A look at a couple mining related news releases that caught my eye this morning.

McEwen Mining - (MUX:TSX) - McEwen is out with production results for the second quarter of 39,164 AuEq oz. The El Gallo mine achieved record quarterly production which helped MUX beat guidance by 15% for the quarter.

Production was higher as a result of higher grade and improved processing. Grade came in at 3.7 g/t gold for the quarter and investors should note this is expected to return to ~2 g/t over the next 6 months.

McEwen is led by Chairman and Chief Owner (25%), Rob McEwen who is a prominent name in the mining world. Mr. McEwen is fully invested with shareholders and draws no salary for his efforts. The only way he makes any money is if the stock price increases and dividends from his shares.

Financial results will be released on Aug 10,2015.

Highlights

- Record quarterly production at the El Gallo Mine of 17,325 gold equivalent ounces 1 .

- Total Q2 2015 production of 39,164 gold equivalent ounces 1 , an increase of 36% over Q2 2014.

- Year-to-date gold production of 72,598 gold equivalent ounces 1 , an increase of 24% over the first six months of 2014.

- Higher average processed gold grade at El Gallo Mine of 3.7 grams per tonne (gpt) vs. 3.2 gpt last quarter.

- Current cash and precious metals of $27.3 million 2 vs. $17.3 million 2 reported on May 11 th , 2015.

- Full year production guidance maintained at 96,500 gold ounces and 3.1 million silver ounces.

- Inaugural semi-annual dividend distribution of $0.005 per share will be paid August 17th , 2015 to shareowners of record on July 31 st , 2015, a current yield of 1.3% annualized.

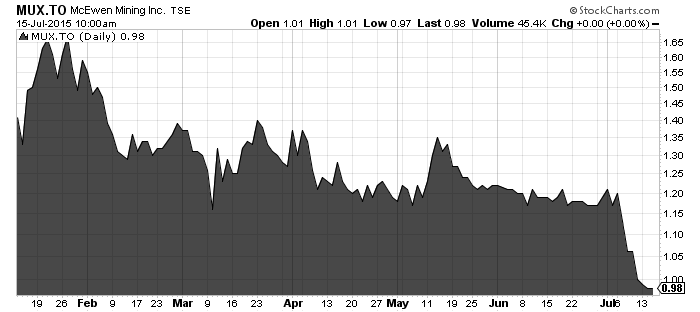

A sharp decline in the stock of McEwen over the last couple years.

My bet is that it will be hard for McEwen to make a profit at current metal prices especially when the grade falls back.

Read: McEwen Mining Announces Record Quarterly Production at El Gallo Mine; Q2 2015 Production Results

Related:‘At the Bar’ having shots and discussing mining

Dalradian Resources - (DNA:TSX) - Dalradian has release impressive infill drill results from the Curraghinalt gold deposit in Northern Ireland. 25 holes have been released this morning (5766m out of 20,000m) with results for the remaining holes to be released when received.

DNA is doing infill drilling to convert ounces from the inferred to indicated category. The drilling will be used to support a PFS.

Highlights:

- 4.40 metres grading 54.84 grams per tonne gold from the 106-16 vein in hole 15-CT-209;

- 5.79 m grading 7.12 g/t gold from the V75 vein in hole 15-CT-204;

- 4.74 m grading 15.26 g/t gold from the No. 1 vein, from 15-CT-214;

- 2.17 m grading 39.53 g/t gold from the Bend vein in hole 15-CT-205.

DNA is a favourite of many analysts as it is a high grade deposit which leads to robust economics. At $1200 gold the project yields a 36.2% IRR (after-tax).

Catalysts for shareholders include a resource update expected later this year which will be followed by the PFS.

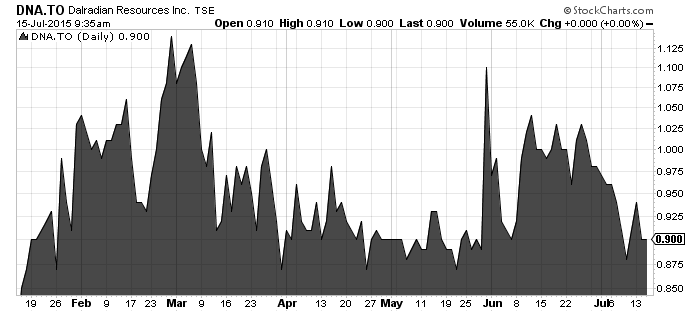

Of note is that Ross Beaty purchased 12,556,000 units at 90 cents earlier this year. DNA is currently trading at 90 cents so investors have the chance to get in at the same price as the legendary resource investor and financier.

Related: Ross Beaty buys 9.9% of Dalradian Resources for C$11.3 million

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.