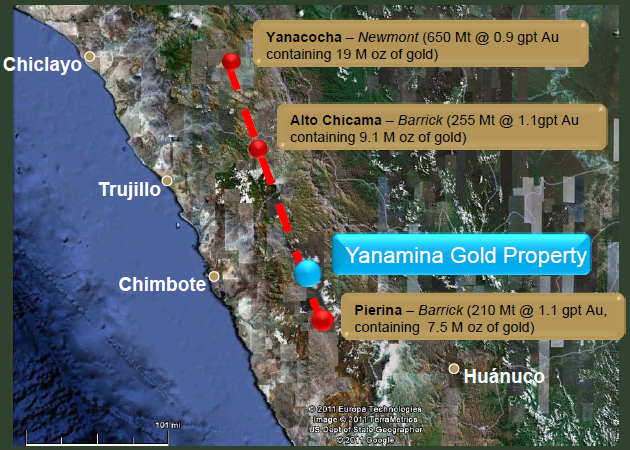

On May 25, 2015 Wealth acquired a 100% interest in the Yanamina gold project which consists of 5 mining concessions in the Department of Ancash, Peru. The property is situated on the prolific Ancash Fault Zone which has formed conduits for gold bearing hydrothermal solutions resulting in gold occurrences and deposits in the region. Staple mines in the region are Barrick’s past producing Pierina Gold Mine, Barrick's producing Alto Chicama/Lagunas Norte Gold Mine, and Newmont's producing Yanacocha (South America's largest gold mine).

The project was acquired by issuing 1,000,000 shares to Coronet Metals. The same management team which was behind the successful sale of Cardero Resource’s Peruvian Pampa De Pongo iron ore project (bought for $500K, sold for $100M) is now focusing on Yanamina to replicate that success. Mr Van Alphen stated, “This acquisition may be one of the best deals I have executed on in my career and I could not be more excited about it”.

Mr Van Alphen, who has had a long and successful career of doing business in Latin America, believes the social issues associated with Yanamina as a result of actions from a foreign energy company can be satisfactorily resolved. He wants to ensure the local communities will be just as involved as Wealth is and that they will receive benefits that will leave a long lasting positive impact. Management plans to hold a press conference in the region later in the fall to advise the communities how Yanamina can be progressed in a mutually beneficial way.

An environmental impact study (“EIS”) which involves a community baseline report (“CBR”) must be completed before exploration permits can be granted. Wealth is in the process of securing a long-term community agreement and the social license necessary to proceed for the application of permits for exploration work on Yanamina. The previous operator had received the permits in 2007, but they expired in 2010. Following receipt of the permits, the initial focus will be to complete resource expansion and definition drilling. “Early drilling at Yanamina was focused on the upper zone and was too shallow to intersect the lower zone. Drill holes in the deposit average 61 metres in depth, although drill holes intersecting only the upper zone average 30 to 40 metres in depth. Future work will focus on infill drilling in the lower zone, north and south of the known deposit before expansion drilling begins”.

To date, work on Yanamina by previous operators includes regional prospecting, rehabilitation of historic tunnels, three adits, and 87 diamond drill holes totalling 4,168 metres. According to the NI 43-101 PEA produced by Coronet Metals there is 4,802,000 tonnes at 1.34 Au GPT and 5.65 Ag GPT to host a resource of 83K Oz Au (Indicated) and 124K Oz Au (Inferred). Heap leach recoveries show 73% gold and 40% silver recovery for production of 151K Oz Au and 349K Oz Ag at cash costs of USD $257 Oz Au Eq. over a 5 year life of mine. CAPEX is estimated at USD $36M and metal estimates used in the economic study were conservative at USD $1,025/Oz Au and $16.50/Oz Ag resulting in a NPV of $41M and payback of 1.5 years once production has started. The key findings in Coronet’s PEA are a proposed 10,000m drill program costing USD $3.5M with the potential opportunity to double or triple the existing resources as it remains open at depth and along strike on both sides.

Yanamina - Drilling performed by previous operator Coronet Metals Inc. (Source: Coronet Metals Inc.)

Management is in the process of completing a revised NI 43-101 technical report for the newly acquired Yanamina project and expects to have that released in the next 12 months. There have also been preliminary discussions about growing Wealth’s technical team to include specialists who have extensive experience operating in Latin America to streamline the permitting process. The team is thrilled about the project as it is an advanced exploration stage project with near-term production potential, low CAPEX, and significant resource expansion through exploratory drilling.

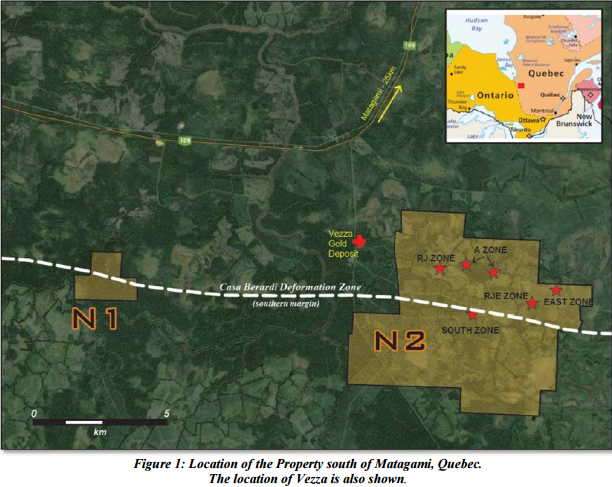

On June 15, 2015 Wealth issued a Letter of Intent to acquire up to 100% of the Noyell Property from Brionor Resources, located in the northern portion of the Abitibi greenstone belt in Quebec.

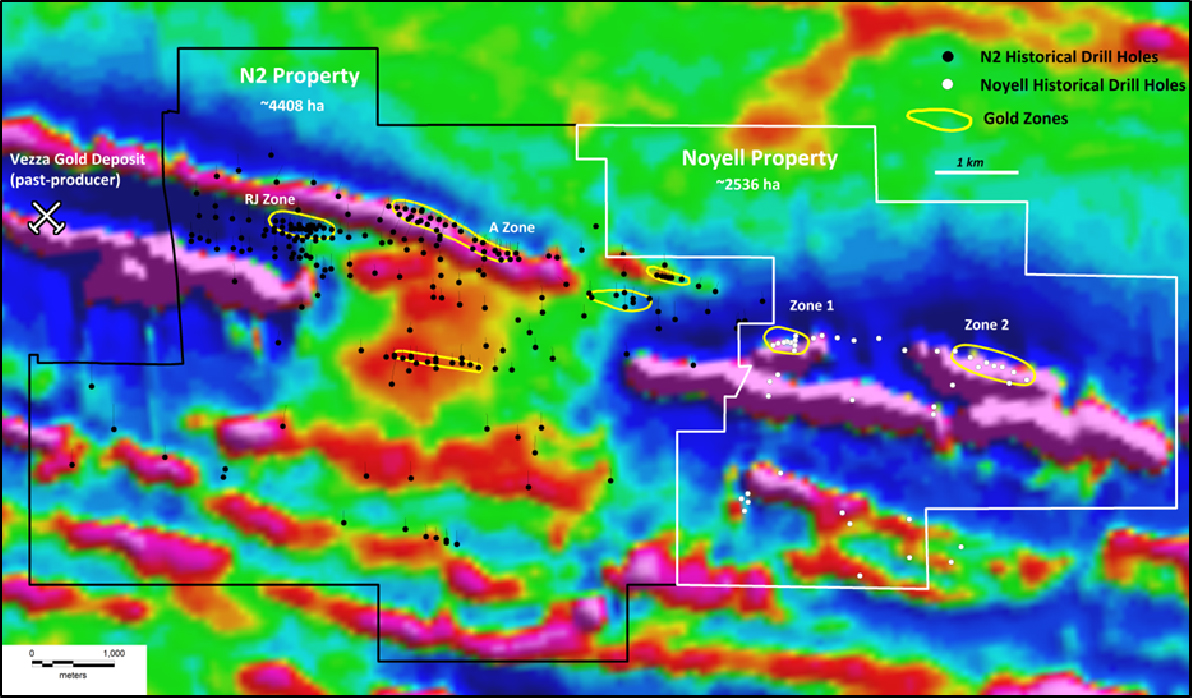

By acquiring the Noyell Property Wealth will gain an additional 2,536 hectares to explore for gold rich deposits on a property with already 2 identified zones hosting gold mineralization defined through historical drilling (Zone 1 & Zone 2, shown below).

“The trend of gold mineralization on the N2 project extends east-west for approximately 7 Km. The Noyell Property will provide a potential extension of 5 Km for a total strike length of 12Km. The regional vertical gradient magnetic field survey below highlights in bright purple linear magnetic highs which define potential mineralized structural zones such as those already associated with known mineralization zones on N2 & Noyell.”

High priority targets which have previously been untested and open for discovery through drilling are the main magnetic high’s, bright purple regions moving east-west, shown directly south of Zone 1 and Zone 2 on the Noyell Property.

N2 & Noyell Properties – Trend of Gold Mineralization with Identified Gold Zones (Source: Wealth Minerals Ltd.)

Both properties are located 25 Km south of the mining centre of Matagami, Quebec, approximately 4 Km south of a major regional highway and are accessible by all-season roads. There is excellent infrastructure in the region and power sources available to assist with exploratory work to be performed on the properties.

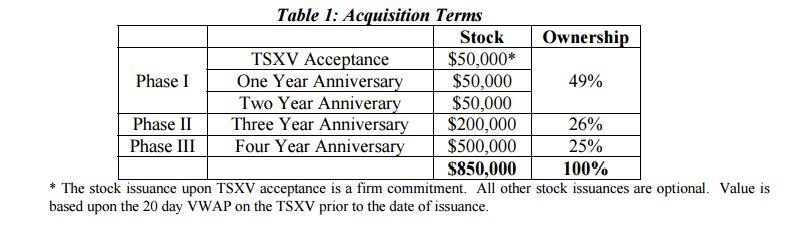

Wealth has entered into a three phased option agreement where the aggregate of $850,000 worth of stock will be paid to Brionor Resources over the course of 4 years to acquire up to 100% in the Noyell Property. Important to note, there are no cash payments or work commitments associated with the deal. The acquisition terms are shown below. Wealth has until July 15th, 2015 to perform due diligence and finalize the formal option agreement.

As mentioned, Wealth has the neighbouring N2 property and is in process to acquire a 75% interest. N2 is a contiguous block of claims totalling 4,408 hectares hosting at least 6 zones of gold mineralization in volcanic-sedimentary rock contacts ranging in depths from 100 to 300 metres which remain open along strike and depth. The two combined properties (N2 & Noyell) stretch along the gold-bearing Casa Berardi Deformation Zone, responsible for hosting the multimillion ounce Casa Berardi gold deposit.

To date work performed on N2 by previous owners include airborne and ground-based geophysical techniques and bedrock drilling. A total of 32,500 metres from 163 diamond drill holes and 70 RC holes have been drilled on the property. Preliminary metallurgical tests conducted on drill core from the N2 – A Zone resulted in recoveries of 91.7% of gold in a flotation concentrate after a moderately fine-grind.

Wealth is working towards an initial resource estimate on the N1/N2 properties through the potential discovery of additional mineralization by exploratory drill testing on the identified six existing targets. The company plans to drill 1,500 metres in the late fall via 6 holes averaging 250 metres focused on some or all of the six exploration targets.

As over 32,000 metres of drilling have been completed on N2, it is a well-understood brown-field target which management of Wealth believe offers the potential for discovery of a large gold bearing system which will add significant value to the N1/N2 property.

Resource exploration and development is a speculative business and requires constant capital injection, so Wealth will require additional equity financing in the near future. Additional funding will be necessary to maintain the interest in the N1/N2 gold project and also to proceed with work on the Yanamina property. Mr Van Alphen has a remarkable record, having raised some $200 million in the last 10 years, and he is closely associated with an additional $800 million in financings. Management of Wealth are capable of executing necessary future financings supported by their extensive network of institutional and high net worth contacts.

Recently, Wealth completed two non-brokered private placements. The first completed on February 2, 2015 at $0.10 for gross proceeds of $750,000 and the second March 25, 2015 at $0.12 for gross proceeds of $720,000. The above two private placement financings have or will become free trading June 27, 2015 and July 31, 2015. The proceeds will be used to address the working capital deficit of $1.429M shown on the February 28, 2015 interim financial statements which can be viewed on SEDAR.

Wealth is currently involved in the review and evaluation of a number of mineral projects in the America’s for possible acquisition. No agreements have been entered into yet but Wealth is still looking.

Mr Van Alphen has co-founded several successful exploration and producing companies including International Tower Hill Mines, Trevali Mining, and Balmoral Resources which have generated significant shareholder value. Wealth Minerals is readying themselves for the return of the upcoming bull market and is a company you should have on your watch list.

Disclosure: This is not investment advice of any kind and always do your own due diligence and consult a licensed investment advisor prior to making any investment decision.The article is by no means a solicitation to purchase or sell any security. Independently verify all information contained in this article as it may contain errors. Check Wealth Minerals’ profile on www.sedar.com for a better understanding of the risks facing the company and understand that all comments in this article about Wealth Minerals are “forward looking’ and may not come true. This article reflects the opinions of the author alone and that is all it purports to be. Author has a financial conflict with Wealth Minerals Ltd. and is therefore biased. You are solely responsible for your own trades. Thanks.