A look at a few of the more prominent mining releases out on this Thursday morning.

NexGen Energy - (NXE:TSXV) - NexGen Energy continues to impress at the Rook I uranium project in Saskatchewan. The first set of results from the 25,000m summer program were released this morning.

NexGen after the Fission/Denison merger is the top uranium exploration stock in the world in my opinion. Drill results this morning show that the Rook 1 project continues to grow in size.

Highlights:

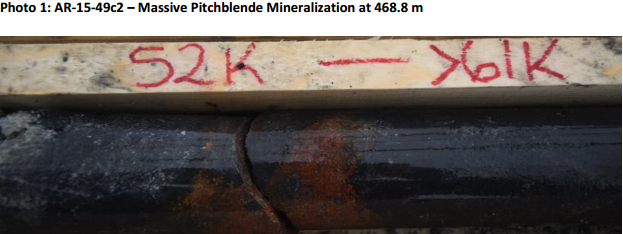

- AR-15-49c2 has successfully extended the high grade mineralization intersected in AR-15-44b (56.5 m at 11.55% U3O8, see news release dated June 15, 2015) up-plunge to the northeast in the A2 shear by 41 m. Hole AR-15-49c2 intersected 73.5 m total composite mineralization including 23.05 m off-scale radioactivity (>10,000 to >61,000 cps) in the A2 shear, and 55.0 m total composite mineralization in the A3 shear all within a 475.0 m section (402.5 to 877.5 m). High grade mineralization in the A2 shear was observed as very dense accumulations of massive pitchblende.

- AR-15-50 has successfully increased the strike length of the Arrow zone by 35 m to the northeast; A total composite mineralization of 37.5 m including 0.20 m of off-scale radioactivity (>10,000 to 12,000 cps) was intersected within a 278.0 m section (502.0 to 780.0 m),

- The Arrow zone now covers an area of 550 x 215 m with the vertical extent of mineralization commencing from 100 to 920 m, and it remains open in all directions and at depth

Garrett Ainsworth, NexGen’s Vice-President, Exploration and Development, commented “Drilling in the A2 and A3 cores continues to impress us with the degree of strong, very dense mineralization encountered over wide intervals. Our directional drilling program with TECH Directional became fully operational on June 26th and has quickly proven to be an optimal technology in efficiently testing the A2 and A3 high grade cores with exceptional pierce point accuracy, resulting in saved time and costs at Arrow. With these early summer results, we are very much looking forward to future drilling and further testing of both the southwest and northeast strike extensions of Arrow.”

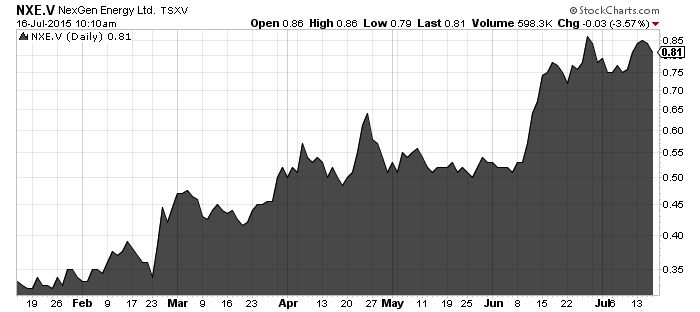

NexGen continues to be one of the better performing stocks on the TSX Venture this year. It goes to show investors even in a weaker market environment discoveries are still rewarded.

The stock is at 52 week highs but has a fair amount of room to go. Raymond James currently has a price target of $1.80 on the stock.

Five drill rigs are turning as part of the summer drill program so investors can expect plenty of newflow from NXE in the upcoming months.

Read: NexGen Drills Intensive Radioactivity at Arrow - Rapid Expansion in the A2 and A3 High Grade Shears

Related: NexGen Energy (NXE:V) the leading uranium exploration stock

Newmarket Gold (NMI:TSX) - Newmarket Gold has completed the merger with Crocodile Gold and has released first quarter results this morning. Second quarter production came in at 55,998 ounces at an average grade of 3.31 grams per tonne.

Newmarket will be a stock to watch simply based on the management and directors team that is full of heavyweights in the industry including Douglas Forster, Rodney Lamond, Lukas Lundin, and Randall Oliphant.

Financial results will be released on July 30th. As at June 30th working capital was estimated to be $24 million.

Douglas Forster, president and chief executive officer of Newmarket Gold, stated: "We achieved a solid performance in the first half of 2015 producing 115,674 ounces of gold driven by a 15.1-per-cent improvement in our consolidated grade profile from the first half of 2014 and a strong increase in recovery across all three operations year to date. Newmarket's second quarter production of 55,998 ounces represents two full years of quarterly gold production above 53,000 ounces and gives us the confidence to reaffirm our full-year 2015 production outlook of 220,000 ounces. With these results, we are also reaffirming our 2015 cost guidance and expect to achieve the lower end of both our cash cost guidance of $780 to $860 per ounce and all-in sustaining cost guidance of $1,020 to $1,100 per ounce. Furthermore, we are extremely pleased to have completed our merger with Crocodile Gold in early July. Moving forward, we are a unified company focused on continued sustainable operating performance from our three existing mines, maintaining a large resource base and generating significant free cash flow that supports the execution of our ongoing gold asset consolidation strategy."

I will definitely be watching NMI stock based on the management team. The other thing I really like is free cash flow generation.

I would not be surprised to see at some point another acquisition by the team.

Related: Mining heavyweights seek to build mid-tier gold producer in $190M Newmarket-Crocodile merger

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.