Gold has broken down overnight after hitting a low of $1080 on a large $2.7 billion sell order. Gold is last trading at $1107 per ounce. Here is a look at a few of the mining releases out this morning with my comments on each.

Royal Gold (RGL:TSX) and New Gold (NGD:TSX) - Royal Gold and New Gold have entered a $175 million dollar purchase and sale agreement regarding the Rainy River project in Ontario.

Rainy River was acquired by New Gold in October 2013 for $310 million. The project hosts 3.8 million ounces of gold reserves and 2.9 million ounces of resources.

The Environmental Assessment approval was received on the project in January of this year.

Mine development is under way and start up is expected in mid 2017. An estimated $300 million will be spent in 2015 with $87 million already spent in the first quarter. The entire project had an estimated development cost of $877 million.

At $1300 gold the project generates an IRR of only 13.1%. I am a little surprised with the current gold price environment they are moving ahead with this project but they obviously expect higher gold prices.

Stream transaction details

- Royal Gold will make two advance payments to New Gold, consisting of $100-million at closing and $75-million once capital spending on the project is 60 per cent complete (currently expected by mid-2016).

- New Gold will deliver to Royal Gold:

- 6.5 per cent of the gold produced at Rainy River until 230,000 ounces have been delivered, and 3.25 per cent thereafter;

- 60 per cent of the silver produced at Rainy River until 3.1 million ounces have been delivered, and 30 per cent thereafter.

- Royal Gold will pay New Gold 25 per cent of the spot price per ounce of gold or silver.

Tony Jensen, president and chief executive officer of Royal Gold, commented, "The Rainy River project fits well into our high-quality portfolio and met all our criteria for new investments with nearly four million ounces of gold reserves, continued exploration upside and projected cash costs below $600 per ounce. We are particularly pleased to add another piece of business in Canada and partner with New Gold -- a company that is well-known for its development track record and operational expertise."

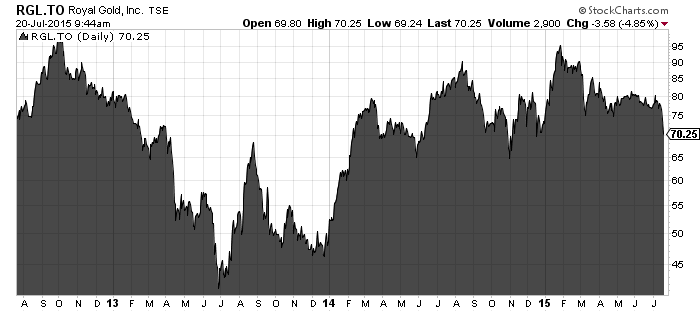

Royal Gold has is level with 2013 prices showing the strength of the royalty business model. Royal is investing for the long term with the New Gold deal.

As the large Mt. Milligan mine of Thompson Creek Metals ramps up cash flow will continue to improve.

Read: Royal Gold Acquires Gold and Silver Stream on New Gold’s Rainy River Project

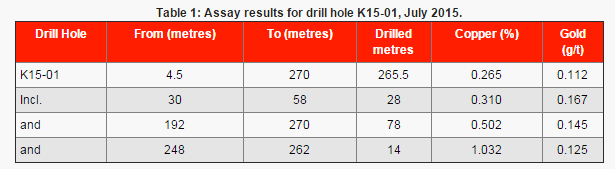

Kaizen Discovery (KZD:TSXV) - Kaizen is out with the the results from the first couple drill holes at the Aspen Grove Project in southern British Columbia. Drill hole K15-01 intersected 78 metres of 0.5% copper and 0.15 g/t gold a very good start to the summer drill program.

British Columbia is well know for its copper-gold porphyries and many companies are exploring to find the next economic deposit.

"We are very encouraged that our first drill hole at the Ketchan prospect has yielded significant copper-gold mineralization over a lengthy interval," said B. Matthew Hornor, President and CEO. "We plan to undertake step-out drilling from this intercept later in the summer after completing the rest of our planned initial 10 exploration holes at Aspen Grove."

The second hole did also intersected copper and gold mineralization but much lower grade.

Kaizen is one of a few exploration companies taking "shots" drilling at multiple exploration properties this summer. As junior mining speculators know the largest share price returns come in the exploration phase of the business when a discovery is made.

Related: The Envy of Metals Explorers

This is not investment advice. All facts are to be checked and verified by reader. As always please do your own due diligence.